ACE Analysis Tues 3 Mar 26: FRES ITRK IWG JSG KLR

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password Username Password * Remember Me Forgot Password

ACE Analysis Monday 2 Mar 26: CRW DATA SNR TSTL

Globaldata (DATA) | ACE Score: +12.7 | Price: 0.83% The Delta: The catalyst is the company’s full-year results, which signal a positive operational inflection point following a period of strategic investment. The key delta for the market is the clear forward guidance, with approximately 80% of analyst revenue consensus for 2026 already contracted, providing significant visibility. This, combined with an … Read More

ACE Week Ahead w/c 2 Mar 26 AV., ENT, VTY, CABP, BNZL, FRES, EDV, KOS, HBR, MTRO

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Fri 27 Feb 26: FLTR GHH MRO PSON

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 26 Feb 26: JSE RR SAV SEPL

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

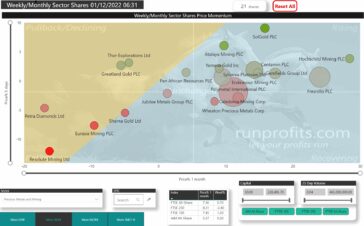

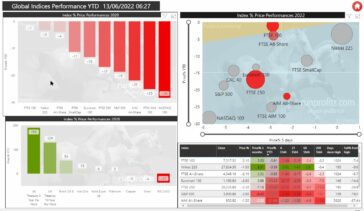

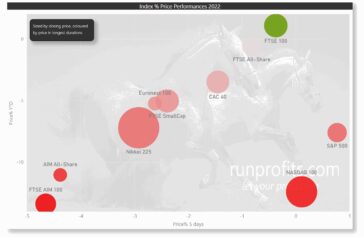

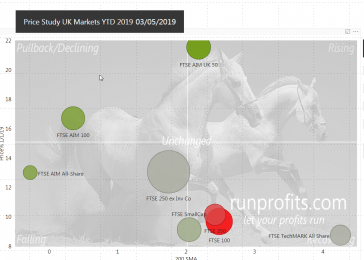

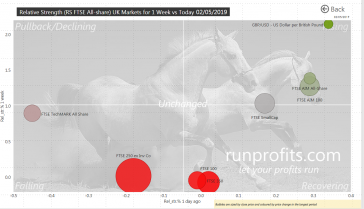

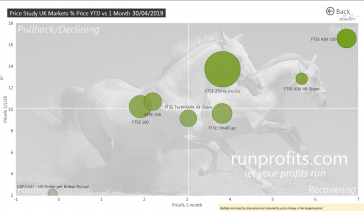

index 3m/1m template

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

FTSE 100 ATH Breadth Infographic

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Tues 24 Feb 26 CRDA CTEC UPR

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Monday 23 Feb 26: CAM CNE MONY

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Week Ahead w/c 23 Feb 26: AFC AML BUR DRX DGE HSBA IAG JSE MCB MRO PSON OCDO RR RMV VALT WPP

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Fri 20 Feb 26: AAL SGRO TBCG

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 19 Feb 26:CRH JLP MDI RIO

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 18 Feb 26: AAZ BA GLEN PAF

Anglo Asian Mining PLC (AAZ) | ACE Score: +17.1 | Price: +5.41% The Delta: Anglo Asian has executed a strategic pivot with its transformational 2026 guidance, forecasting a tripling of copper production to a midpoint of 22,500 tonnes. This guidance serves as a primary catalyst, significantly outperforming peer expectations and fundamentally altering the revenue profile towards copper, which is projected … Read More

ACE Analysis Tues 17 Feb 26: ANTO BHP IDOX IHG ITM KYGA

BHP Group Limited NPV (DI) (BHP) | ACE Score: 1.15 | Price: +1.46% The Delta: BHP has executed a structural pivot, with Copper now contributing 51% of earnings, eclipsing Iron Ore. The primary catalyst is a significant beat on historical financial performance, reporting Underlying EBITDA of 15.5 bn ( vs15.0bn consensus), driven by a 25% increase. This backward-looking strength is … Read More

ACE Analysis Monday 16 Feb 26: BKS ITM

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Week Ahead w/c 16 Feb 26:

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

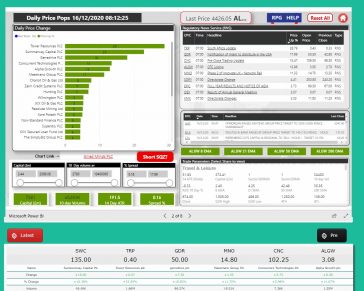

Runprofits Video Help GENERIC

Best Viewed in Full Screen – Mouse over and Hit [ ] to enlarge video

ACE Analysis Fri 13 Feb 26: 0705 : NWG

Fundamental ACE Score is 16.4 but the Final Score is 4 Why does the protocol do this? The Analyst is programmed to be forensically cynical of “Falling Knives.”Historically, when a stock has been aggressively sold off leading into results (-8.9% in the last 10 days), a “beat” often results in a “sell into strength” event rather than a clean re-rating. The … Read More

ACE Thurs 12 Feb 26: MGNS RELX TRI S32

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 11 Feb 26 KEFI PAF PZC RSW SEE

PZ Cussons PLC (PZC) | ACE Score: +18.6 | Price: +9.84% The Delta: PZ Cussons has delivered a robust 9.5% like-for-like revenue growth, significantly outperforming peer benchmarks such as Unilever (~4.7%). This commercial traction has prompted management to raise full-year operating profit guidance to a range of £53-57m. The strategic disposal of non-core assets, including the PZ Wilmar stake, has … Read More

ACE Analysis Tues 10 Feb 26 APTD BP BWY DNLM GMR

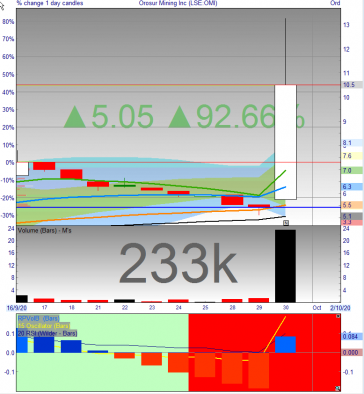

ACE really liked the GMR update from this morning which saw a change in fortunes for the US and RoW revenues with an increases in 10% revenues and 15% EBITDA .. meanwhile the chart showed a bit of price puke with some solid dumping of GMR to a new 52 week low and a double bottom at an RSI of … Read More

ACE Analysis Monday 9 Feb 26: PLUS PRV PWR W7L WYN

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Week Ahead w/c 9 Feb 26:ASHM BATS BARC CCH DNLM PRV PLUS NWG S32 GLE AZN RSW ULVR

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Fri 6 Feb 26: BRES VCT

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 5 Feb 26: AAL ITH SHEL VALT

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 4 Feb 26 COBR DCC GSK SSE WOSG

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Tues 3 Feb 26:ENSI FTC FNTL JSE

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Weekly Navigator w/c 2 Feb 2026:

The Week that Was: I. FORENSIC AUDIT: WEEK JUST GONE (JAN 26 – JAN 30) OBSERVATION: Data indicates a structural decoupling. US Industrial metrics advanced significantly, exceeding forecasts. UK Domestic metrics declined or missed forecasts, specifically in credit and housing. TABLE 1: HIGH-IMPACT DATA ACTUALS (THE EVIDENCE) I. FORENSIC AUDIT: WEEK JUST GONE (JAN 26 – JAN 30) OBSERVATION: Data … Read More

ACE Analysis Monday 2 Feb 26: AEP DSCV

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Week Ahead w/c 2 Feb 26: FTC JSE AAL WOSG ENSI GSK VCT SHEL BT

