Contents: Click on Link to View

ToggleA Look Through the Indices

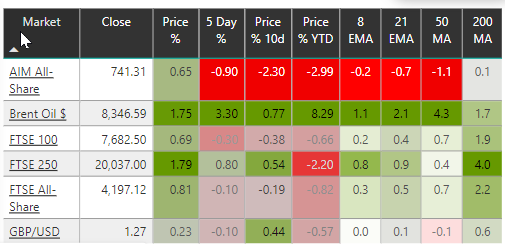

New month new money helped lift the UK indices on Friday, albeit this was triggered by the US rally following weaker economic data Friday afternoon which dented the dollar and helped the risk-on trade. We closed the month with the FTSE100 and FTSE250 +0.8% and +0.7% to the good while the AIM All-Share share was - 1.5% for February. That’s in stark contrast to the Nikkei plus 10.8% the Nasdaq plus 6% and the DAX +5%

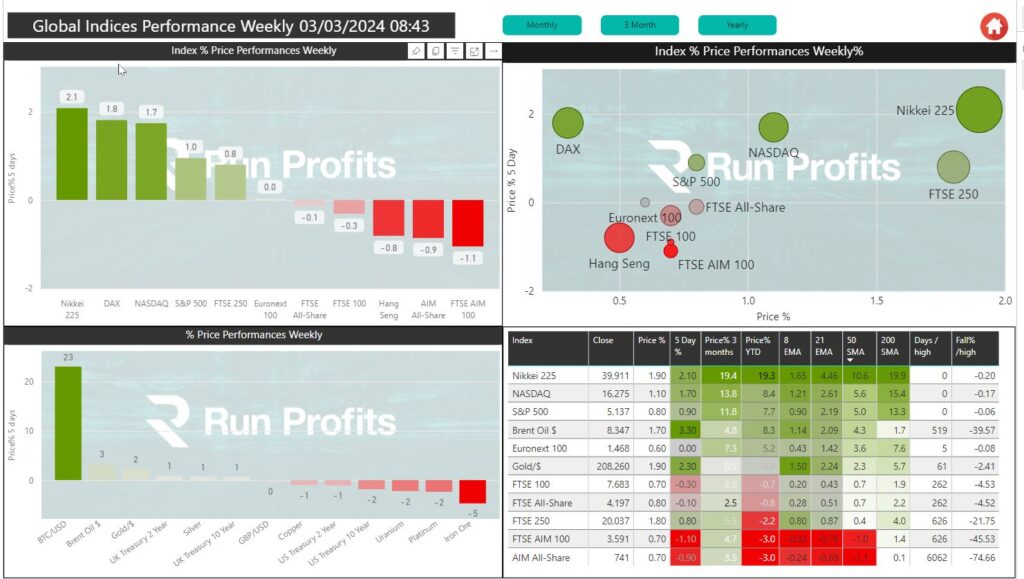

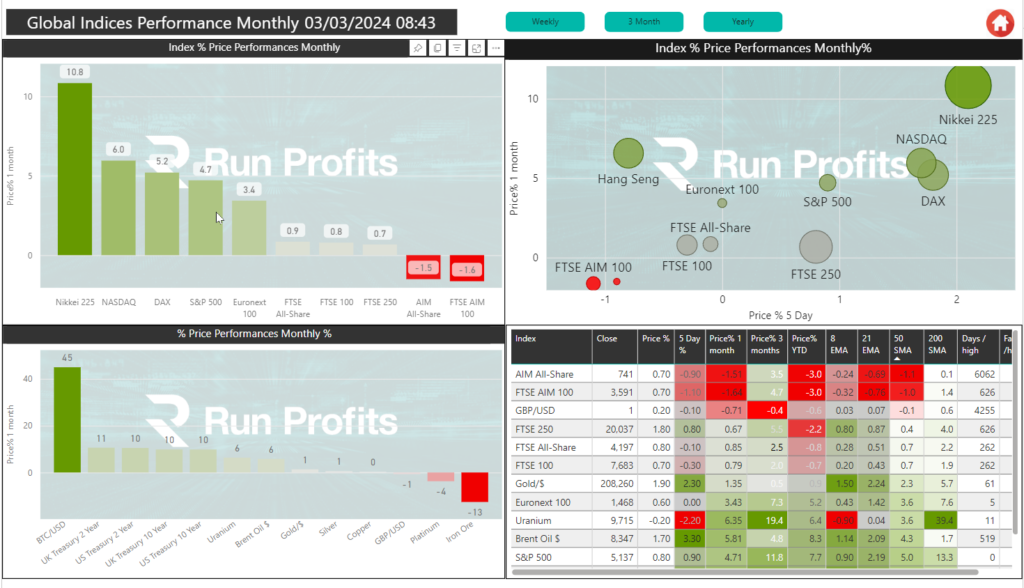

A summary plot of the global indices, commodities and main currencies is shown below along with the monthly (these can be viewed in the market dashboard)

Last week saw new all-time highs in the Nikkei index the Nasdaq , S&P 500 , EURONEXT 100 and the German DAX . While the UK indices continue to lag, there are reasons to be cautiously optimistic on a developing breakout especially in the mega and mid-caps But also potentially in the small cap AIM stocks.

