Next update at 07:15 for Pre Market News

Pre Market 07:15 Update

Given the burly-burly of the US elections overnights, the futures markets have proved unsettled as the likelihood of a decisive outcome has diminished. UK futures have swung from strongly positive to slightly negative at pixel reflecting the overall uncertainty not just in outcome but in the events that may unfold were divisiveness to spread.

Yesterday proved a hugely strong day in green across the board as all of the UK indices rallied, the big caps leaving key support areas and closing near highs suggesting some confidence in the moves

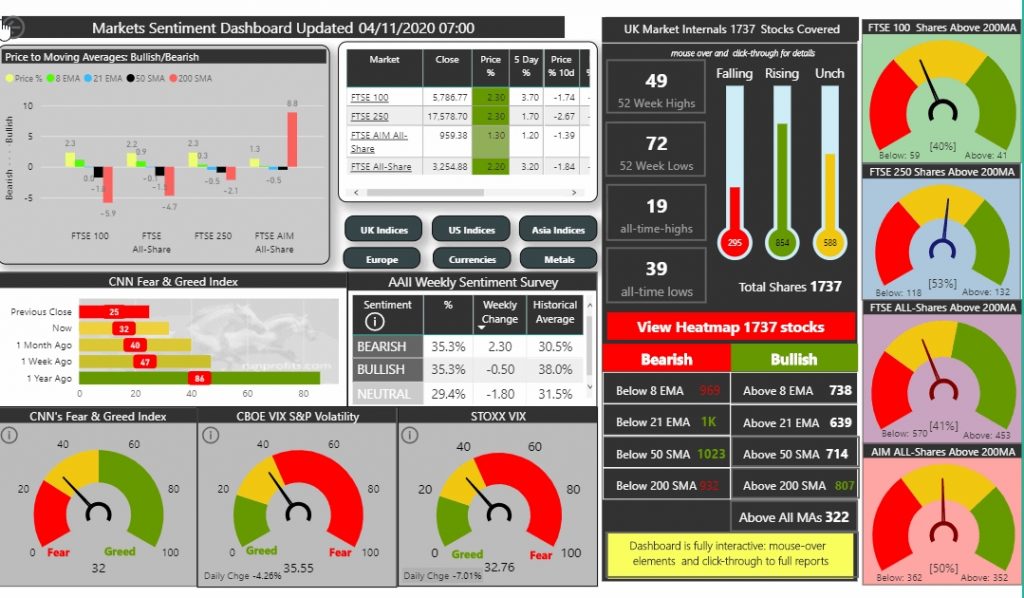

The VIX has fallen back to 35 still signalling a lot of caution and protection being held while the F&G index improved from 25 to 32.

Gold pulled back after a strong day yesterday when it broke above $1900, oil continued to rally but rejected the 200MA at 40.8: OPEC is rumoured to be planning yet more production cuts to support price by limiting supply.

Markets likely to remain volatile as it looks likely the US election outcome may take several days.

Yesterday's UK rally saw improving technicals in the indices with all of the indices reclaiming their 8 EMAs and stopping short of the 21 EMAs. Only the AIM All-Share stays north of its 200MA see market dashboard .

21 companies reporting including MKS, BYG, PFG

Search by Company/EPIC Below

[stock_market_widget type="search" template="redirect" color="#23282c" url="/stocks/{symbol_lc}" target="_blank" api="yf"]

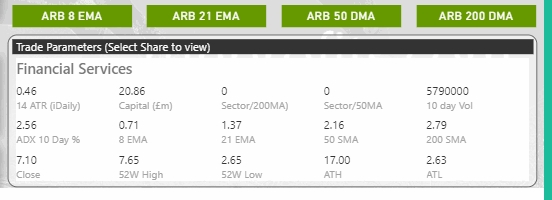

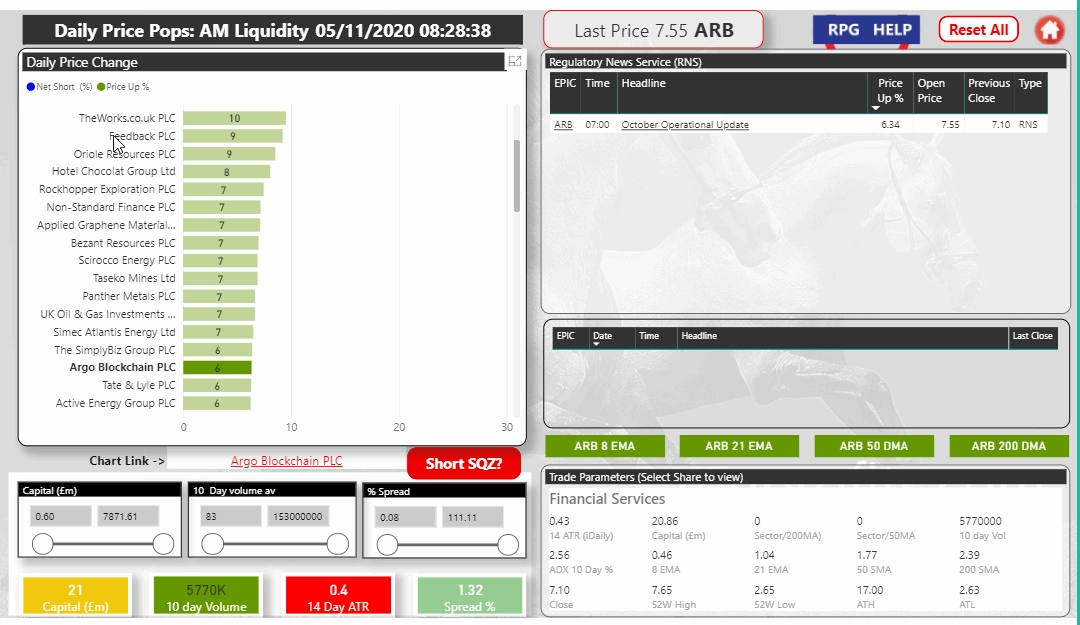

ARB is pretty tiny at £21M cap but has good technicals above all its MAs with the 200MA flat but set to start an upward trend. ARB is showing good accumulation having dropped to 2.5p in the Covid Crash

It has a positive catalysts today in reporting a monthly operational update which has been well received thus far.

A break above 7.7p is bullish : rejection may see a check of the 8EMA and bounce: if that fails then the 21 EMA around 6.5p may be questioned. However if BTC remains in its upward trend on the back of weak dollar, improving BTC adoption and overall macro concerns then the path of least resistance is likely upwards with an interim target of 9.0p

Da

Da