Contents: Click on Link to View

Toggle

[stock_market_widget type="comparison" template="basic" color="teal" chart_range="1d" chart_interval="5m" assets="MCL.L,NBB.L,PEN.L,MWG.L,CYAN.L,GDR.L,EQT.L,PRE.L" fields="name,change_abs,change_pct,volume,market_cap,chart,open,high,low,last_update" api="yf" style=" width: 1200px; margin-left: auto; margin-right: auto; background-color: white;"]

Price quotes delayed by 15 minutes or more, see update timestamp for details. Refresh page to force update

Pre Market 07:15 - US Holiday, Oil at $48, Gold at $1810, BTC Pulls-Back: Sentiment at Extreme Greed

- FTSE Futures point to a positive start +20 to recheck the 6400 level. US markets are closed today so indices likely to be quiet

- Yesterday saw the FTSE 100 pullback by 0.6% as the sideways consolidation continues following the 14% rally since the start of November.. The MID 250 took back 1.5% and eclipsed the previous day's gains in a move which may see further weakness while the AIM All-Share closed flat on the day

- Today sees oil remains bullish above $48 while copper has held its recent gains and looks set to continue its move north. gold is digesting its recent lurches south as it ranges around the $1800-1810 level

- As highlighted yesterday, BTC has pulled back below the 8 EMA after a stellar run: the crypto is now below $18,000 after recent highs of $19800 making a double top with the previous ATH in 2018 (see chart). The speed at which this was reached and with an RSI above 90 and diverging strongly suggests a potential deep pullback: this may check the 21 EMA around 17000 before consolidation.

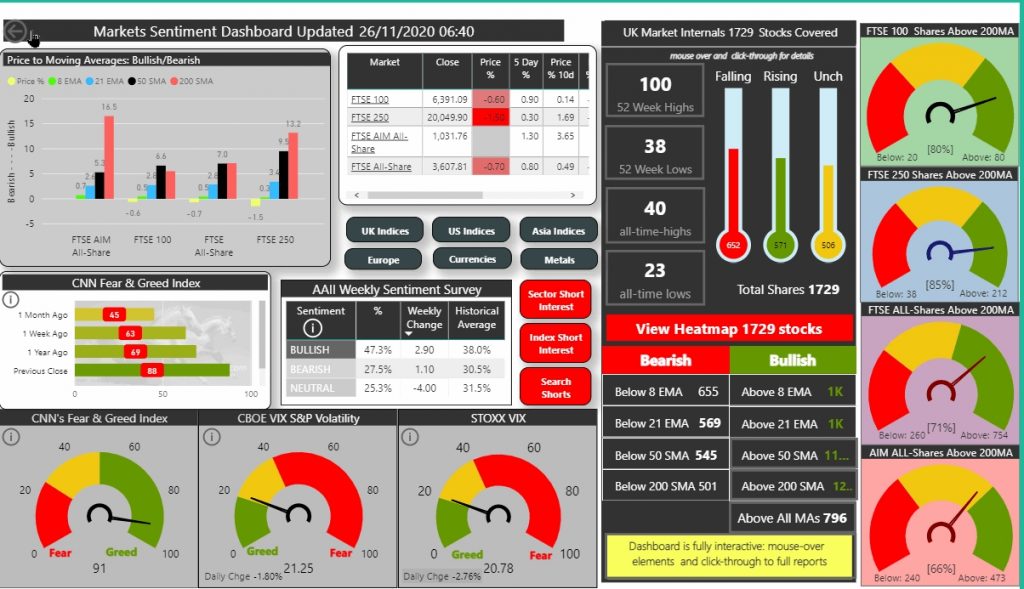

- Market sentiment shows the VIX lower around 21 while the F&G Index is above 90: Extreme Greed. At extremes, sentiment readings become contrarian indicators suggesting a pullback is long overdue

BTC Double Top Reversal from Near All-Time Highs

35 UK Companies Reported by 07:20

Read Yesterday’s RPG and View the Data Reports

Select Report by Tab: If Report Appears Incomplete Hit “Reset All” to Refresh