Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15 : identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Daily Shares in Focus

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="ASC.L,BOO.L,CINE.L,CURY.L,IQE.L," fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]PM Price Action 15:00

some paring of gains in the indices into the afternoon which is likely profit taking in many of the double digit pops over the past few days : tomorrow is the end of month and a four day Jubilee holiday will likely make for thin trading volumes

There are a few themes emerging

- 1.:Small caps are starting to play catch up as AIM clears the 21EMA intraday with some of the most hated and the most shorted sectors and shares making significant (>5% intraday) gains. Meanwhile the mega cap FTSE 100 is sideways below the 7600 level mainly owing to AAF -6.5% with BATS, IMB and AZN lagging: IAG, OCDO, JD are all up >3%

- 2. Travel, Leisure and Retail are all making a comeback and are potentially picking up on sentiment with the recent Sunak giveback but also the anticipation of feelgood and spend from the 4 day holiday weekend ahead

- 3. digital advertising seeing some recovery with XLM, ZOO and TRMR p >3%

- 4. Miners PAF, HZM and ALL rallying >3%

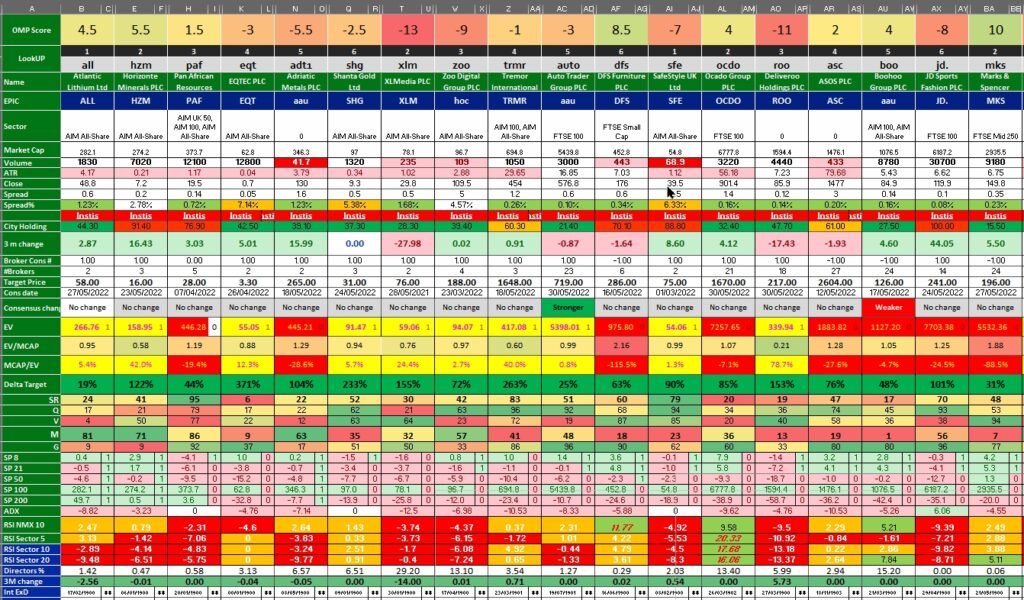

Here are some quant fundamental and technical comparators for the above groups

Opening Price Reactions and AM Liquidity 08:15

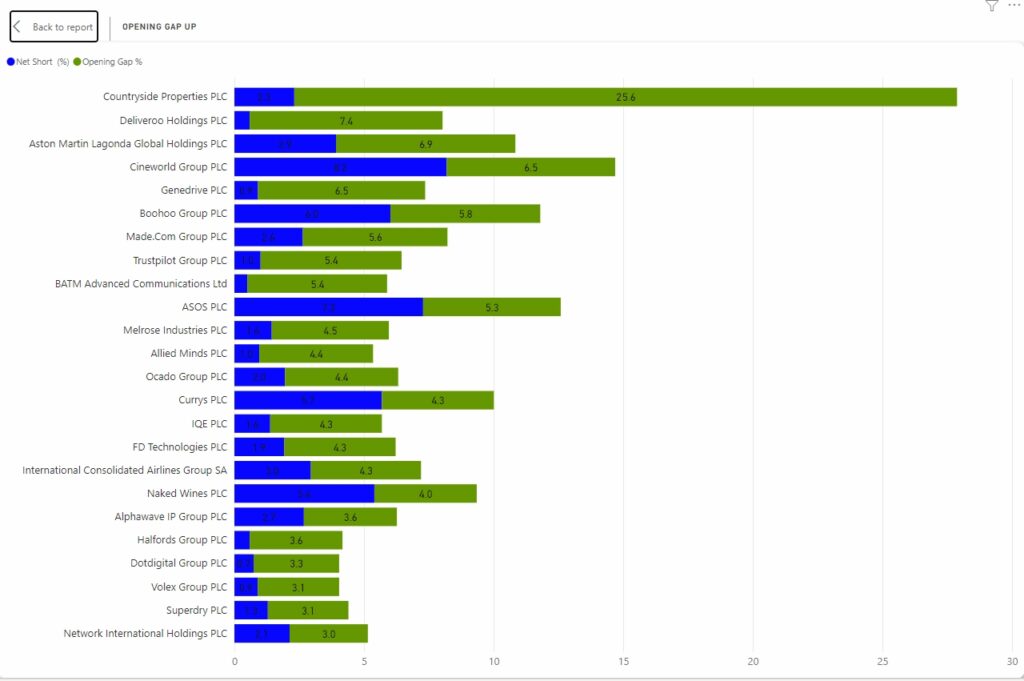

Fairly broad rally after the open with retail and heavily shorted names continuing to cover , AIM was expected to pop given the NAZ rally into Friday's close and is up 1%, 250 up 1.1%

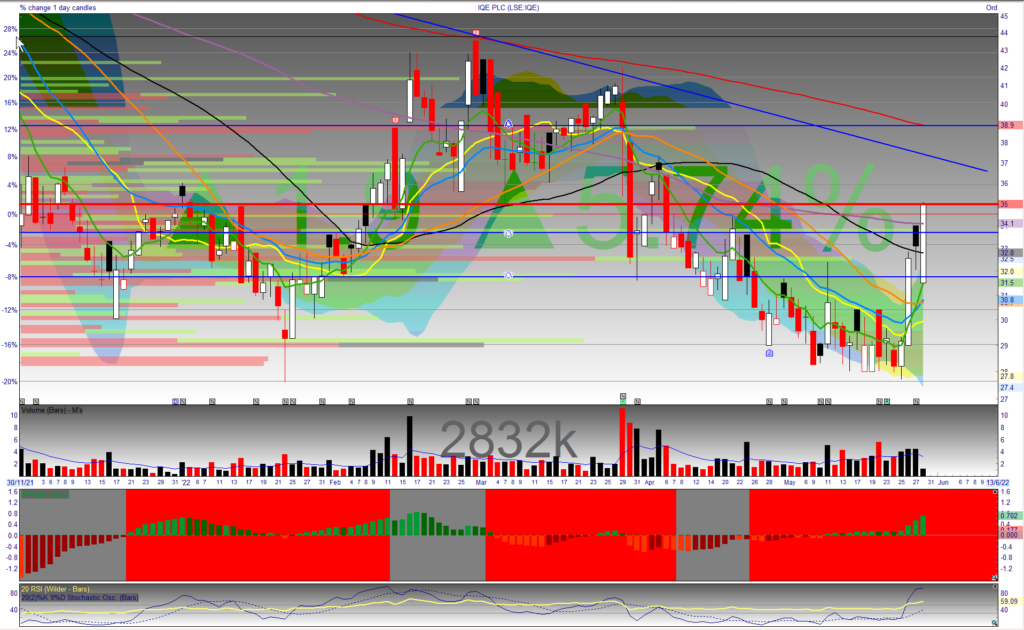

IQE, highlighted Thursday 26th with entry 29.4 up another 5.6% this am clearing 100 DMA and in day 4 of a vol squeeze : these tend to run 5-7 days in supporting markets. Given this is almost 20% gain on entry price, took a further 25% off at 34.85 to leave remainder run at reduced risk [stock_market_widget type="inline" template="generic" assets="IQE.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