WACE IS BACK! New improved and a lot more in-depth – it has now been updated with changes to the scoring model and a skew to the technicals and trend (reducing the role of Analyst and Consensus) it uses some of the ACE technical scoring logic but can’t compete with ACE’s insight engine and lexcial scoring (because we don’t yet … Read More

ACE Analysis Fri 30 Jan 26: AVON GRX SVML YCA

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 29 Jan 25: ANTO ITM GLEN LUCE TRB WIZZ

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 28 Jan 26: ECOR FRES MTL SKL SML

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Tues 27 Jan 27 BIG ELCO ENOG GEN: SLP WAG

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Monday 26 Jan 26: ATM COST OMI PAF THX SFOR VANL VLG

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Week Ahead w/c 26 Jan 26

WACE IS BACK! New improved and a lot more in-depth – it has now been updated with changes to the scoring model and a skew to the technicals and trend (reducing the role of Analyst and Consensus) it uses some of the ACE technical scoring logic but can’t compete with ACE’s insight engine and lexcial scoring (because we don’t yet … Read More

ACE Analysis Fri 23 Jan BAB CLA

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 22 Jan 25: ALTN CCC HBR S32 SNR ZTF

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 21 Jan 26: AFC AMRQ HOC RIO SQZ

EPIC Triage Score Decision Summary of Announcement Key Financials & Metrics Scoring Explanation GFRD 11.5 P1-DEEP DIVE Galliford Try Holdings plc reports strong H1 performance, leading to an upgraded full-year outlook. The Board now expects revenue towards the upper end of expectations and profit to be slightly above the top end, supported by a strong £4.1bn order book and robust … Read More

ACE Analysis Tues 20 Jan 26:BGEO CREO EYE FCH G4M KMK PTAL QQ WISE

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Monday 19 Jan 26: ACG ANP DWL SRC XPP

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Weekly Navigator w/c 19 Jan 2026: Pullbacks Ahead on an Orange Swan Event

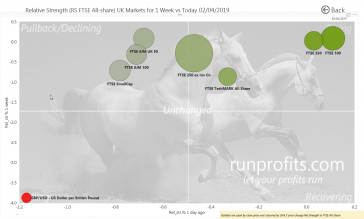

The Week that Was: The second full week of 2026 continued in a bullish vein despite all of the UK indices being stretched with the AIM All Share adding another 1.8% in the week to clear 5% YTD. Further advances in commodities especially industrial metals and a breakout in oil helped to add to gains. The mid cap 250 also … Read More

ACE Archive

#23282c23282c

ACE Analysis Fri 16 Jan 26: GLE GNS JSG

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 15 Jan 25: AAZ OXIG SAV

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 14 Jan 26: ATYM DATA FDEV FXPO MSI

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE on the Move

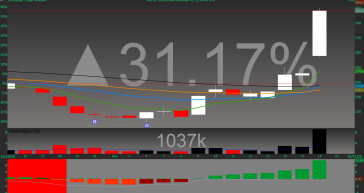

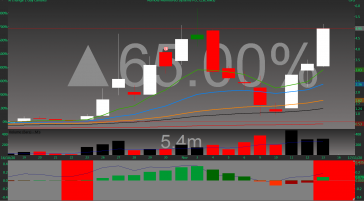

High scoring ACE names up over 10% in 10 days – jump on board opportunities

Institutional Global Macro Outlooks 2026

Below are the summary pages and links to the 2026 global macro outlook reports from the world’s biggest financial institutions. These give insights on how some of the largest money managers are positioning based on market expectations. No one can predict the future but big trends tend to persist and thought leadership can play a key role in setting direction. … Read More

ACE Analysis Tues 13 Jan 26: BBSN HTG ITX PTAL THS THX

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Monday 12 Jan 26: Coreo IQE Knights Grp Oxford nanopore PLUS500

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

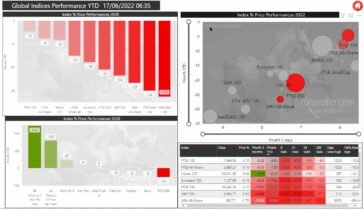

Weekly Navigator w/c 12 Jan 2026: UK Markets Start the New Year with a Bang

The Week that Was: The first full trading week of 2026 delivered a textbook “Bad News is Good News” setup. Almost all of the UK economic data reported this week was a miss – see Table .The UK economy is flashing Stagflation., but remember the stock market is NOT the economy . Inflation (BRC) is ticking up, while Growth (PMI) … Read More

ACE Analysis Fri 9 Jan 26:CKN PLSR SBRY SML

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 8 Jan 25: AMRQ CAML GRG KIST SHEL

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 7 Jan 26: APTA ENSI TPT GGP (late reported)

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Tues 6 Jan 26: KEFI NXT ZIOC

Next ACE +11.2 Beat and raise greeted by a fairly lukewarm response of +2.6% : did clear the 50MA briefly but is struggling – chart looks like it wants to breakout but is into overhead resistance to the recent all-time highs of 145p: it closed the breakout gap on the last earnings announcement into year end ’25: good chance this … Read More

Beyond the Gold Rush: Constructing Your 2026 Alpha Matrix

1. Executive Summary: The Interpretation Game The global economic landscape of 2026 is defined by a transition from the reactive volatility of the post-pandemic era toward a structural regime characterized by institutional analysts as “The Interpretation Game” (Barclays) or “Pushing Limits” (BlackRock). This era is marked by clashing orders of magnitude between massive capital expenditures in artificial intelligence (AI) and … Read More

ACE Analysis Monday 5 Jan 26: ACSO CNE KOS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

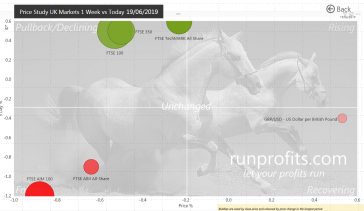

2025 Lookback: A Goldmine for the Stockpicker

To the casual observer, 2025 was an exceptional year for UK equities. The FTSE 100 gained 21.5%, hitting new all-time highs and rivalling the US tech giants. However, beneath this headline number lies a more complex reality that defined the difference between a profitable performance and a losing one This report, Part 1 of the Run Profits Annual Review Process, … Read More

ACE Analysis Fri 2 Jan 26: IES

Invinity Solutions and AIM listed energy storage provider starts the new year on a positive not scoring an ACE of 12.8 on a beat in 2025 revenues of £17m vs £15m expected ( though down from £22m in 2024) and a order book of £17m for 2026. Positive gap up on the open to clear the 50MA and consolidation trendline … Read More

ACE Wed 31 Dec 25:

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Tues 30 Dec 24: GMS SAVE ZPHR

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Institutional Global Macro Outlooks 2025

Below are the summary pages and links to the 2025 global macro outlook reports from the world’s biggest financial institutions. These give insights on how some of the largest money managers are postioning based on market expectations. No one can predict the future but big trends tend to persist and thought leadership can play a key role in setting direction. … Read More

ACE Analysis Monday 29 Dec 25: PAT

Boxing Day saw some melt-up moves in Precious metals with Silver exploding over 10% and platinum +8.6% . This saw RSI values approaching high 80s with some retail-driven giddiness especially given the low volumes involved. Some pullbacks today to 5 EMA levels in the charts – if price bids off these levels then momentum prevails. I am expecting some consolidation … Read More

ACE Analysis Fri 19 Dec 25: KOD QHE SMWH: CWR Update

In last week’s analysis of Ceres Power (CWR) following the short attack, I highlighted the critical importance of the volume profile support between 250p–275p given the impact on sentiment and pending a reply from the CWR Board . I noted that if this level failed, we would likely see a move down to 225p, which corresponds to the 61.8% Fibonacci … Read More

