Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15 : identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Daily Shares in Focus

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="SQZ.L,PTAL.L,IQE.L,888.L" fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]Trades On : IQE PTAL 888 SQZ

recent trades posted on RPG

PTAL 40.5p here

IQE entry 29.4 - here closed final tranche on rejection of O/H resistance line at 35.75 @14:46 (+22%)

888 added at 204p to existing 192p here

PTAL Approaches 50p Fib Projection : Take Partial Profits at 48.5p

scale out some of the position from 40.5p entry as now around +20% on trade: will allow remainder to run further as no overhead resistance though price is very stretched relative to VWAP at 39.5: closed at 48.5p

Opening Price Reactions and AM Liquidity 08:15 Trade on SQZ

SQZ

08:10 Trade on with Serica as it bounces from a 618 Fib retracement of the Nov breakout to April high : supported by retaking the 200MA and the pop in oil prices initial position from 261.4p with an intermediate target of 300p stop around recent low of 240p and 2:1 R:r

[stock_market_widget type="inline" template="generic" assets="SQZ.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

BME

- the Shorters have it : despite some support around the previous low at 420p and a failed attempt at a gap fill, BME has moved south and targets 400-380p region with previous support from Oct 20: this is confluent with a 50% retracement from the pandemic low to the Dec 22 highs. This might prove a significant support level.

No trade on

[stock_market_widget type="inline" template="generic" assets="BME.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

Pre Market Analysis 06:30 and Short Squeeze Opportunities

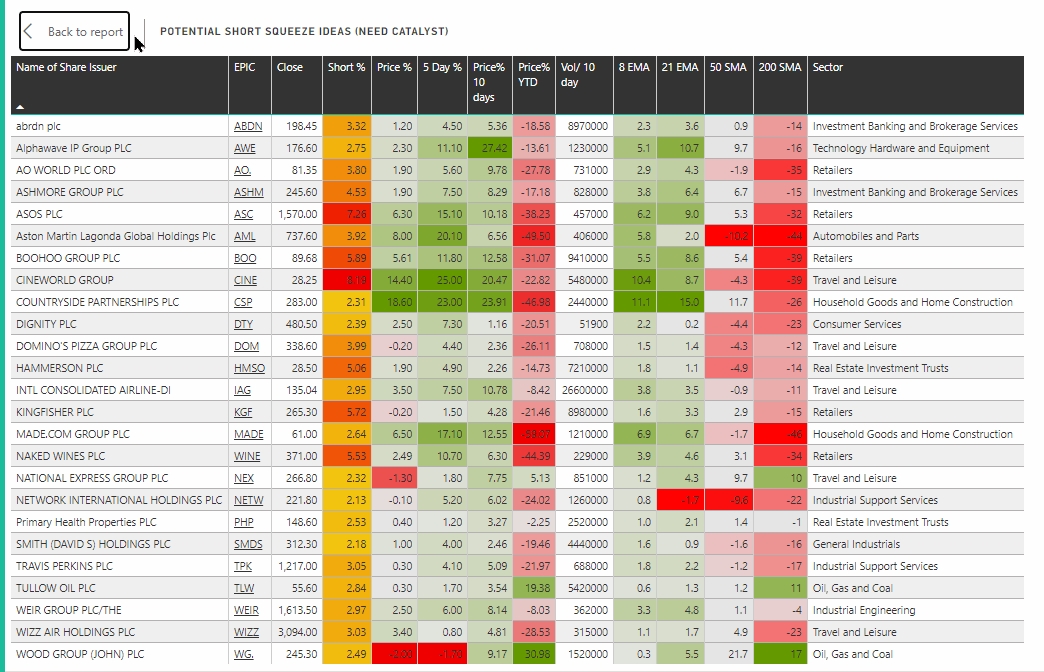

Return from hols for US today sees FTSE futures unch overnight at 7602 as pop in oil overnight is likely to lift oilers and BP/SHEL today. Copper moved north overnight (chart) as China starts to reopen: gold as highlighted yesterday remains muted around 1852 (chart). Short week and thin volumes may impact overall direction though today is the last day of the month. Some very dramatic pops in shorted shares yesterday with the likes of CINE +18% on the day : Will be watching a few other highly shorted shares (see Table) today for similar opportunities to jump on board explosive moves VSTOXX has dropped to 23.7 while the DXY has eased slightly at 101.4 which should be supportive equities.

- - Brent crude on further EU sanctions to Russian imports : should lift oilers and drag on airline (chart)

- - VSTOXX 23.9 (VIX from Friday as US holidays) - see dashboard

- - DXY- dollar index - drops to 101 and looks likely to may check 100 level: this is bullish stocks

- - Copper clears 21EMA on China reopening chart

- - Gold rangebound at 1852 below 21EMA awaiting directional move- chart

Charts - click to open to full size

Gold Chart

DXY Chart

Copper Futures Chart

Shorted Shares

RNS Analysis and Opening Price Action

RNS Report is published at 07:15 each day (approximately) and may be updated during the day to reflect the total RNS newsflow for that day : timestamp on the report indicates the latest update

RNS Analysis Potential pops

Relatively light day in substantive market updates with BME of note - 4.1% short reporting this am Results probably not worse than was expected so a positive reaction may be due: the SP is off recent lows and has re-grabbed VWAP with some resistance around the 21EMA at 460p. A positive break above the 21EMA (blue in chart) should see the 500p in the immediate term: a miss may see the lows around 420 revisited .one to watch on the open for reaction on the open.

PM Price Action 15:00