Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15 : identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

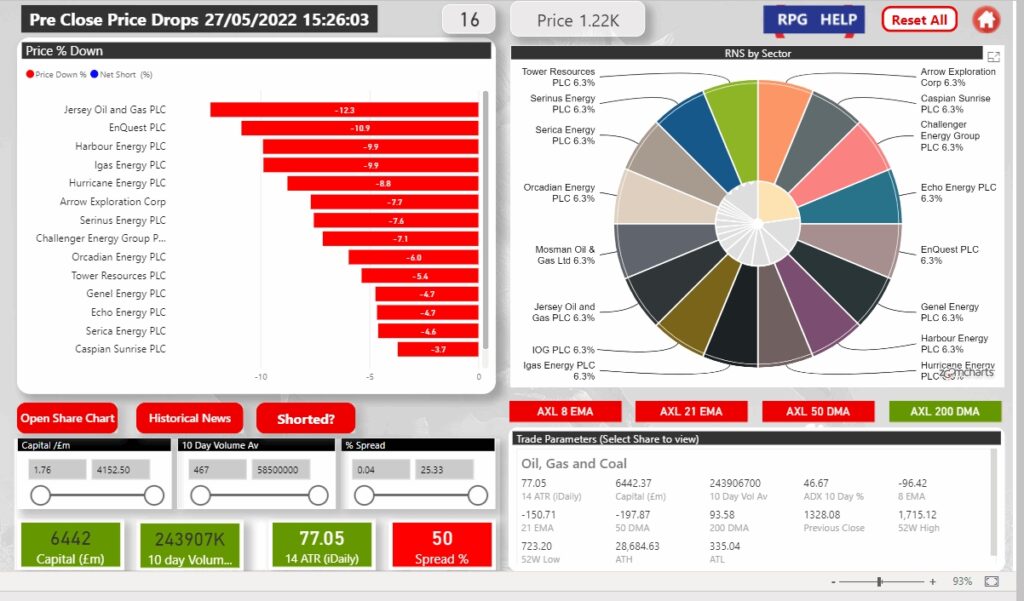

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

PM Price Action 15:30

Moving into a Friday afternoon before memorial weekend in the US - i.e month end with long weekend for our American cousins: while there have been plenty of pops this week, many of these have faded as profits are taken PDQ: it's a febrile market and will likely stay this way for some time. Adding the uncertainty of how the US markets will close today and what we may face on Monday morning is a consideration in what to keep open over the weekend. At pixel, the S&P and NAZ are up strongly on the day with the DOW lagging at 0.8%. This reflects some of the rotations we are seeing with a good bit of profit taking in Oil and gas and Miners today

The increased volatility offers good short term gains but also needs care with risk management : placing a trade is asking the market a question for which you are expecting a positive answer but accepting that a negative response comes a cost. In these markets, waiting for a longer time to get an answer brings increased risk especially when events can occur outside market hours

so best current plays involve

- - liquid instruments/shares

- - smaller position sizes

- - shorter durations.

This way you can take advantage of the relatively higher volatility (ATRs) without increasing risk levels in absolute terms ( as opposed to keeping stake sizes the same and widening stops to allow for vol. )

Daily Shares in Focus

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="WKP.L,BOY.L,VMUK.L,PTAL.L,IQE.L" fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]Opening Price Reactions and AM Liquidity 08:15

IQE from yesterday's entry of 29.4 up another 5.6% to exceed target 1 at 33p and partial profit take at 33.6: muted open with FTSE 100 rallying to previous resistance around 7575 and pulling back

closed remainder of yesterday's long from 7537 at 7568 as may see some rotation into mid and smaller caps with relative underperformance in the mega caps intraday: stil favour a retest of 7600 in the intermediate term and may revisit for another go [stock_market_widget type="inline" template="generic" assets="UKXNUK.L" markup="{name} is at {price} ({change_pct}){last_update}" display_currency_symbol="true" style="font-size: 13px" api="yf"]

Took a small Gold long from 1853.7 as highlighted Pre market with the intention of scaling in should it progress and target around 1870 [stock_market_widget type="inline" template="generic" assets="GC=F" markup="{name} is at {price} ({change_pct}){last_update}" display_currency_symbol="true" style="font-size: 13px" api="yf"] : took this off on second rejection of the 1861 level and diverging RSI.. it's the weekend so time to go flat in leveraged accounts

Trade : Adding to Winners - 888 Vol Squeeze Contines: PTAL + 8% Intraday

Initial position from volatility squeeze breakout at 192p [stock_market_widget type="inline" template="generic" assets="888.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

breakout continues - added at 204p

PTAL highlighted yesterday at 40.5p continues north set to takeout 50p : volume over past 3 days above average so likely to maintain momentum

[stock_market_widget type="inline" template="generic" assets="PTAL.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

RNS Analysis and Opening Price Action

RNS Report is published at 07:15 each day (approximately) and may be updated during the day to reflect the total RNS newsflow for that day : timestamp on the report indicates the latest update

RNS Analysis Potential pops

Notable pop potential in CLON (spudding) having pulled back to the 50% retrace of recent B/O to high at 0.475

BOY, notice of holdings increase with a good reversal pattern and potential breakout (chart)

GEM on record emerald sales , supported by share buyback and good technicals with a pullback to VWAP : it's low volume and below 50MA (chart)

Overnight Action and Pre Market Analysis 06:30

US rallies overnight though data from China on industrial production makes grim reading with an expected 12.2% rise in Industrial profit met with a -8.6% actual as Covid lockdowns hit

- FTSE futures -10 below cash close at 7551

- Brent crude breaks north as highlighted yesterday from 114 to 115

- VIX 27.5 while VSTOXX 25.7 as Europe become the apparent less risky prospect: this is bullish the FTSE 100

- DXY drops further to 101 handle supporting risk assets

- Gold tentative rally from weaker DXY but if risk appetite increases might not catch a bid: potential long