Pre Market 07:15 Update

UK futures show a negative outlook to trading with FTSE 100 futures down 70 points at 5650 at pixel and a very bearish outlook to the day.

Selling continued across global markets yesterday as we approach month end, the US election next week and a darkening COVID outlook globally. Given the speed of recovery from March lows, profits taking and rotations are expected to be swift and violent

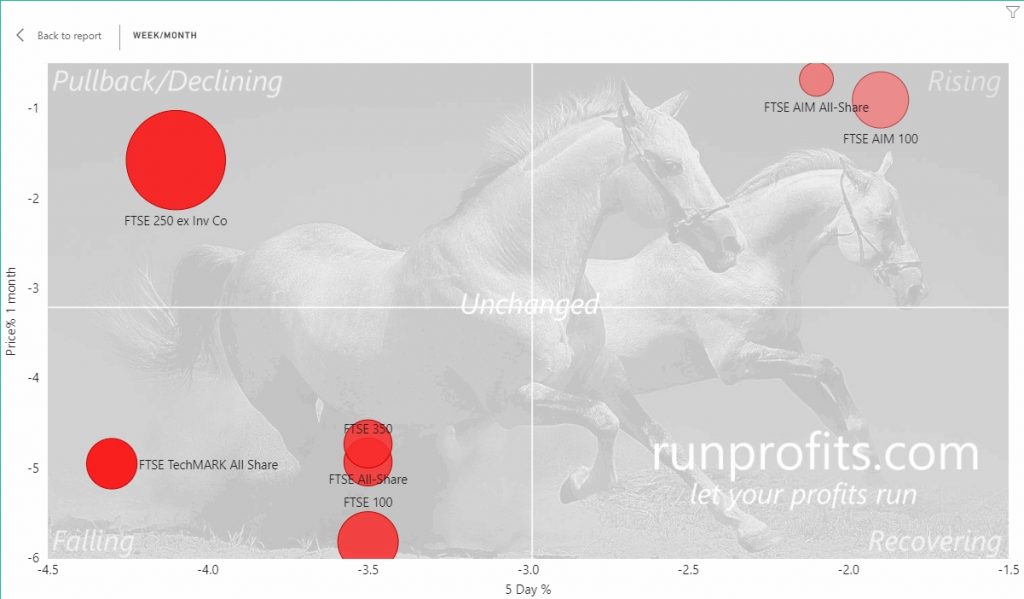

The UK saw the FTSE 100 lose 1.1% with the 250 down another 1.8% and AIM down 0.4%. The big and mid cap indices are now bearish across most timescales while AIM continues to hold its 50 and 200 moving averages

The FTSE 100 hangs perilously around support from a falling wedge of the the June post COVID highs. with many of the mega caps reporting this week the fate of this support will be decided: Thursday is a major earnings day with GSK, RDSB and many of the behemoths reporting

27 UK companies reported this am thus far

AM Update

Yesterday's stars, RMS [stock_market_widget type="inline" template="generic" assets="RMS.L" markup="{name} ({symbol}) is trading at {price} ({change_pct}){last_update}" style="font-size:x-small" api="yf"] and MTL [stock_market_widget type="inline" template="generic" assets="MTL.L" markup="{name} ({symbol}) is trading at {price} ({change_pct}){last_update}" style="font-size:x-small" api="yf"] are featuring in the early price action today though this time on the big fallers side as they give back some of their recent advances. The bearish mood across markets today is conducive to profit taking as all of the UK and European indices kicked the day off deep in the red with the mega and mid caps down over 2%. The FTSE 100 led down by Insurance, Oilers and Banks as the mega cap index dipped below 5600 and tested the lower support line of a channel that has been in play since the June post COVID highs. This is a key area to watch for clues on future direction: a bounce and close north of the 5600 level would bring some respite and the hope for the post COVID rally. A move below this may well see the March lows retested

PM Update 15:30

Selling had remained the dominant theme today as all indices took fright losing typically 3% plus across the globe: Gold's continued weakness saw it go south to dip below $1870 while oil tipped over 4% to lose the $40 level

