Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Daily Shares in Focus

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="ATM.L,ECR.L,PTAL.L,SQZ.L,888.L,BLVN.L" fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]Closed Remainder PTAL on D/T at 60.3

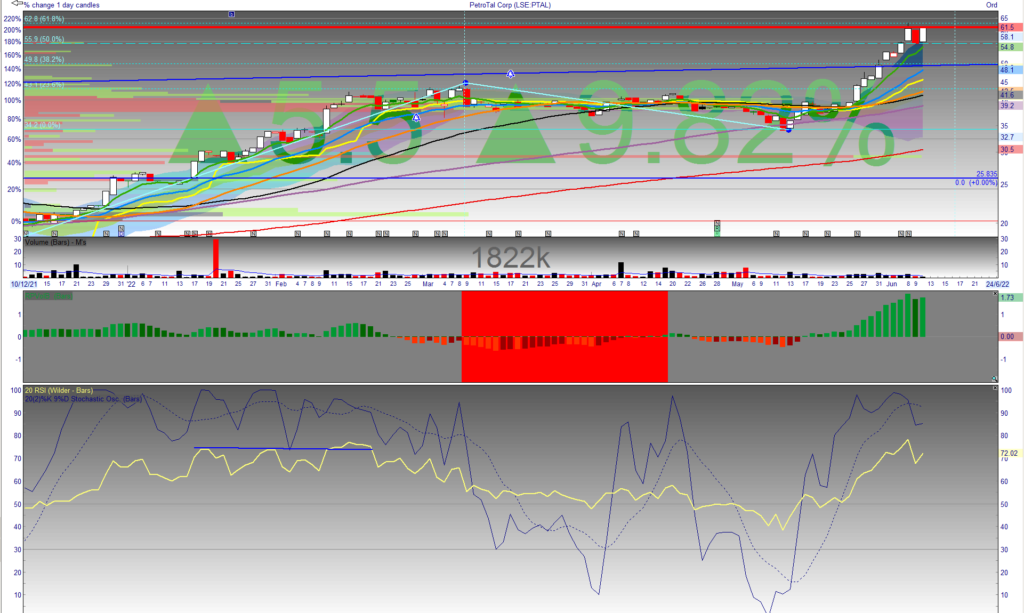

UPDATED Fri 10/6/22: PTAL reclaiming lost ground as Oil continues north . RSI is diverging as price approaches previous ATH - expecting a rejection so will close the remainder if price doesn't exceed recent high of 63p with supporting volume

As already stated: parabolic moves are difficult to predict but technicals are stretched . This may well have room to run as the max historic RSI is 85, the 61p price is below the target of 93p so should be room to run

VWAP is at 45.5, 8 EMA at 54.8. Given overall weakness in markets, if oil rolls over then rapid profit taking may occur which could see a sharp pull back to the 48.1p area which is the 21EMA: this may provide a buying opportunity

[perfectpullquote align="full" bordertop="true" cite="" link="" color="#F00000" class="firstclass" size="28"]Closed the remainder of this trade at 60.3 as it appears unlikely PTAL will push through the recent high [/perfectpullquote]

PTAL 40.5p here took additional profitsat 59.4p to cover costs of capital and book partial profits letting the remainder run risk free: from entry that is +47%

[stock_market_widget type="inline" template="generic" assets="PTAL.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

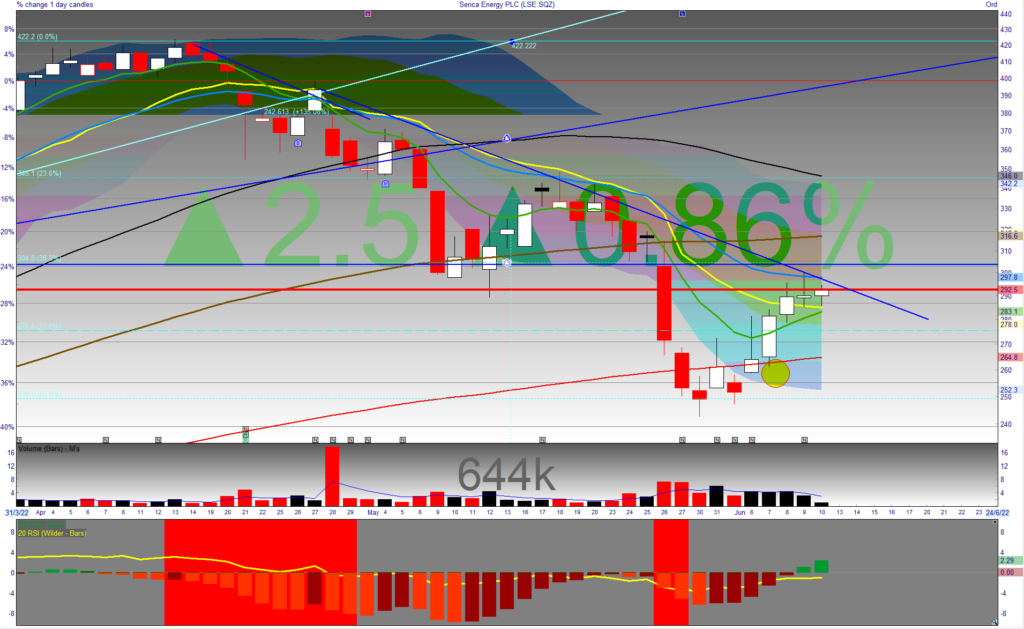

Partial Take Profit in SQ at 293.0

Given overall negativity in the market , took half of the SQZ trade off at 293p for a profit of 12% from an average entry of 262.6 posted here

Chart shows rejection of the 21EMA and overhead resistance around the 300p level although price is respecting the VWAP (yellow line) : I was tempted to take profits around the 297p yesterday but held pending the overall bullishness in oil. However, market sentiment is increasingly suggesting that oil will be the final shoe to drop and given DXY renewed momentum to the upside, it seems more unlikely that oil will maintain this momentum

Pre Market Sentiment and Charts Influencing UK Markets 06:30 (3 mins read)

FTSE Futures -50 on cash signal adding to yesterday's 1.5% drop as the US sold-off heavily y led by tech with some weakness in Energy which has held to date owing to higher oil prices. This likely signals the end to the recent brief relief rally and more chop to come : see charts.

Oil is consolidating the latest move around $122.5 and remains in a strong uptrend if stretched: may recheck 8EMA at $120 to test momentum strength.

DXY makes a move north from consolidation which weighs on stocks: copper has reversed all last week's gains and drops 200MA and 21EMA.

Gold is hugging the 200MA around 1845 in consolidation building for a move: continued DXY strength is negative the metal and may dominate the safe haven appeal. Underlying technicals in the short to medium term are bearish so a decisive move around the 200MA will likely signal the next big move

Sentiment sees VIX rise to just 26 despite sharp falls while yesterday's AAII retail investor sentiment showed a marked shift to bearishness as just 21% of investors remain bullish 47% bearish with the rest neutral (dashboard)

Charts - click to open to full size

Market Dashboard

FTSE 100 Futures

US Stockmap Close

Gold Chart

DXY Chart

Brent Oil Chart

Copper Chart