Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15 : identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Daily Shares in Focus

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="ATM.L,ECR.L,PTAL.L,SQZ.L,888.L,BLVN.L" fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]RNS Analysis and Opening Price Action

RNS Report is published at 07:15 each day (approximately) and may be updated during the day to reflect the total RNS newsflow for that day : timestamp on the report indicates the latest update

Pre Market RNS

Pre Market Sentiment and Charts Influencing UK Markets 06:30 (3 mins read)

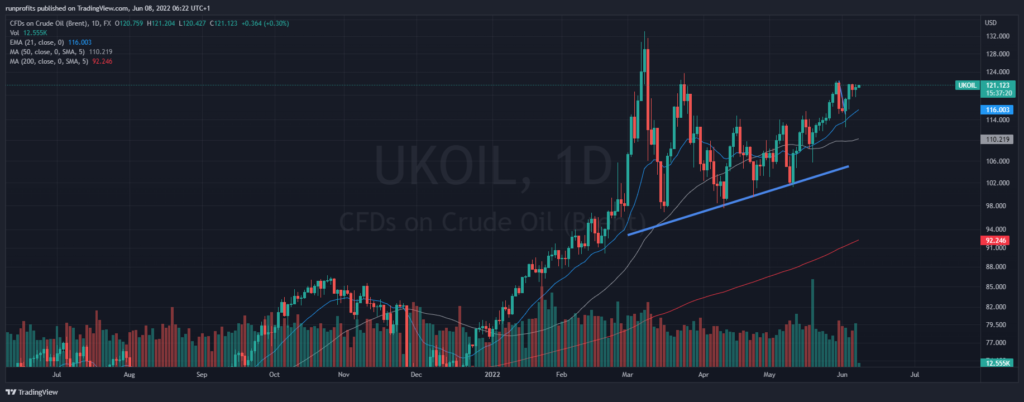

UK Futures suggest a firmer open +20 on cash close at 7618 after the US closed in green with the S&P up 1% and technically looking set to break north from a cup and handle reversal pattern (though below 200MA and in a strong downtrend!) : tech rallied 0.9% , DOW 0.8% in a broad rally with Energy outperforming significantly as oil prices move higher (see map) . Brent above $121 (chart) ,Sentiment improving with VIX 24 (see dashboard) : Gold and copper are sideways clinging to 200MAs (charts)

BRC Retail data released overnight show UK Retail sales fell -1.5% in May against expected +0.2%: this may counterbalance any cheer from the expected boost of the Jubilee weekend sales.

UK PMIs at 09.30 will give a read on the health of UK's Services sector in May along with the composite PMI.

- - US stocks close in green broad rally with energy up significantly and participation acrtoss most sectors - see map

- - Brent looks set to break north at $121 (see chart)

- - VIX drops to at 24 VSTOXX 23.6 - see dashboard

- - DXY- dollar index sideways 102 5- (see chart)

- - Copper hugs 200MA sideways building energy (see chart)

- - Gold back below $1850 holding 200MA (see chart)

Charts - click to open to full size

Market Dashboard

FTSE 100 Futures

US Stockmap Close

Gold Chart

DXY Chart

Brent Oil Chart

Copper Chart

Take Partial Profit : PTAL +47% Profit : Hold SQZ +11%

recent trades posted on RPG

PTAL 40.5p here took additional profitsat 59.4p to cover costs of capital and book partial profits letting the remainder run risk free: from entry that is +47%

: parabolic moves are difficult to predicts but technicals are stretched and PTAL RSI is approaching 80 . This may well have room to run as the max historic RSI is 85, the 61p price is below the target of 93p so should be room to run

Fundamentals also excellent

[stock_market_widget type="inline" template="generic" assets="PTAL.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

SQZ 261.4p here [stock_market_widget type="inline" template="generic" assets="SQZ.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

Added at 265.1 here average price of 262.6

Selling from Institutions and BP contributed to poor price action and dampened sentiment with signs of recovery: looks set to reach 300p