Contents: Click on Link to View

ToggleDollar and Commodities Copper, Gold and Brent Charts

The dollar spent the week in a consolidation mode with the dollar index slipping from 105 to just below the 104 level having checked the 200 MA twice and just about clinging to the 21 EMA

This combined with a bit of a resurgence in the Chinese market outlook contributed to further strength in copper which is also supply constrained.

Gold and silver also advanced on the back of a slightly weaker greenback , With gold ending the week above its 50 MA for the first time since early February. this augurs well for some further strength into branch oil

Brent oil remained in a sideways consolidation around the 81 level with uranium ore losing significant ground and slipping below its 50 ma for the first time since early 2023. Uranium has had a stellar run over the past year and so and so was prone to a pullback and some consolidation for these major moves. It's likely to remain range bound in the medium term as it digests these moves. This will obviously play out in a number of the uranium-dependent names like Yellow Cake and Geiger Counter.

Dollar drops below $104 level - Click to enlarge

Copper continued strength sets-up for a potential move north -

Click to enlarge

Brent Crude rangebound below resistance at the $83-84 level:

Click to enlarge

Sectors on the Moves: Banks, Non Life Insurance, Leisure Goods Winners: Miners, industrial Materials and Pharma/Healthcare Losers

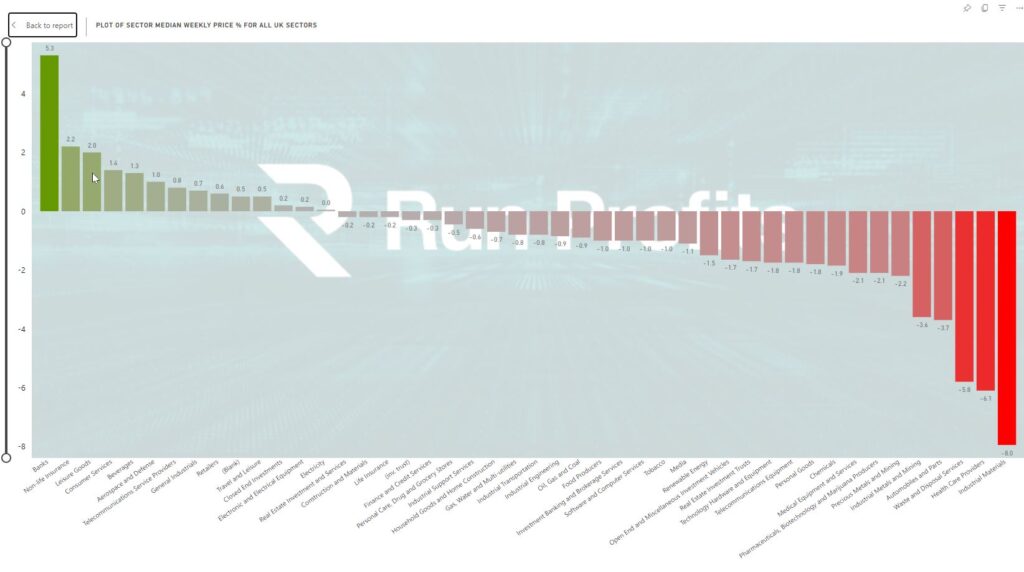

In sectors – just 14 of the 45 sectors were in Green this week compared to 27 last week .

Banks led while Telecommunication Service Providers yet again featured as it has year to date , non Life Insurance showed particular strength

Miners pharmaceuticals health care providers and industrial materials particularly underperformed In the 32 sectors that closed in the red this week