ACE Thurs 18: CURY FRP ITM

ITM ACE 5.7 a small contract win but with a high profile customer – Kimberly Clark via Octopus Energy partners. Success in deployments like these can open the door to broader adoption within large multinationals like KC but also to other players in this and aligned sectors . It adds to the cadence of contract wins from ITM – see … Read More

ACE Wed 17 Dec 25: ATM IHP SNX SRP

Brent oil dropped to a April ’25 low yesterday as the support highlighted in the Weekly Navigator buckled under supply, geo political and economic demand worries: it is catching a bounce bid today and may retest the $60 level . A rejection would confirm this as intermediate resistance and open the door to a new low . Recapturing and a … Read More

ACE Analysis Tues 16 Dec 24: BOWL GDWN IGG TIME WJG

Dollar slips further testing the October lows while gold dips below $4300 , silver reasserting the uptrend yesterday but failed to breakout and sits around the $63 handle : platinum breaks $1800 Brent is testing the $60 floor big level to watch! Yesterday saw a relief rally off the Friday sell-off FTSE 100 led the +1% charge lifted by … Read More

ACE Analysis Monday 15 Dec 25: GSF PRV RSG

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Weekly Navigator w/c 15 Dec 25: ‘Twas the Week before Christmas – CPI & BoE

The Week that Was: AIM Outperforms on Miners n Metals In last week’s navigator the relative weakness in UK indices compared to the US was given some breathing space to allow for consolidation from the post budget pop. I did put a proviso, we wanted to see some strength in evidence in the week just closing We didn’t and we … Read More

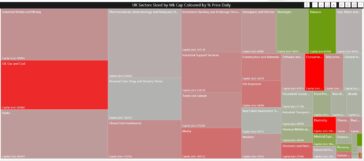

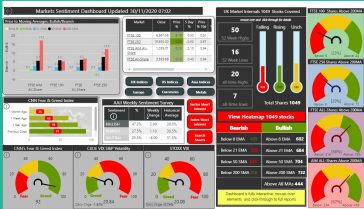

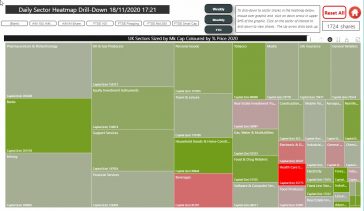

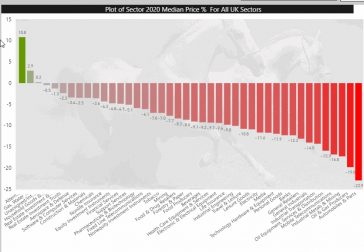

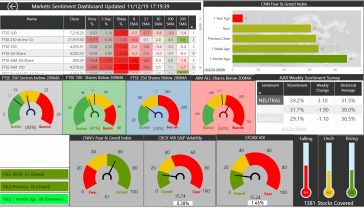

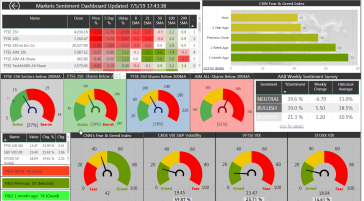

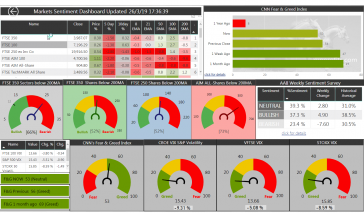

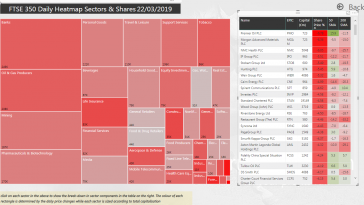

UK Daily, Weekly, Monthly 3M Heatmap

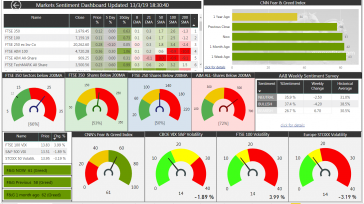

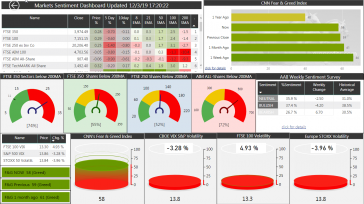

IMPORTANT! These are NOT live prices and are only updated end of week for trend following analysis: the heatmap in the Market Dashboard is updated every day with end-of-day data

ACE Analysis Fri 12 Dec 25: FTC ITM

ITM Power released a much needed filip to a flagging sentiment announcing 2 new engineering contracts in Canada and Australia with an ACE of 10.3 and a chart that was showing a deep pullback to the 200MA confluent with a 50% retrace of the April breakout to the July resistance high. In technical terms this is a good place for … Read More

ACE Thurs 11 Dec 25: DRX NCC RM TRU : CWR Short Attack

UPDATED 18:00 Grizzly Capital MGt Hidden Hand – 1.28% Shorts In the Shorts by Shorters part of Runprofits you can view individual short interest positions, Grizzly took their position yesterday using the standard one-day disclosure delay allowed by the FCA, they were able to keep their hand firmly hidden until the trap was set and the attack launched overnigh – … Read More

ACE Wed 10 Dec 25: BKG CHRT FAN GKP RCN

Berkeley Group ACE +4.3 Clears 8 EMA on a Hammer Candle to Challenge Downtrend BKG DID hold both the 5 and 8EMA and got a broker TP raise today from 3700 to 3900p from RBC though the UNDERPERFORM rating is maintained. Often sell-side analysts lag price and in many cases are contraindicating. Homebuilders are staging a stuttering … Read More

ACE Analysis Tues 9 Dec 24: REST WINE BEG TGA OMG

Calendar CHG DIAL IXI OMG AHT MOON WINE BEG UK reporting see here UK BRC UK Retail sales -MISS 1.2% vs 2.6% expected and 1.5% previous

ACE Historical Scores

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Monday 8 Dec 25: BIG MER SN

OWING TO A DATA FEED ERROR , THE PRICES AND TECHNICALS QUOTED IN THE ACE REFER TO EOD Thursday 4 December

Weekly Navigator w/c 8 Dec 25: Commodities Busting Moves: Oil on Watch for a Breakout

The Week that Was: Uk Consolidates, US Rallies to Resistance The first week of December delivered the consolidation as anticipated in last week’s navigator The velocity of the move (Breadth +20% in a week) demands a consolidation. We should some consolidation of these moves early in the week. Weekly navigator 30/11/25. Following the post-Budget relief rally, the domestic indices entered a … Read More

ACE Analysis Fri 5 Dec 25:GDR SBTX

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 4 Dec 25:BBY FRAS FUTR ITM WOSG YCA

8 names slated to report including AJB SSPG WOSG BBY – see the calendar 09:00 UK Construction PMIs 10:00 EU Retail Sales

ACE Analysis Tues 2 Dec 24: Discoverie Group, Gooch & Housego, On the Beach , Severfield, Topps Tiles

Calendar UK reporting see here 18 UK names in the frame including UK BRC Shop Index Overnight 10:0 EU CPI

Weekly Navigator w/c 1 Dec 25: Bear Trap Snapback

The Week that Was: Budget Relief The last week of the second-last month of the year ended strongly in green led by the mid caps with a sigh of relief following the budget. One of the most trailed and speculative that we have seen in a long time. Purdah entered the lexicon of the broader public as No 11 broke … Read More

