Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15 : identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

PM Price Action 15:30

FTSE 100 made a decisive move north of resistance prompting an SB long from the 7537 to target 7565 area as first resistance, 7600 seems likely before close:

Update: took half off at 7572 with stop to b/e and zero risk should be a small div adjustment after the close: happy to leave O/N

[stock_market_widget type="card" template="basic" color="#5679FF" assets="UKXNUK.L" display_currency_symbol="true" api="yf"]

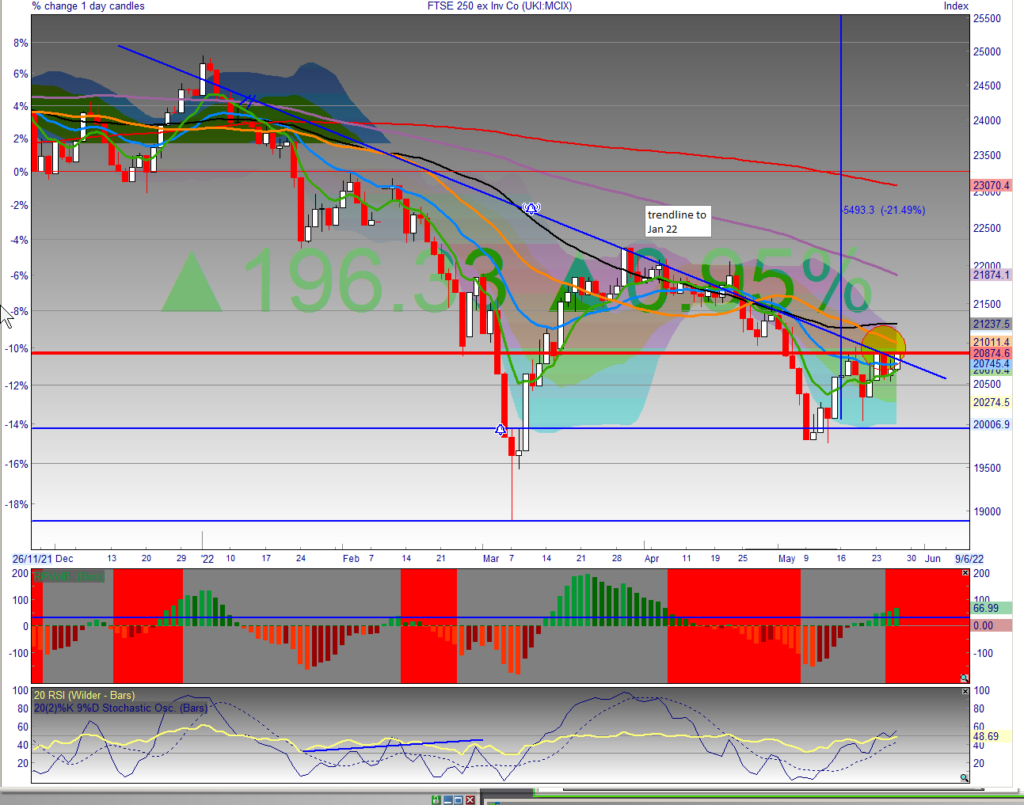

FTSE 250 similarly moving through resistance with participation of many beaten-up and shorted names: this likely sets usup for a multi day rally prompting an ETF long in the MID250 with an initial MIDD position from 1897p : this has few fees, tight spread and good liquidity so easy to reverse out of with low execution costs.

[stock_market_widget type="inline" template="generic" assets="MIDD.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

How to Find High Liquidity Squeezes for Spreadbets

higher liquidity squeezes with tight spreads often make good spreadbetting trades: not participated today as too many balls in the air

set the Capital to >100M

volume to >700K

Spread to <3% and RPG filters down to fewer opps that are open to Spreadbetting

This decreases the number of prospects from 33 to a more manageable 18

IQE Trade from 29.4p

Making one of my favourite set-ups a volatility squeeze : popped on news recently but sold back to key level and reloaded: note it has a small 1.04% short interest and joins today's long list of potential short squeezes/covers though at such a low level this is unlikely to feature in the intraday price action

Entry: 29.49

Stop 27.6

Target:1: 33p (subject to supporting markets and a multiday index pop)

R/r = 2

clear stop below 27.8 target 1 33p around 50MA which is where most breakouts seem to fail in current market

[stock_market_widget type="inline" template="generic" assets="IQE.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

Daily Shares in Focus

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="PTAL.L,IQE.L,MDD.l,," fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]Opening Price Reactions and AM Liquidity 08:15

Markets remain weak and sideways lacking direction : indices are flat on the open with little conviction but bias to the upside given US overnight and recent bearishness: US GDP later today may inform sentiment though month-end is tomorrow. Maintain smaller positions, shorter timescales and reduced risk but open to rapid short-covering rallies and reversals. Trade what you see, not what you think you should see

Cornish Metals [stock_market_widget type="inline" template="generic" assets="CUSN.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

RNS Analysis and Opening Price Action

The below RNS Report is published at 07:15 each day (approximately) and may be updated during the day to reflect the total RNS newsflow for that day : the timestamp on the report indicates the latest update

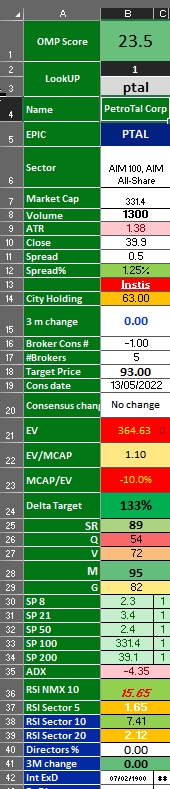

RNS Analysis PTAL

in sideways consolidation of an uptrend with good results today: BUT guides down on social disruption to production and reduced BPOD though decreased output offset by increased contracted oil price at $102 pb

Potential takeout of recent 44p high to new ATHs in clean air

WAIT for price reaction to RNS and volume participation through 40.5p level : trade on with target >44p assuming oil maintains momentum with fib projection to 50p

[stock_market_widget type="inline" template="generic" assets="PTAL.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

Overnight Action and Pre Market Analysis

More signs of an overdue rally which may prove explosive given the recent chop and lack of direction over the past few days: likely we have reached peak bearishness for now

- FTSE futures remain unch around the key 7520

- day in green in the US with tech posting a 1.5% gain though rejecting the 8EMA while S&P held 8EMA . DOW is signalling a reversal with a tentative indication of a rally ahead (chart)

- Brent crude at $114.looking set to break north (Chart)

- VIX 28 as sentiment improves Chart

- DXY remains muted around 102 off recent 105 highs and below 21EMA

- Gold puked yesterday and is at $1846 despite weaker DXY

Key level to watch in FTSE100 around 7513

FTSE250