Year to date all of the UK indices are in the red though the price action is starting to look increasingly like consolidation with a breakout due and given the overall underperformance versus rest of the world - that is most likely to the upside. That being said, we need recovery in the commodities with a flow through to names in the Oil and Gas , Mining sector and then an uplift in Pharmaceuticals to achieve that breakout. The US more so than ever is playing the lead role for all of the major global indices, especially given the Chinese lag whihc especially hurts the UK .

The S&P500 rallied to an all-time high Friday with Energy and Healthcare participating strongly , this gives some reason to believe these sectors are joining the party and we may rotate into them as the rally broadens out of AI and Tech.

(Clicking on charts and plots makes them full screen - click on the "x" in the upper right corner to return to article )

Dollar and Commodities : Gold Breakouts Friday, Brent through Resistance

Last week saw more weakness in the metals with iron ore down 5%, copper down 1% platinum down 2% and uranium below the $95 mark. However, the strong rally in gold on Friday which added 1.9% to the $2082 after a long period of consolidation may give some reason to believe the rest of the commodities complex might follow. Silver also participated in the rally but stopped short of its 200 MA, retreating intraday- this is a level to watch next week.

Dr copper is often seen as a key indicator for overall economic activity - this has remained in a consolidating channel since early December 2023 (see chart) . It does start to look like a move to the upside is coming - so a good clear and close above the $3.9 level next week would be bullish the overall mining sector

(Clicking on charts and plots makes them full screen - click on the "x" in the upper right corner to return to article )

Copper consolidating in channel since Dec '23: breakout is bullish the miners

Major breakout in gold following 2 months of consolidation- Gold miners to follow

Brent Crude Pushing Through resistance closes above $83

Brent Crude rangebound below resistance at the $83-84 level:

Brent oil similarly made a major move on Friday closing above the key $83 resistance level but stopping short of breaking through $84 - I have been highlighting this area of supply for the past few weeks. If this breakout is sustained, this will lift the oil and gas sector and in turn may see a sentiment shift across the UK indices. Macro supply-demand dynamics do suggest oversupply with the US showing record productions at record efficiencies: however, this is counterbalanced by the expectations from the next OPEC+ meeting on 3 April which may see production cuts prolonged and extended.

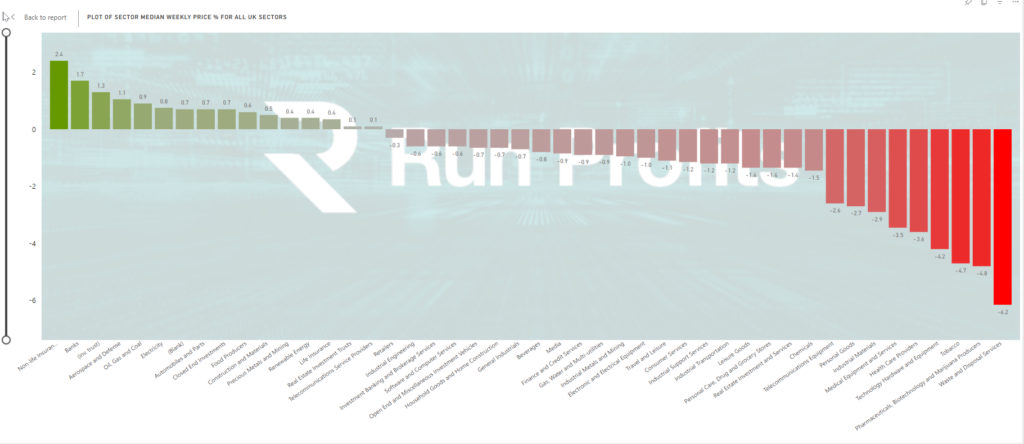

Sectors in The Week Ahead Should See Green for Oil and Gas and Resource Stock Especially Gold Miners

As highlighted in last week’s weekly wrap, I expected further strength in the non life insurance and banking sectors. These turned out to be the two strongest sectors this week, With the majority of the names in both sectors positive on the week especially in banking - NatWest (+7%) Standard Charter (+9%) Bank of Georgia Group(+10%) and Close Brothers Group (+14%) were all up strongly on the week: Direct Line rallied 25% while Admiral and Hiscox were up 6%.