ACE Thurs 27 Nov 25: AOM HFD PAF SQZ

Broad relief with the budget saw bond yield drops especially longer dated 10 and 30 year which raised sterling to a 1 month high In sector terms, Banks saw some of the biggest moves with bond proxies, REITs and utilities rallying as did grocery and Renewables ( CWR up 8%) A&D is staging a comeback as defence sending gets raised … Read More

ACE Wed 26 Nov 25: ATG CBOX MCG PETS SDY

All the UK indices took cheer Tuesday after a very lacklustre start to the week and following last week’s sharp pullbacks: good bit of evidence that short covering may have helped in moving prices BUT – rallies in the most budget-sensitive Sectors such as Construction, Homebuilders, Retail, Travel all in evidence while Banks lifted the FTSE 100 in the main … Read More

ACE Analysis Tues 25 Nov 24: AO AXS EZJ IGP KGF MARS TEP

In the Weekly Navigator I commented that 70% of Thanksgiving weeks were positive stocks over the past 50 years , so this week started well after last week’s big pullback with the NASDAQ rallying 2.6% crushing vol as VIX fell back 12.5% to 20. The chart of US tech shows a rally to, but a rejection of, the 50 day … Read More

ACE Analysis Monday 24 Nov 25: CER MWE SAAS TTG

Good Monday Quiet start to the week with FTSE futures hold their after market gains from Friday signalling a +50 open on Friday’s cash close Brent at $62 and one month lows Gold holding $4050 but muted SIlver shy of $50 Copper glued to the $5.01 level with moving averages massively compressed Bitcoin snapped back to the 5EMA around $87000 … Read More

Weekly Navigator w/c 24 Nov 25: Budget Boom or Bust ? UK Markets on a Knife Edge

The Week that Was This past week saw another week of fairly wild volatility which isn’t truly reflected in the overall changes in the indices, the FTSE100 down just 1.6% on the week with the 250 off 2.2%. That the US VIX spiked to almost a 7 month high of 27, (its highest since April and the Tariff tantrums) is … Read More

ACE Week Ahead w/c 24 Nov 2025

WACE results from last week have been updated with changes to the scoring model and a skew to the technicals and trend (reducing the role of Analyst and Consensus) : unlike ACE which is a well established and statistically validated Alpha generator, WACE remains a prototype scanning tool which is under both review and development

ACE Analysis Fri 21 Nov 25:ASC BAB PAT NWF TLW

Happy Friday ! Last week we started Friday after a weak week , this week we end the week on a lot more weakness. FTSE 250 dipped below the 200 day moving average for the first time since early May after the April Trump-Dump recovery. In a fairly remarkable (in mcap terms) , pop of over 5% in Nvidia, the … Read More

ACE Thurs 20 Nov 25:DOCS JD JMAT PAY SNR TRCS

Yesterday was a fairly muted day in markets following the recent slides as FTSE250 closed unch and FTSE100 yielded 0.45% on a big ex div day : the AIM All-Share rallied 0.85% to reclaim the 200MA boosted by gold miners and resource stocks with SRB adding 8% and YCA + 3.6%: the goldies following the snap back in gold, silver … Read More

ACE Wed 19 Nov 25: AET HILS ITH SGE SMIN

Major indices checked in at key support levels yesterday as selling broadened : today we watch for reactions off these key levels – the FTSE 100 at the 50MA and the FTSE 250 at the 200MA. Today is a likely pivot day given UK economic data, US Fed minutes and Nvidia earnings The Advance/Decline line I … Read More

ACE Analysis Tues 18 Nov 24: CML CRST FGP KMR G4M SCT THX

FTSE 100 futures signalling an open sharply lower as selling accelerates, futures down 120 points at pixel below 9600 suggesting we take out Friday’s low in the cash today . The rally I expected yesterday didn’t appear though the mega cap index did revisit 9700 before promptly rejecting and signaling a good short opportunity CBOE VIX is at 22 after … Read More

WACE Archive

WACE ACE Week Ahead w/c 2 Mar 26 AV., ENT, VTY, CABP, BNZL, FRES, EDV, KOS, HBR, MTRO Donncha@runprofits.com – 01/03/2026: 9:32 pm What is the Matrix? How to Read the Risk Asymmetry Matrix The Risk Asymmetry Matrix is a forensic topographical map… Read More WACE ACE Week Ahead w/c 23 Feb 26: AFC AML BUR DRX DGE HSBA IAG … Read More

Article Archive

Analysis Archived Article Macro Opinion Research Institutional Global Macro Outlooks 2026 Runprofits – 13/01/2026: 5:07 pm Below are the summary pages and links to the 2026 global macro outlook reports from the world's biggest financial institutions…. Read More Analysis, Archived, Article, Macro, Opinion, Research ACE Analytics Analysis Archived Article Macro Research Thematic Beyond the Gold Rush: Constructing Your 2026 Alpha … Read More

ACE Analysis Monday 17 Nov 25 GEN MTL SRAD

Good Monday We start the week with FTSE futures signalling a flat 9685 open off a cash close of 9698 gold retesting the 21EMA, copper sideways though showing more weakness, oil similarly muted around the 21EMA , Bitcoin is finding some support at May levels having had a 10% slide in a week while the dollar squeezes in a tighter … Read More

Weekly Navigator w/c 17 Nov 25

My primary macro call last week was a conditional test of the market’s resolve. I wrote that we were “set for a BounceBack UK” but attached a critical, cautious contingency: “We need this to prove itself with strength rather than facing more weakness (rallies get sold)”. This is precisely what occurred. The FTSE 250 rallied for the first two days, … Read More

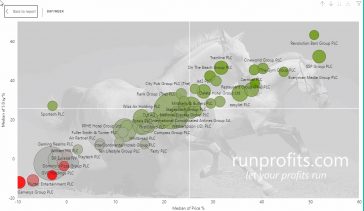

ACE Week Ahead w/c 17 Nov 2025

The Four Opportunity Buckets: A Quick Guide I’ve improved WACE to its final iteration for a while and now classify every opportunity into one of four specific “Market States.” Here is how to interpret them and the probabilistic price behavior associated with each. The Matrix shown in the Peer analysis Report now shows how these opportunities aggregate into the four … Read More

ACE Analysis Fri 14 Nov 25: AMRQ MRO

Happy Friday ! Red day UK yesterday saw FTSE 100 pullback from the 9900 level , few ex divs at play but the overall weakness entering as the US session gto underway in another AI darling sell-off. the NasDAQ closed down over 2% retesting the 50MA , the S&P 500 holding up better with some evidence of rotation into other … Read More

Daily ACE Help Video Nov 25

Short video showing the latest improvements to ACE including the Daily RNS view, link to the calendar and how to access charting. Hit comments below to feedback , comment make suggestions

WACE The Movie

Video guide to the latest version of the WACE with the Week Ahead prospects for 17 Nov 25

ACE Thurs 13 Nov 25: ATYM ALFA AV BRBY CTEC FLTR KLR PSN PFD BME PTAL QQ RR WIZZ

Oil highlighted yesterday pre market with a note on the Opec report here finding some reprieve after a big red day yesterday to settle around $62.3: Gold clears $4200 while silver outshines but sees some resistance at the previous ATH of $54 UK GDP and productivity numbers today but the slew of earnings in the mega and mid caps will … Read More

ACE Wed 12 Nov 25: ALL AVON CGS EEE SML VLX

fresh news highs in the FTSE 100- Vodafone covered in yesterday’s ACE HERE with a score of 14.5 breaking out and shifting 8.3% higher on the day into 2 year highs: homebuilders catching a bid in anticipation of earnings from the likes of Taylor Wimpey today and Persimmon tomorrow Brent cleared $64 eyeing $65 lifting oilers while nat gas is … Read More

