Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15 : identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Daily Shares in Focus

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="GKP.L,MDC.L,SBRE.L,PETS.L,TEK.L" fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]RNS Analysis and Opening Price Action

The below RNS Report is published at 07:15 each day (approximately) and may be updated during the day to reflect the total RNS newsflow for that day : the timestamp on the report indicates the latest update

Pre Market Trading Opportunities

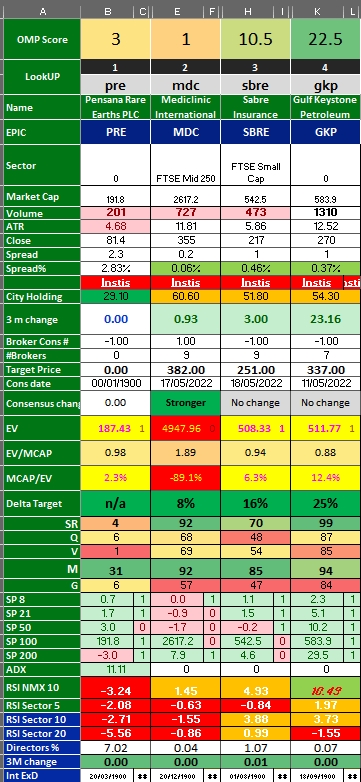

Favourable charts and news flow for MDC , SBRE , GKP

- Identify opps from Pre market

- likely pops drops

- charts

- supporting data - short interest etc

- correlations to other drivers

- intermarket

- commodsoil/gold/currency

Overnight Action and Pre Market Analysis

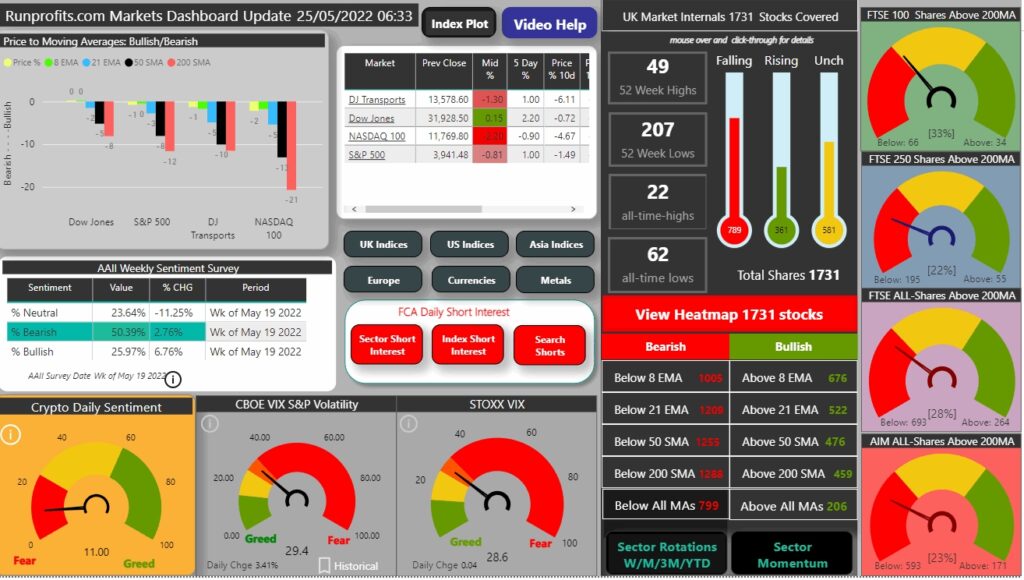

cautious signals of a turnaround and rally ahead : given recent price dynamics this is likely to set up for a multi day rally though end of month beckons and anything is possible in current market conditions: stick with liquidity, smaller positions sizes and shorter timescales

- Brent crude i>$114.4 looking set to break north from bull flag (crude inventories later today\)

- FTSE futures s+60 to exceeding resistance level at 7513 as US selling abated and the DOW ended in green: tech still being sold while defensive sectors caught a bid

- USD index finally pulling back to 101 level and dropping 21EMA convincingly : thsi will set up for a pop in stocks

- Copper is showing some strength but remains close to the 21EMA : favour a move north which will confirm the above

Key level to watch in FTSE100 around 7513

FTSE250