. Few things except for the VIX were rallying as volatility took a spike above 40 : levels not seen since early June. Selling is pretty broad with around 1600 of the 2100 LSE shares in the red today and 600 down 3% or more

RMS [stock_market_widget type="inline" template="generic" assets="RMS.L" markup="{name} ({symbol}) is trading at {price} ({change_pct}){last_update}" style="font-size:x-small" api="yf"] a

EOD Update 17:30

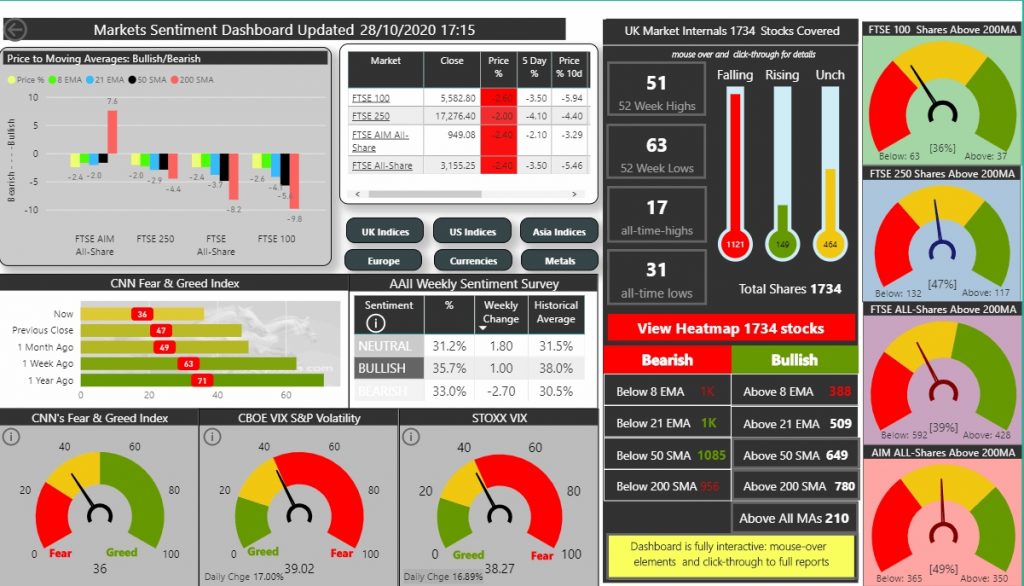

The EOD dashboard below provides a good summary of today's mass selling as all of the UK indices lost at least 2% with even the AIm shedding 2.4%. Of the 1734 stocks covered by RP, 1121 fell on the day while just 149 rallied with the remainder unchanged

The FTSE 100 did close off its low and has held onto the bottom trend line in the channel dating back to June but just shy of the 5600 level: this is an encouraging indicator in an otherwise bearish sell-off. the US and Asia session may signal more weakness and tomorrow's slew of earnings will probably prove make or break in directional terms for the short term. The Mid 250 closed off its lows as well today and held the important 17200 level for now which has been support since late May 2020. A breach and close below 17000 may prove bearish and signal more selling to come

The VIX has spiked sharply today clearing 40 at one stage while the CNN F&G index has dropped to 36 : it was almost twice that level last week.

At pixel America is taking up the selling baton with the S&P down 2.9% the NASDAQ down over 2% and the DOW down around 3%

Gold also sold-off today but is basing around the 1880 level and may well revisit the 1900: for now it seems to not be a safe haven of choice despite little movement in the dollar