ACE Analysis Tues 11 Nov 24: 3IN ABDP DIA LUCE OXIG VOD

The mega cap FTSE 100 eked out yet another ATH on Monday as the US resolution to its government woes brought some cheer and more liquidity into markets. Cable stayed muted around the $1.31 level flattering the index which saw broad gains across sectors though banks and Tobacco stay bid. Bit of a safety trade still inplay so one to … Read More

ACE Analysis Monday 10 Nov 25: CMCL KNOS RHIM RBW SOLG

Good Monday We start the week with gold on a rip as highlighted on Friday HERE and analysed in detail in the Weekly Navigator , hope you are positioned and have taken the opportunity to add to goldies on the pullbacks . We watch for how emphatic the move develops and whether we are yet sufficiently reloaded to break to … Read More

Weekly Navigator w/c 10 Nov 25

last week was a difficult week which saw broad selling across global bourses with the US “unwinding” some of the AI trade : In last week’s Navigator – I did prophetically suggest that there was a fiscal fear factor at play – not knowing Reeve’s would appear on Tuesday to forewarn us of the budget ahead and set the scene … Read More

ACE Week Ahead w/c 10 Nov 2025

The model has had a major upgrade this week to better sort through the tidal wave of data and identify opportunities in broad buckets. The overarching principle is still the same: I am not in the business of crystal ball gazing but in quantifying and qualifying expectations based on data-driven insights. The market is often led by sentiment, which (as … Read More

ACE Analysis Fri 7 Nov 25: MEGP RMV WPM

Happy Friday ! yesterday’s BoE announcement at 12:00 did set a dovish tone on UK plc which initially saw a positive response from the mid cap 250 – this rapidly reversed as the US liquidity entered the market and ended up down 0.8% on the day – dropping the 50MA yet again. Support in the AIM All Share failed by … Read More

ACE Thurs 6 Nov 25:AFC DGE HWDN SBRY VTY WOSG

Choppy markets as we bounce back from support levels across the board, 11 FTSE 100 and 11 FTSE250 names reporting in a super Thursday along with the BoE Interest rate decision at noon will set direction but the charts are suggesting expectations are we go higher Macro & Indices UK PMI Services: Beat expectations yesterday. Mid-Caps: Bounced off the 50MA … Read More

Sector-Vector: Renewables Reloaded

Hydrogen-Based Renewables: Buying the Dip in a Bull Trend The AI-driven data center (AI-DC) build-out has created an immediate, critical power-demand crisis. The market’s initial “solution”—Small Modular Reactors (SMRs)—needs a reality check on at least one aspect : time to power. SMRs are a decade-long solution. AI demand is a today problem. I produced an infogrpahic summarising this theme back … Read More

ACE Wed 5 Nov 25: BTRW JDW KITW HEAD MKS TRN WEIR CWR on China Deal

In the weekly navigator I commented on the Fiscal Fear factor as a potential headwind in November as the budget looms: I wasn’t expecting Reeves to make a surprise speech yesterday! Her grim warnings did help send the FTSE 250 lower as the pound weakened sharply (again signalled in the Weekly Navigator at the weekend) and triggered sell-offs in Homebuilders, … Read More

ACE Analysis Tues 4 Nov 24: ABF BP DOM DOTD TUNE

Highlighted in the weekly navigator and part of my cautious tone in to November, dollar strength is starting to play out impacting commodities with copper dropping below the 21 EMA: Brent still sees the 50MA as resistance and stays below the $65 level gold has slipped 4,000 and as I highlighted in the Weekly Navigator, the 21EMA which was … Read More

ACE Analysis Monday 3 Nov ENSI KOS RENX

Good Monday We start the week with Brent above $65, gold tracking $4000, platinum above $1600, copper compressed between the 21EMA and the 8EMA squeezing: my cautionary tone in the Weekly Navigator may well prove unfounded as Doc Copper does look like it wants to move north SHell gets RAISES from Citi and Berenberg adding to the Goldman and UBS … Read More

Weekly Navigator w/c 3 Nov 25

A few calls from last week’s navigator played out well The analysis identified specific momentum and dislocation opportunities which were subsequently validated by the market. The Thesis 4 dislocation call on Jubilee Metals (JLP) worked well , with the stock rallying +19.2%. The momentum calls were also confirmed, with Glencore (GLEN) and Serica Energy (SQZ) continuing their uptrends, gaining of … Read More

ACE Week Ahead w/c 3 Nov 2025

In many of the below I have reviewed the charts to compliment/challenge WACE’s model-driven narratives . i suggest you do similar and take the model’s narrative as a “prove it” jumping off point. I am predominantly a technical trader so when I am in doubt, the chart and price ALWAYS wins 1. High-Risk Setups: Caution Required This group includes … Read More

ACE Analysis Fri 31 Oct 25 ALL AAU BKG SVML KP2

Apple and Amazon both beating in the after hours given this big bull another dose of adrenaline although breadth is narrowing at these lofty heights. FTSE 100 held firm yesterday closing unch but looking tired and in need of a break : RSI is at 76 and it has formed a hanging man on the daily : time for some … Read More

ACE Thurs 30 Oct 25: CCC FTC HLN SEPL SHEL SLP

Some disappointment in the US overnight on unexpectations of rate of interest rate eases with Powell striking a more cautious note than was expected. This sent bond yields higher and the dollar index found some support which is just below 100. Gold and precious metals showed a bit of weakness. I wrote about this yesterday though it wasn’t much of … Read More

ACE Show me the Money! A Bit About ACE: Part 2

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

A bit about the ACE : Part 1

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

CWR Ceres Power Infographic: 28 July 2025

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 29 Oct 25 :80M AML ECOR GLEN GMET NXT : CWR Broker Catalyst

Big day in Risk today even as NASDAQ made new term highs with NVIDIA adding nearly 5% on announcements during the GTC conference. Also big earnings in US tech after the close today with GOOG, META, MSFT reporting along with the much awaited Fed decision on rates and the US China trade talks. Gold Holds 50% Fib at $3900 I … Read More

ACE Analysis Tues 28 Oct 25: AAF AAL AMRQ RSG YCA

YCA Breaks Out of Consolidation on Quarterly Update at last Yellow Cake starting to awake and up over 6% on the quarterly report this am. – ACE’s rules don’t do an awful lot wilth updates like this : they are predicated on finding major catalysts and alpha generating events so on that basis it struggled a little bit in … Read More

ACE Week Ahead w/c 27 Oct 2025

Into the last week of the month and in this week ahead view I want to do a few of things. First of all I want to reflect on the what was the first week of this trial which had the occasional hiccup not least yet another IT plumbing issue with AWS on Monday (along with a third of the … Read More

ACE Analysis Monday 27 Oct 25 : 1SN ALTN BVXP GGP RBW: Gold Getting Sold to $4000

Priced for Perfection: Greatland Gold’s Stellar Results Muted Response* The ACE warnings that Greatland Gold (GGP) was priced for perfection have proven prophetic, at least in the intial price repsonse on the open -3.68% on stunning results. Despite posting an extraordinary year of financial and operational success, the market has turned its focus to the future—and it looks troubled … Read More

Weekly Navigator

It was a wild ride in this second last week of October, with big swings across the board. The major action was in commodities. Gold, one of the year’s biggest gainers YTD , took a sharp dive. The relentless rise reversed almost 10% from its all-time high of $4,400 to near $4,000 in just two days—though this is still a … Read More

UK Macro Data 26 October 2025: Cautiously Optimistic as Inflation Eases, Manufacturing Recovers, Services Expand