Plot: Banking, Non Life Insurance and A&D were Sector Winners this Week with Losers concentrated in Healthcare, Pharm, Tech Hardware

Given the breakout in gold and strength in oil , we should see some outperformance in these sectors over the coming week

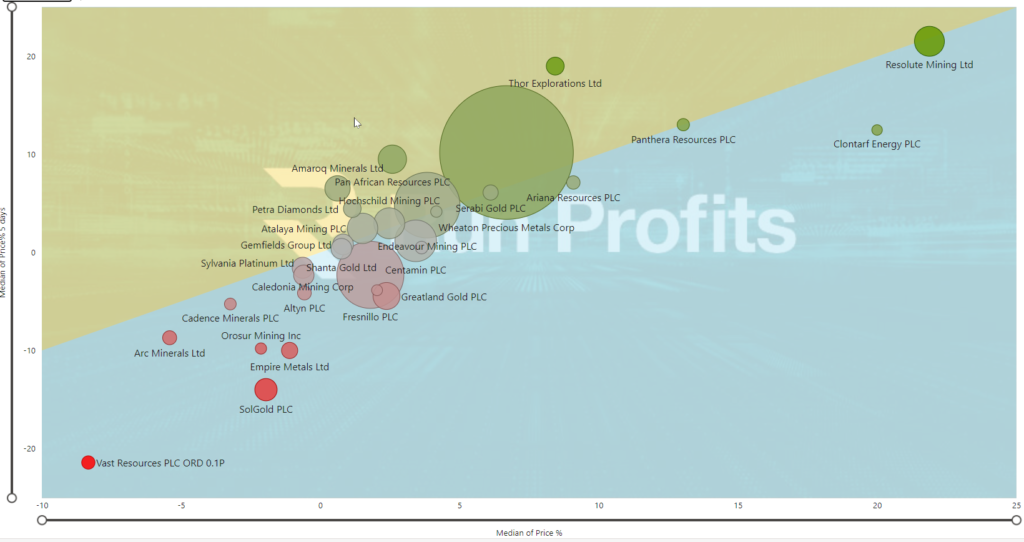

Strength in Precious Metal Miners should continue: RMI, CLON , PAT leaders - HOC looks set to follow

Hochschild Mining HOC looks set to breakout - I took an initial position following the first gold update of the low cost Mara Rosa mine on 21 Feb posted here: chart below shows a volatility breakout building on the daily: I'll add to my position upon a clear of the 50MA resistance levels around 96p

HOC set-ups up for a move north with a volatility squeeze forming on the daily into resistance around the 50MA

Earning and Economic Calendar Week 10 of 4 March 2024

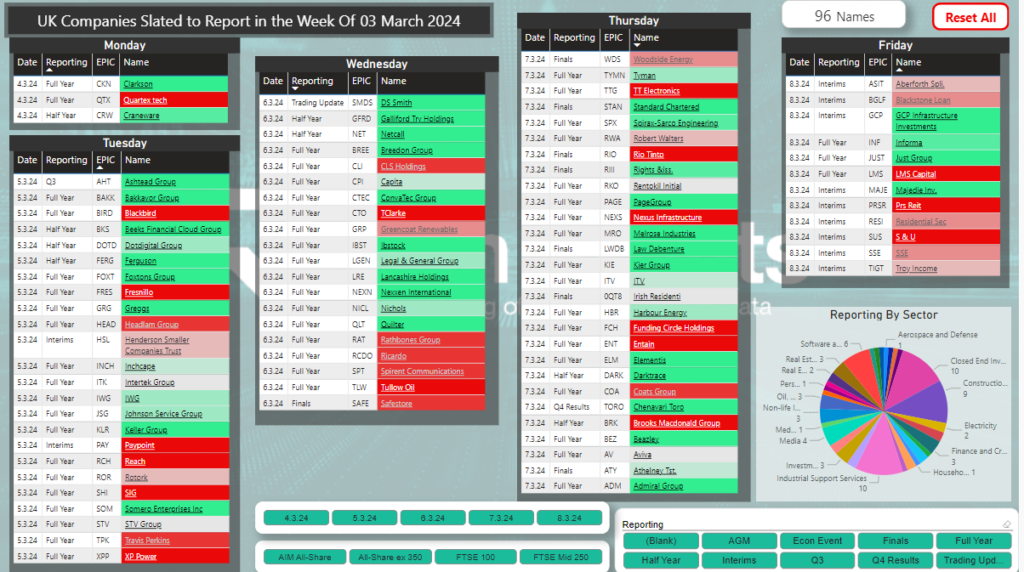

96 names set to report in the coming week - see the RP Calendar here : screen grab below

Big week for the construction sector with 9 reporting including GFRD , KLR, KIE while 10 Industrial Support Services companies report including : FERG, INCH ,IWG , JSG, PAY, SHI, CPI PAGE

Scree Grab below - full details in the interactive calendar

- see the RP Calendar here : screen grab below