Sector Winners and Loser on the Week

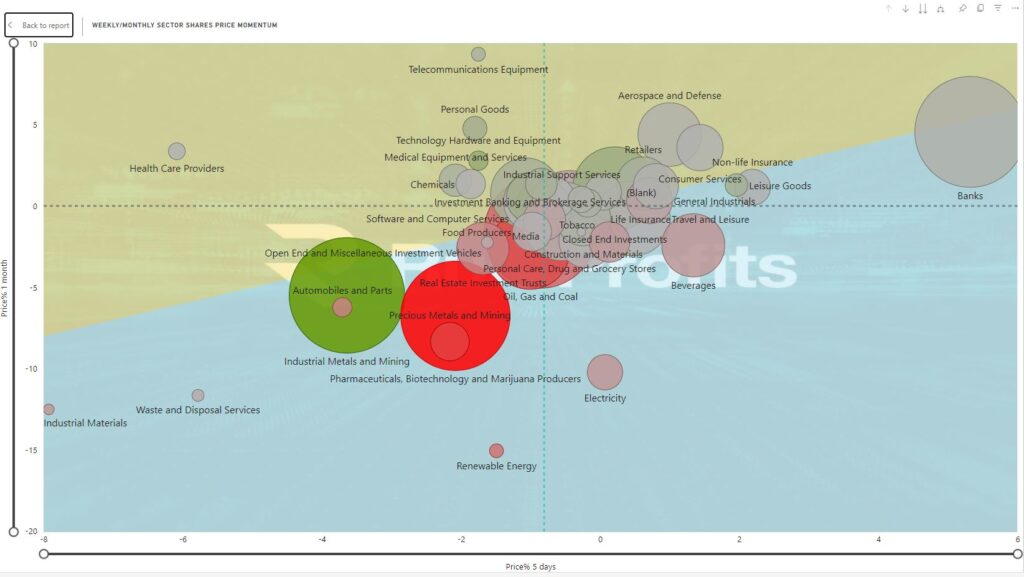

Sector Momentum Weekly and Monthly - Strength in the Upper Right

Sector Highlight : Banking Rerates - Potential For More Positive momentum

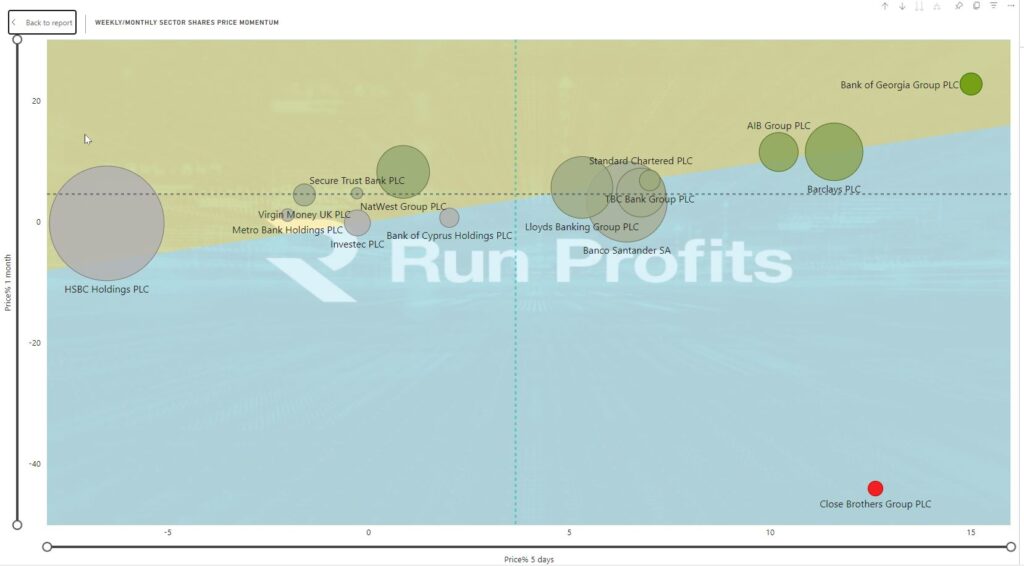

Of the 16 shares in the banking sector, 10 were up on the week and of those four were up over 10% including BGEO, CBG, BARC and AIBG. This was highlighted in last week’s weekly rap as six of them were slated to report. There were some fairly significant breakouts in a number of these names but it’s worth some further research if this is a sector of interest to you. Clearly, there was a degree of undervaluing of some of these names with the notable exception maybe of HSBC. As a result, there’s been something of a rerate of some of these names which are likely to will maintain positive momentum over the coming days and weeks - Barclays, Lloyds and NatWest all cleared significant moving averages including the 200 MA. You can do these analyses in the Sector Momentum section of the Market Dashboard and look for leading and lagging shares over different timescales

Banking Sector 16 Names Momentum Plot over Weekly and Monthly

Earning and Economic Calendar Week 9 of 26 Feb 2024

Big week in earnings ahead with a bumper number of 54 companies reporting on Thursday the 29th of February, yes it's a leap year!

17 Funs, 10 Investment Banking/Brokers 11 REITs

- see the RP Calendar here : screen grab below

A Look Through the Indices

Yet another week of underperformance by the UK indices as many of the world major indices went on to make all-time highs including the S&P 500 the Nikkei Euronext 100 the DAX the CAC. The Chinese Hang Seng Index was the outperformer of the week and looks to be making a breakout from its long term downtrend. Worth noting from a technical point of view, US indices are advancing to new highs with quite significantly diverging RSI s- this is often a precursor to a sell-off and with the end of month falling next week, I wouldn't be one to chase these highs. Healthy and potentially significant pullbacks are likely ahead.

The FTSE 100 closed out the week relatively unchanged while the 250 was down- 0.3 percent with the AIM ALL-Share down -1.5%. In economic data this week, one of the highlights was the core CPI read from Europe coming in lower at 2.8% versus the expected 2.9% while US GDP came in as expected. Nvidia’s earnings on Wednesday after hours resulted in the Nasdaq gapping-up Thursday and gaining 3% in the day, recovering the last ground from earlier in the week, and stopping just short of its all-time high.

All the above helped to support a risk-on environment in most markets except the UK where despite significant outperformance in banking owing to the number of the big banks reporting and beating expectations, indices were driven lower by underperformance in miner, pharmaceuticals and oil & gas. Our relative weighting of these latter three sectors continues to be the root cause for our overall underperformance on an index level, but also highlights the need to be selective in choosing shares in outperforming sectors