This week witnessed a distinct improvement in investor confidence, as a series of better-than-expected economic data points from both the UK and the U.S. altered the market narrative. Concerns over persistent inflation, which have constrained gains for months, were superseded by signs of resilient consumer spending and a notable rebound in UK business activity. This shift in sentiment propelled UK … Read More

Site Guide by Doing: Part 2

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Site Guide by Doing: Part 1

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Friday 24 Oct 25: ALU CNE NWG OMI

Highlighted premarket for CNE on positive ACE catalyst: this is a reversal play so prone to failure if we get any overall adverse market conditions but in supporting markets these can do well Big break-out gap cleared more than the 21EMA I was looking for and gapped up clearing the 50MA and into overhead resistance (supply) before retracing to almost … Read More

ACE Thurs 23 Oct 25 Reports on ANTO CER DNLM GMET HTG REL AND IHG INCH RSW SYNT AAU

Yesterday’s beat in inflation saw the midcaps rise by 1.8% led by recoveries in inflation sensitive sectors like homebuilders, retailers, travel and REITS .Gold and precious metals remained weak though both gold and silver held their 21EMAs with gold observing support at $4000 highlighted yesterday . Of note was platinum’s dip below the 21EMA before a 5.4% rally intraday to close … Read More

ACE Wed 22 Oct 25 : AURA FRES HOC MPAL SRT SCT

US session closed flat with Japan’s Nikkei forging ahead further overnight to new highs: Netflix reporting after the close failed to meet lofty expectations and is down over 6.5% in aftermarket. Gold lost over 5% yesterday with silver down almost 8.5% : both staging some recovery overnight as gold did indeed check in to its 21EMA as highlighted yesterday . The … Read More

Gold and SiIver Hit the Skids

I mentioned this am that gold had a strong yesterday but formed a double top …one to watch. We didn’t have long!! After forming a potential double top yesterday without confirming a new high, gold has set up for the sharp bearish reversal we’re seeing today. Intraday, it’s printing a bearish engulfing candle on an almost 4% move down to … Read More

ACE Analysis Tues 21 Oct 25 ATYM BZNL BRCK CLBS NCC S32 SRC

Mornin’ In the overnight China and Japan have made strong moves Japan to an all-time high following on from good US session with Apple making an all-time on a beat in iphone 17 sales. NASDAQ printing an intraday ATH (see the US stock market heatmap from the links section) . Gold is back after a very strong day yesterday recovering … Read More

ACE Analysis Monday 20 Oct 25 ALL COBR DATA GRX PLUS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

WACE week 1 Email HTML

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Week Ahead w/c 20 Oct 2025

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Friday 17 Oct 25 EMG HLCL JLP PSON SHI

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

WACE

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 16 Oct 25 AAZ CAPD CUSN ENSI GBG SBRE TPK

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Wed 15 Oct 25 : BOOM ENT KMR OMG PAGE THX

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Tues 14 Oct 25 BP PTAL RIO SRB THS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Register

[wp_eMember_registration]

ACE Analysis 13 Oct 25 1SN FAR MTL SAG SPA SQZ TSTL

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

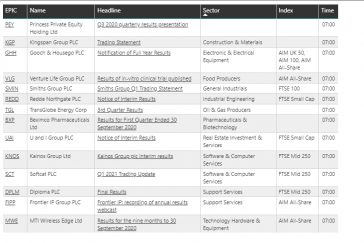

UK Companies Reporting This Week

SCROLL TO BOTTOM BAR BENEATH REPORT – HIT DIAGONAL ARROW (LOWER RIGHT) TO MAKE FULL SCREEN > UK Reporting Calendar The calendar is fully interactive : use the boxes, pie charts and menus on the RIGHT to slice the table according to index, sector, date . Hit RESET to reload the calendar Names in the table above are coloured by … Read More

ACE Analysis 10 Oct 25 RNS IBST ENW HAS VP

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Thurs 9 Oct 25 CAML FAN HSW MOTR SSPG TET

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Sign-up

I’d like to join RunProfits – email me an invite (you will receive an email with joining instructions, check you spam folder if this does not arrive within 2 hours)

ACE Wed 8 Oct 25 AAU GNC MARS NET PANR RFX VTU

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Analysis Tues 7 Oct 25 HOC GGP SHEL TEP KOS

I’d like to join the ACE Trial Group Here

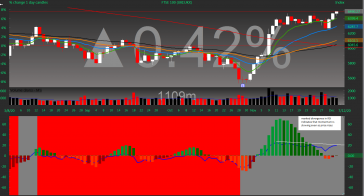

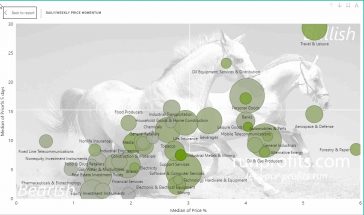

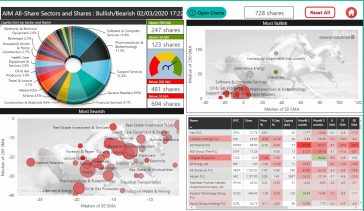

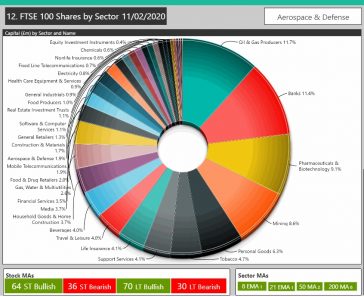

RP Bull Score

How to Use the Bull Score: A Simple Guide One of the most powerful and unique tools you’ll find on our platform is the Bull Score. This guide will explain what it is, how it works, and how you can use it to gain an edge in your trading and investing. What is the Bull Score? Think of the Bull … Read More

ACE Analysis Tues 7 Oct 25 HOC GGP SHEL TEP KOS

I’d like to join the ACE Trial Group Here

ACE Analysis 6 Oct 25 AML BKS DIA FXPO HSS ZPHR

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

6 Oct RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

6 oct scraps

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

6 OCt 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Welcome to ACE Membership

https://runprofits.com/wp-content/uploads/2025/10/ace-team-Welcome-Final.mp4

ACE Fri 3 Oct 25 RNS JDW

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

2 Oct 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

01 oct 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

1 Oct 25 RNS

[aipkit_chatbot id=43474]

30 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

29 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

PCE Week Ahead 29 Sep 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

pce v1 27 sep 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

ACE Week Ahead 29 Sep 25 V2

Week Ahead Catalyst Report Date: September 26, 2025 | Generated by AI Engine v3.1 Full Analysis Index Avacta Group Boku Inc Devolver Digital Inc Greggs Animalcare Group Carnival & Corp AG Barr JD Wetherspoon EJF Investments Niox Group Tesco Dunedin Income Growth IT Huddled Group Airea Malvern International Aeorema Communications Physiomics Novacyt SA Blackbird Northcoders Group Futura Medical GENinCode Tissue … Read More

Week Ahead 29 Sep 25 V1

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

25 Sep 25 NS AAZ ATLN

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

25 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

24 Sep 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

23 sep rns

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Mon 22 Sep 25 ELIX ITA ITM VANL

Daily RNS Catalyst Report Date: 22 September 2025 | Generated by Catalyst-AI v2.5 Full Analysis Index ITM Power (ITM) Ilika (IKA) Elixirr International (ELIX) Van Elle Holdings (VANL) Catalyst Summary Bullish Catalysts ITM Power (ITM): +4.1 ITM Power announced a capacity reservation agreement with RWE for 150MW of NEPTUNE V units, equivalent to 30 units, with call-offs expected by 2027. … Read More

