Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Pre Market Sentiment and Charts Influencing UK Markets 06:30 (3 mins read)

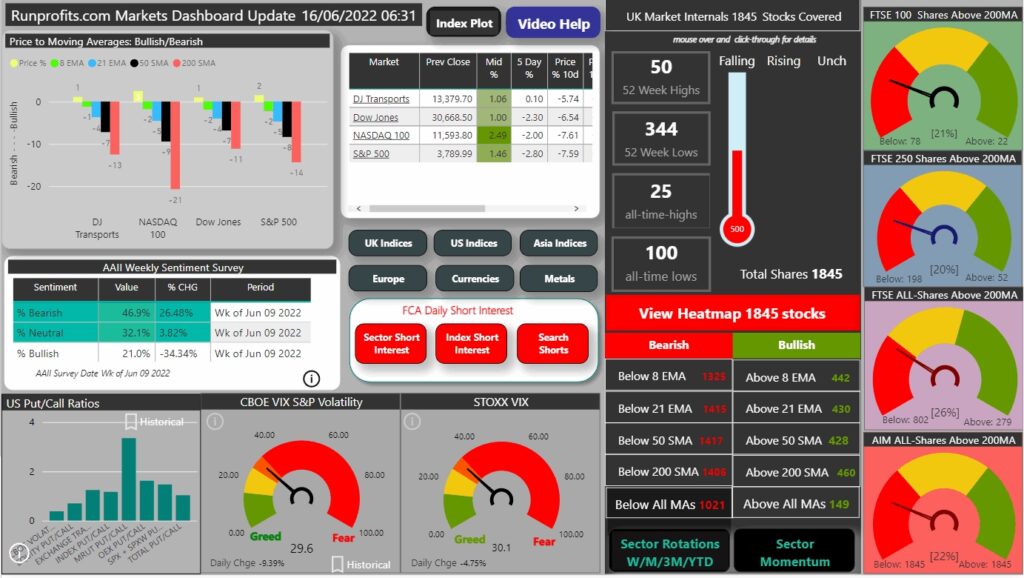

FTSE Futures unch at 7280 following positive US close and reaction to Fed announcement: all US indices forming a doji candle on the daily which signifies some uncertainty. The 75 bps increase in interest rate had been signalled so didn't surprise though the ECB 'ad hoc' policy meeting did. The markets are looking to discount the outcome of further rises in '22 and price accordingly : for now it would appear we have a cautious rally from deeply oversold conditions but in very uncertain conditions.

US close saw quality tech lead again with the NASDAQ +2.5% , S&P +1.5 - Energy and Consumer Defensives pulled back highlighting the rotation: these may form themes and are trends to watch. Positive NASDAQ is positive AIM.

DXY has pulled back somewhat on the Fed announcement but remains elevated at 104.9: any further pullback is positive equities and gold.

Sentiment improved slightly: VIX below 30 at 29.6 which is elevated but encouraging.

OIl has pulled back to the 21 EMA while oilers have seen some profit taking as rotation from this crowded trade continues.

Copper remains weak and below all MAs.

Gold rallied yesterday as highlighted from the trend line to the 2021 breakout : it has seen resistance yesterday at the 200 MA and is currently held below the 8EMA.

Econ Calendar : BoE interest rates set for 25bps.

Comments/feedback below

Hit Share on the right

(click on any image to make full screen)

Market Dashboard

US Stockmap Close

Gold Chart

DXY Chart

Brent Oil Chart

Copper Chart