European indices fared even worse with the CAC down 3.4% and the DAX down 4.2%

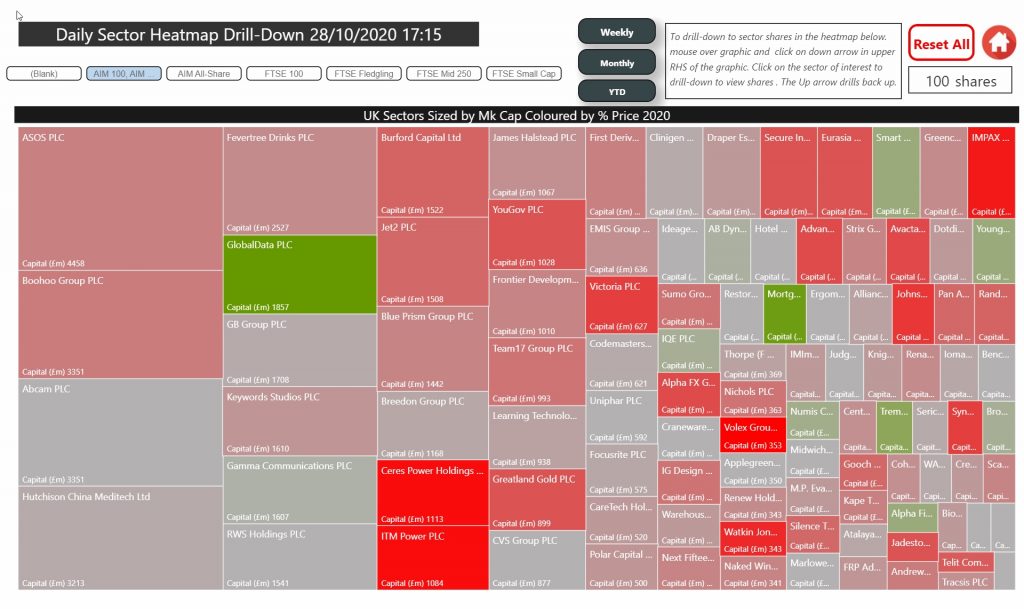

AIM continues to be the most resilient of the UK indices with the above figure showing how the UK 100 has lost 3.5% in a week and almost 6% in a month while AIM has lost just 1% in a month and all of that today (as well as 1.5% gains). The heatmap below shows the performance today in the AIM 100 with only a few names in the green

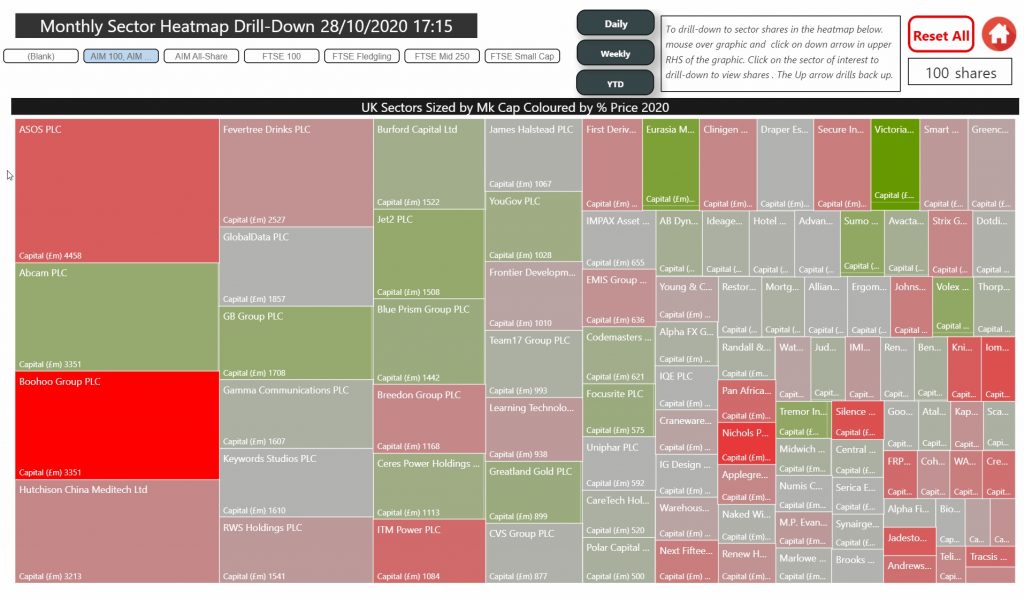

For comparison, the monthly heatmap shows relative performance of the AIM 100 names over the past month with significant outperformance by ABC, GBG, BUR, JET2,PRSM all up 10-25%

Search by Company/EPIC Below

[stock_market_widget type="search" template="redirect" color="#23282c" url="/stocks/{symbol_lc}" target="_blank" api="yf"]