22 sEP 25 rns

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Fri 19 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Thurs 18 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

17 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

TUES 16 SEP 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Tues 16 Sep 25 EKF ELCO EYE FNTL KAV KMK PRV TRST TUNE

Daily RNS Catalyst Report Date: 16 September 2025 | Generated by L:6 / Q:5 / T:0 Full Analysis Index EKF Diagnostics Holdings (EKF) Elecosoft Public Limited Company (ELCO) Eagle Eye Solutions Group (EYE) Fintel (FNTL) Headlam Group (HEAD) Kavango Resources (KAV) Porvair (PRV) Trustpilot Group (TRST) Focusrite (TUNE) Kromek Group (KMK) Catalyst Summary Bullish Catalysts EKF Diagnostics Holdings (EKF): +5.2 … Read More

15 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

11 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

10 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Mon 8 Sep 25 CNC GMR PANR RSG THX

Daily RNS Catalyst Report Date: 08 September 2025 | Generated by Alpha-Semantic- Analyst_v42 Full Analysis Index Pantheon Resources (PANR) Thor Explorations Ltd (DI) (THX) Resolute Mining Limited NPV (DI) (RSG) Concurrent Technologies (CNC) Gaming Realms (GMR) Catalyst Summary Bullish Catalysts Pantheon Resources (PANR): +9.6 The primary catalyst is a significant operational update from the Dubhe-1 appraisal well, confirming a 63% … Read More

4 Sep 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Wed 25 AHT BAKK CORA CHH ECOR HFG WINE

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

3 Sep RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Tues 24 RNS ALU EVPL IDHC JSG MBH ONT SFR UPR WIZZ

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

2 Sep 2025 RNS ALU EVPL IDHC JSG MBH ONT SFR UPR WIZZ

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

1 Sep 25 rNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Mon 1 Sep 25 : AOM DIA KNOS MWE PLSR RBW TIG

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

28 Aug 25 RNS AXL EEE HTG PPH PRTC SCT SRB

https://gemini.google.com/app/fa57963c0a610212

27 Aug RNS EUA FARN HOC JD THX TRCS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

26 August 25 RNS : AT, BNZL, EKF, ITM, MWE. OMI , PLSR

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

26 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

19 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

22 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

21 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

fluent test

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

20 aug rns 2

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

20 Aug 25 RNS ANG CORA ITH KMR SVML

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Tues 19 Aug 25 RNS : APN, BHP , IWG. TRB

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Resource Stocks

Identifying High-Potential UK-Listed Resource Equities Executive Summary This report presents a proprietary, data-driven framework for the analysis and selection of investment opportunities within the UK-listed resource sector. Moving beyond traditional qualitative assessments, this framework operationalizes the strategic concepts of the mining life cycle, jurisdictional risk, financial resilience, and management capability into a robust, quantitative scoring system. The primary objective … Read More

18 Aug 25 RNS : BVC, EEE, IKA , KAV, PLSR, QED , TGA ,THX

https://gemini.google.com/app/f5708ccd18000ce7

15 Aug 25 RNS :SOLG OCN

https://aistudio.google.com/prompts/new_chat https://gemini.google.com/app/083aa2cd6668f951

Thurs 14 Aug 25 RNS ANTO CAPD ITM MHA RNK SBTX TRU TXP

https://gemini.google.com/app/0c5e711744e1c0e5 https://docs.google.com/spreadsheets/d/1uZnUIzlLgdxwXbqg-apMiIVA4rY1QkslTa2wTqUEwcY/edit?gid=1966718526#gid=1966718526

12 AUg 25 RNS ATUM, THX, BWY,

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Short Infographic 12 AUg 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

12 AUg 25 RNS : ATYM BWY ENT GEN THX

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

11 AUg RNS test wiith Broker Updates and Max baselining

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

11 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

8 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

rns 6 aug

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

7 Aug 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

baseline and judgemetn mixed up but of for template work

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Templates with Analytcial baseline in

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Tues 5 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

The Alpha Catalyst Engine Infographic

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Mon 4 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Fri 1 aug 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

1 Aug 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Thurs 31 July 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

AI Power Dilemma Infographic One Pager 30 July 25

Currently not signing up subscribers : CLICK HERE if you want an invite for when we are Currently not signing up subscribers : CLICK HERE if you want an invite for when we are

30 July 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

AI Power TLDR

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

The AI Power Crisis Infographic

RunProfits Infographic: The AI Power Crisis RunProfits.com Visual Mining of UK Stock Market Data The AI Power Crisis: A Grid-Locked World Demands a New Solution Analysis of a Technology Enabler at the Nexus of Exponential Demand and Systemic Infrastructure Failure “The ‘Why Now?’ for Ceres Power is not a story of incremental progress but of a perfectly timed intersection with … Read More

Tues 29 July 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

29 July 25 DEV ACE Work

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

CWR FInal Infographic WIDE

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

CWR Infographic

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Shorts infographic 28 July 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

24 July Daily RNS Catalyst Report Part 3 QTX to WIZZ

IN TEST : Want to be invited to Join this when it goes Live?? : CLICK HERE if you want an invite to your inbox Want to be invited to Join this when it goes Live?? : CLICK HERE if you want an invite to your inbox

24 July Daily RNS Catalyst Report Part 2 ELCO to JSG

IN TEST – Want to be invited to Join this when it goes Live?? : CLICK HERE if you want an invite to your inbox IN TEST – Want to be invited to Join this when it goes Live?? : CLICK HERE if you want an invite to your inbox

24 July Daily RNS Catalyst Report Part 1 AAf to ELCO

IN TEST – Want to be invited to Join this when it goes Live?? : CLICK HERE if you want an invite to your inbox IN TEST – Want to be invited to Join this when it goes Live?? : CLICK HERE if you want an invite to your inbox

v27 23 juy

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

v27 23 July 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

23 July final v28.1

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

23 July V28.0 Before P and Temp settigns

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

23 July 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

odds 23 july

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Tues 22 July 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

odds

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

21 JUL;Y ODDS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Mon 21 july 25 RNS

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

friday

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Wed 17 July 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

7AM Matrix

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

15 July final assets NEW Scoring

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Tues 15 July 25

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and … Read More

RNS Trading Mon 14 July 25

RunProfits Interactive Dashboard DAILY RNS CATALYSTS – 14/07/2025 Daily RNS Catalyst Report Date: 14/07/2025 P1 Deep-Dive Analysis Serabi Gold (SRB) Thor Explorations Ltd (DI) (THX) Beeks Financial Cloud Group (BKS) ECO Animal Health Group (EAH) Pulsar Group (PULS) Petrotal Corporation (PTAL) Jadestone Energy (JSE) Today’s Catalyst Summary Bullish Catalysts Serabi Gold (SRB): +8.8Record quarterly production and strong cash flow. Thor … Read More

7AM Edge

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Wed 9 July 25

CEY Chart set-sup for a move north with gold at ATHs and strong results with increased EBITDA and margins, lower AISC and big increases in FCF HIGHLIGHTS 9.5 million hours worked at the Sukari Gold Mine (“Sukari”) with zero lost time injuries (“LTI”). The Group lost time injury frequency rate (“LTIFR”) of 0.08 was an 83% … Read More

Friday 12 July 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Thurs 10 July 25

RunProfits Dashboard Market Overview Bullish Bearish Neutral Deep Dive Catalyst vs. Bull Score Today’s market-moving news. Bullish Catalysts Bearish Catalysts Neutral Catalysts RunProfits Daily RNS Analysis: 10 July 2025 Part I: Executive Intelligence Summary Daily Catalyst Monitor Bullish:Rank Group, Trifast, CML Microsystems, Atalaya Mining, Hostelworld Group Bearish:Macfarlane Group, PageGroup, Liontrust Asset Management, Vistry Group, Central Asia Metals, Polar Capital Holdings … Read More

Wed 9 July 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Mon 7 July 25

Currently not signing up subscribers : CLICK HERE if you want an invite for when we are

RNS Trading Fri 4 July 25

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and … Read More

RNS Trading Thurs 3 July 25

RunProfits Daily RNS Analysis: 03 July 2025 PART I: EXECUTIVE INTELLIGENCE SUMMARY Daily Catalyst Monitor BULLISH CATALYSTS: CURY, GRID, BCG, QTX, AOM, IGP, CRS, MKA, PEEL BEARISH CATALYSTS: WOSG NEUTRAL CATALYSTS: GPE STRATEGIC CATALYSTS: GRID (De-risking), MKA (Business Combination), AOM (Acquisition), CRS (Portfolio Asset Approval) Key Catalysts Identified A clear bifurcation emerged in today’s trading updates. On one hand, operational … Read More

Daily Shorts One Pager

RunProfits.com | UK Short Interest Analysis runprofits.com July 2, 2025 FCA Disclosed Short Interest Disclosed Tuesday 1 July 2025 Top 10 Most Shorted Companies Ranking of companies by the highest percentage of short interest. Sector Spotlight Industry breakdown of the top 30 most-shorted firms. Short Squeeze Indicator This chart plots short interest against recent price changes to identify squeeze candidates. … Read More

RNS Trading Wed 2 July 25

CEY Chart set-sup for a move north with gold at ATHs and strong results with increased EBITDA and margins, lower AISC and big increases in FCF HIGHLIGHTS 9.5 million hours worked at the Sukari Gold Mine (“Sukari”) with zero lost time injuries (“LTI”). The Group lost time injury frequency rate (“LTIFR”) of 0.08 was an 83% … Read More

Dash 1 July 25

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

RNS Trading Tues 1 July 25

Report Contents Part I: Executive Intelligence Summary Daily Catalyst Monitor Key Thematic Currents Performance & Risk Quadrant Part II: Granular Company Analysis J Sainsbury plc (SBRY) Zanaga Iron Ore Company (ZIOC) Adriatic Metals (ADT1) Mercia Asset Management PLC (MERC) Kitwave Group plc (KITW) Gelion (GELN) Mpac Group plc (MPAC) Supreme plc (SUPR) Wynnstay Group Plc (WYN) Windar Photonics plc (WIND) … Read More

RNS Aggregator

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Master RNS Meanings: Making Money from Market-Moving Language

Report on the Quantitative Analysis of UK RNS Catalysts and Their Market Impact Executive Summary This report presents a comprehensive framework for identifying, categorizing, and quantifying the market impact of linguistic catalysts found within UK Regulatory News Service (RNS) announcements. The primary objective of this study is to move beyond simplistic sentiment analysis and create a robust, data-driven tool for … Read More

RNS Trading Mon 30 June 25

Currently not signing up subscribers : CLICK HERE if you want an invite for when we are Part I: Executive Intelligence Summary Daily Catalyst Monitor Bullish Catalysts Amcomri Group (AMCO): Secures a significant £12.9m contract in the renewable energy sector, enhancing earnings visibility for FY25/26. hVIVO (HVO): Reports partner’s “extremely impressive” and “excellent” Phase 2b study results, validating hVIVO’s capability … Read More

RNS Trading Fri 26 June 25

Daily RNS Catalyst Report: 27 June 2025 Daily RNS Catalyst Report Source: runprofits.comDate: 27 June 2025 Part I: Executive Intelligence Summary Daily Catalyst Monitor Bullish Catalysts: Likewise Group (LIKE): Reports a 10.0% increase in gross sales revenue in a subdued market, indicating significant market share gains and improving operational gearing. Andrada Mining (ATM): Secures £5 million in funding, critically including … Read More

Premarket Catalysts Thurs 26 June 25

Source: runprofits.com Date: 26 June 2025 DAILY RNS CATALYSTS – FINAL VERSION Table of Contents Part I: Executive Intelligence Summary Part II: Granular Company Analysis Cavendish Financial (CAV) Associated British Foods (ABF) Moonpig Group (MOON) Manolete Partners (MANO) Foresight Group (FSG) Made Tech Group (MTEC) Patria Private Equity Trust (PPET) Schroder European Real Estate Investment Trust (SERE) Chrysalis … Read More

Ruprofits Latest Articles

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Gold Market Cycle High Analysis

Gold Market Analysis and Outlook (April 2025): A Comprehensive Review Executive Summary This comprehensive report analyzes the gold market, focusing on historical bull markets and their drivers. This includes the 1977-1982 period, the 2001-2011 cycle (which coincided with the Great Financial Crisis), and the current 2013-2025 cycle. By examining cyclical patterns, monetary dynamics, geopolitical factors, and the role of gold … Read More

The Probabilistic Nature of Trading Setups

A trade’s success hinges on two core components: the setup (a probabilistic set of conditions) and the trigger (a specific event validating the setup). This report synthesizes research to demonstrate how triggers enhance probability, the psychology of disciplined waiting, and practical strategies for novice traders. The Anatomy of a Trade: Setup vs. Trigger A setup is … Read More

Zweig Thrust Breadth Work

### Unlock Professional Analytics Access to this data requires an active membership. [mepr-pricing-table id=”YOUR_GROUP_ID”] Already a member? Username Password * Remember Me Forgot Password

Historical Anatomy of Bear Markets Key Characteristics Depth & Duration: Declines range from 20% to over 80%, lasting weeks to decades[1][3]. The 1929 Crash saw an 89% drop over 3 years, while the 2020 COVID crash recovered in 4 months[2][4]. Triggers: Common causes include economic shocks (e.g., 1973 oil crisis), financial crises (2008 subprime collapse), and exogenous events (COVID-19)[2][3]. Recovery … Read More

High Probability Trade Set-ups an Overview of What Works

High-Probability Trading Strategies: A Detailed Analysis This report examines various trading strategies and setups, evaluating their probabilities of success based on empirical data and academic research. It also highlights common pitfalls and offers recommendations for maximizing profitability. Methodology This analysis incorporates a combination of quantitative and qualitative factors: Statistical Data: Win rates, risk-reward ratios, and drawdown metrics. Academic Research: Studies … Read More

Counter Trend Trades are Popular Ways to Lose Money – But IF you Must Use a Setup

Countertrend Reversal Trading Strategy: A Statistical and Practical Analysis Strategy Framework Core Parameters Technical Indicators RSI Divergence: Identify overbought (>70)/oversold (<30) levels with price divergence (new price lows not confirmed by RSI). Volume Confirmation: Volume spikes may signal significant price movements, indicating trade entry points ( Bookmap). Reversal Candlestick Patterns: Pin bars, engulfing patterns, and hammers at key support/resistance levels. … Read More

Short Changed: Uk Daily Short Interest Changes

SCROLL TO BOTTOM BAR BENEATH REPORT – HIT DIAGONAL ARROW (LOWER RIGHT) TO MAKE FULL SCREEN

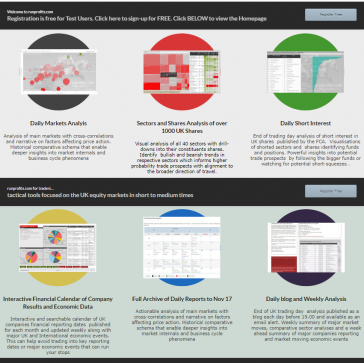

runprofits Blog Posts and Articles