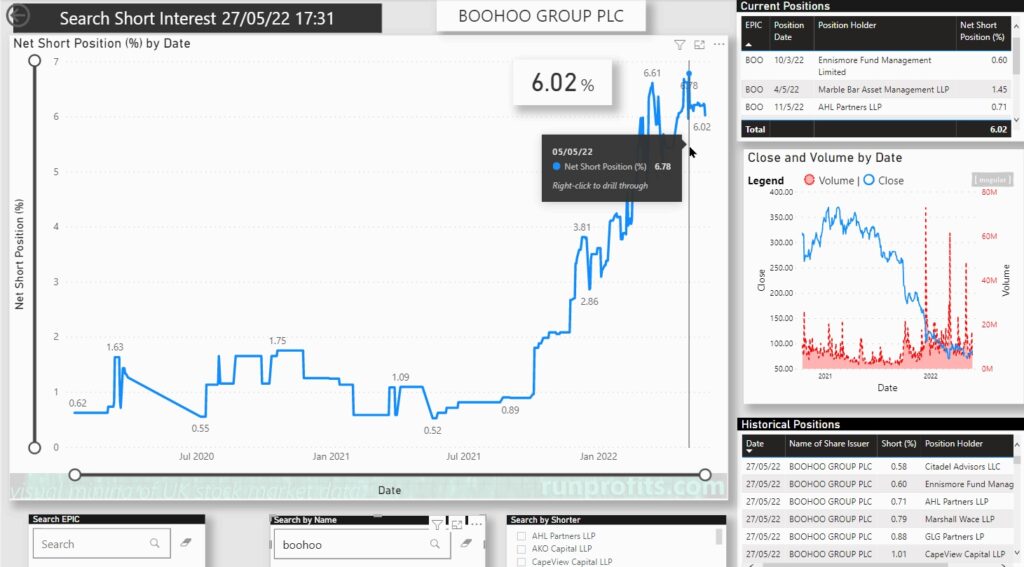

BOO looks to be in a short squeeze with shorts closing from a high of 6.8% recently to 6% now: may well reach for 100p if volume kicks in +7% intraday at 100DMA and some resistance around 91p

RNS Analysis and Opening Price Action

RNS Report is published at 07:15 each day (approximately) and may be updated during the day to reflect the total RNS newsflow for that day : timestamp on the report indicates the latest update

Pre Market Analysis 06:30

US rallied strongly into the close on Friday lifting the indices above 21EMAs across the board with the NASDAQ +3.3% all on good volume, this should feed through to AIM which is underperforming mid and mega caps. Dr Copper saying "yes" to the rally so far : gold, silver and PGMs improving as USD weakens. Today is a holiday in the US. Oil is up, Gold >$1860 retesting 21EMA: FTSE 100 futures +30 on Friday close. Today is likely to be quiet given lack of US liquidity though some catching up is needed on recent rally

- - Brent crude continues slow grid higher at $116 but encountering O/H supply from March highs: key European decision on Russian imports this am

- - VIX drops to 25 with VSTOXX at 24 which is the most bullish in weeks - see dashboard

- - DXY- dollar index - drops to 101 and looks likely to may check 100 level: this is bullish stocks

- - Gold remains indeterminate around the 21EMA level ($1859) which is showing resistance: if DXY stays weak, Gold should rally but watch for a break above the $1862 with some conviction. Continued hestinance around the 1861 level is prone to failure

- - PGMs and base metals showing signs of improvement which will feed through to UK miners : silver looks set to break north and is potential long

Charts - click to open to full size

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation