Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15 : identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Daily Shares in Focus

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="ORPH.L.,ENOG.L,NEX.L,SQZ.L,888.L" fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]RNS Analysis and Opening Price Action

RNS Report is published at 07:15 each day (approximately) and may be updated during the day to reflect the total RNS newsflow for that day : timestamp on the report indicates the latest update

Pre Market RNS

Pre Market Analysis 06:30

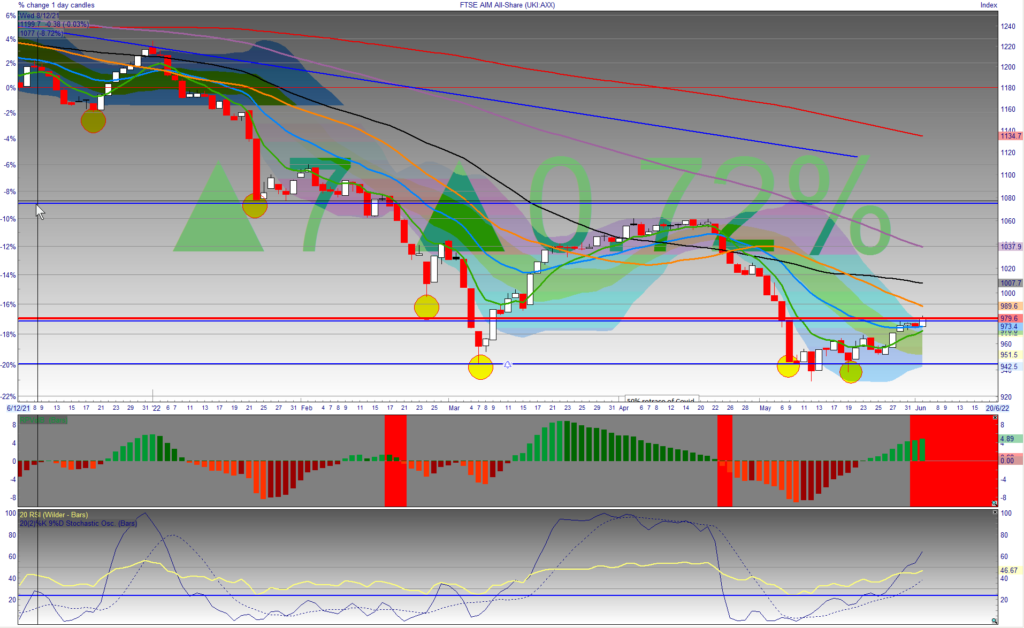

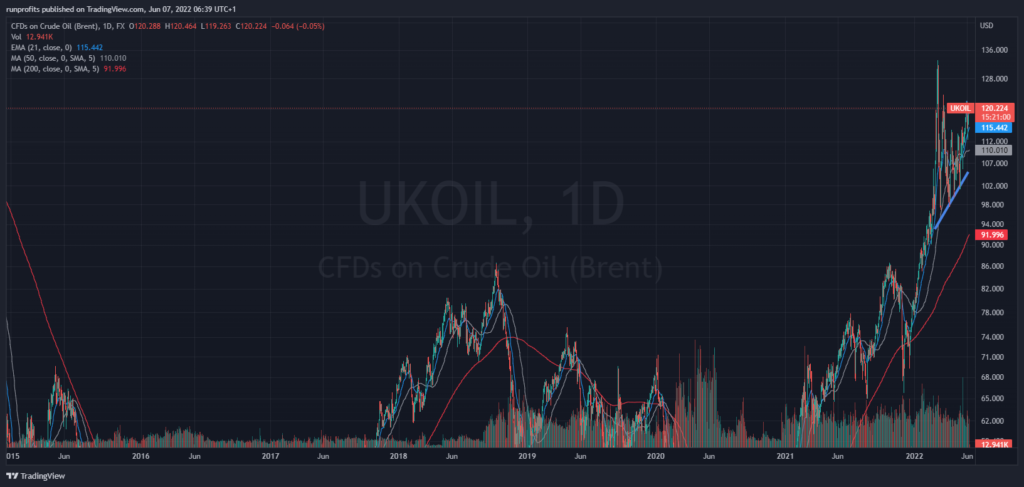

UK Futures suggest a softer open -40 on cash close at 7572 where yesterday's price saw the index revisit recent highs and reject them: the FTSE 100 does seem to be forming a large head and shoulders pattern which needs confirmation. UK played catch-up yesterday after a long weekend with a broad rally across the board and mid caps outperforming. The AIM All-Share index turned more bullish yesterday finishing 0.7% to the good and is setting-up for a breakout (chart) . US closed mildly in green as Tech and the NASDAQ outperformed while the DOW lagged with Energy underperforming (chart). Similar rotation out of this crowded trade also evident in some UK oil names.Premarket sees oil sideways at $120, gold weaker at $1842 hugging its 200MA as dollar looks set to move north again from 102.4 (chart)

- - US stocks close in green with tech outperforming, energy seling - see map

- - Brent crude sideways at $120 consolidating (see chart)

- - VIX at 25.1 VSTOXX 23.0 - see dashboard

- - DXY- dollar index firmer at 102 - below 21EMA (see chart)

- - Copper pulls back to 200MA (see chart)

- - Gold weakened as DXY moves north(see chart)

Charts - click to open to full size

Market Dashboard

AIM All-Share Chart

US Stockmap Close

Gold Chart

DXY Chart

Brent Oil Chart

Copper Chart

Trades On : 888 , PTAL SQZ

recent trades posted on RPG

PTAL 40.5p here [stock_market_widget type="inline" template="generic" assets="PTAL.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

IQE entry 29.4 - here closed final tranche on rejection of O/H resistance line at 35.75 @14:46 (+22%) [stock_market_widget type="inline" template="generic" assets="IQE.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

888 added at 204p to existing 192p here [stock_market_widget type="inline" template="generic" assets="888.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

SQZ 261.4p here [stock_market_widget type="inline" template="generic" assets="SQZ.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]