Next update 07:15 for pre-market news

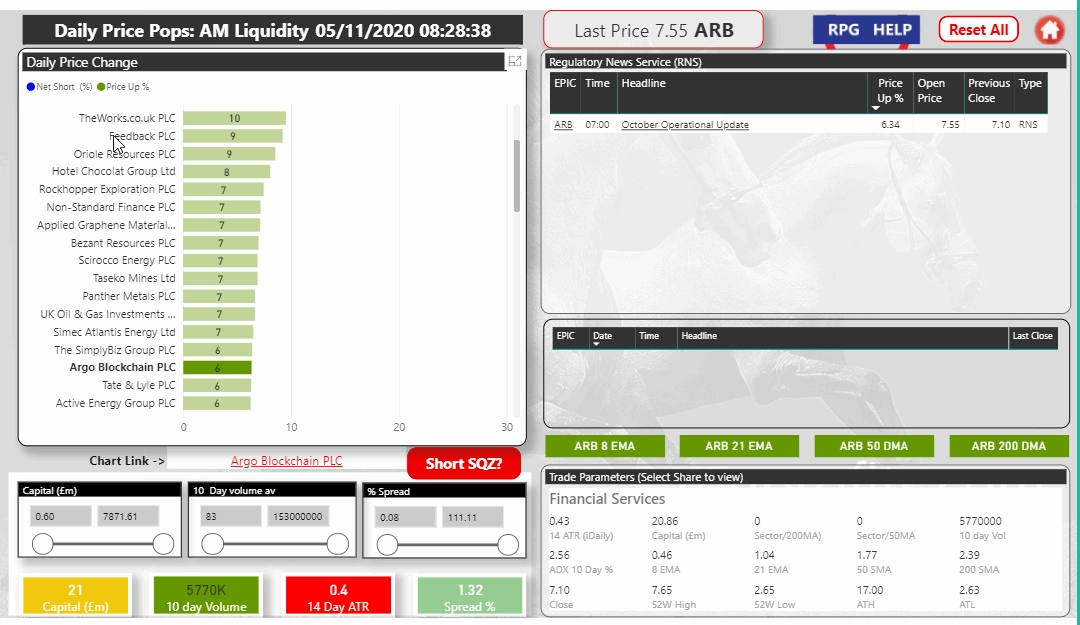

Radar Lock-on : Argo Blockchain [stock_market_widget type="inline" template="generic" assets="ARB.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size:x-small" api="yf"]

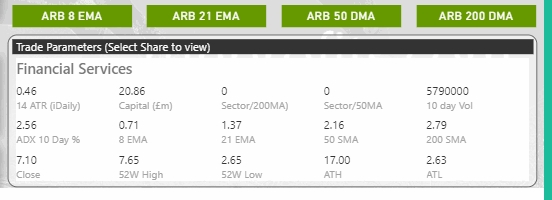

ARB , (a London HQ'd Canadian- based crypto miner quoted on AIM) is a pretty tiny prospect at £21M cap but has good technicals above all its MAs with the 200MA flat but set to start an upward trend. ARB is showing good accumulation having dropped to 2.5p in the Covid Crash (click on + in tab below to view chart as you read)

It has positive catalysts today in reporting a monthly operational update which has been well received thus far but more importantly a very bullish break-out in BTC to multi-year highs.

A break above 7.7p is bullish : rejection may see a check of the 8EMA (7.1) and bounce: if that fails then the 21 EMA around 6.5p may be questioned.

However if BTC [stock_market_widget type="inline" template="generic" assets="BTC-USD" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size:x-small" api="yf"] remains in its upward trend on the back of weak dollar, improving BTC adoption and overall macro concerns then the path of least resistance is likely upwards with an interim target of 9.0p (stop to b/e) though ARB is expected to see 11p and may well break above this to test previous highs of 14p +

Entry : 7.4

Stop: 6.3 (-15%)

Target 1: 9.0 (+20% stop to b/e)

Target 2: 10.8 (+50%)

click on the + to the right to expand the charts in the below tabs

One Day Chart 5 Minute Data Interval

[stock_market_widget type="chart" template="basic" color="#1BBC9C" assets="ARB.L" range="1d" interval="15m" axes="true" cursor="true" range_selector="true" style=" width: 1100px; margin-left: auto; margin-right: auto; background-color: #23282C;" api="yf"]

Getting data please wait

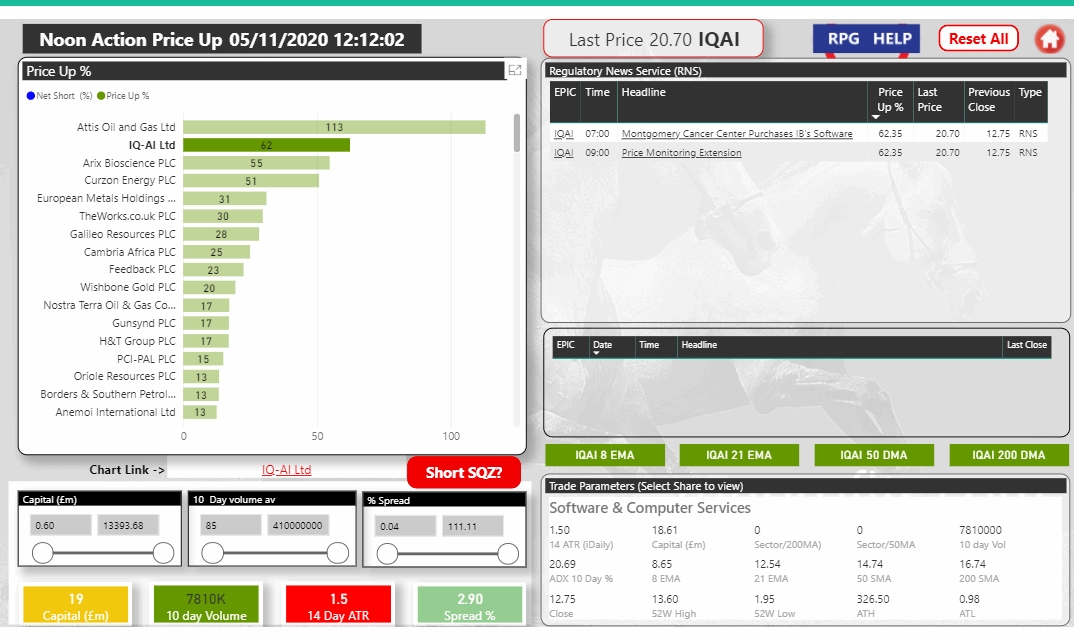

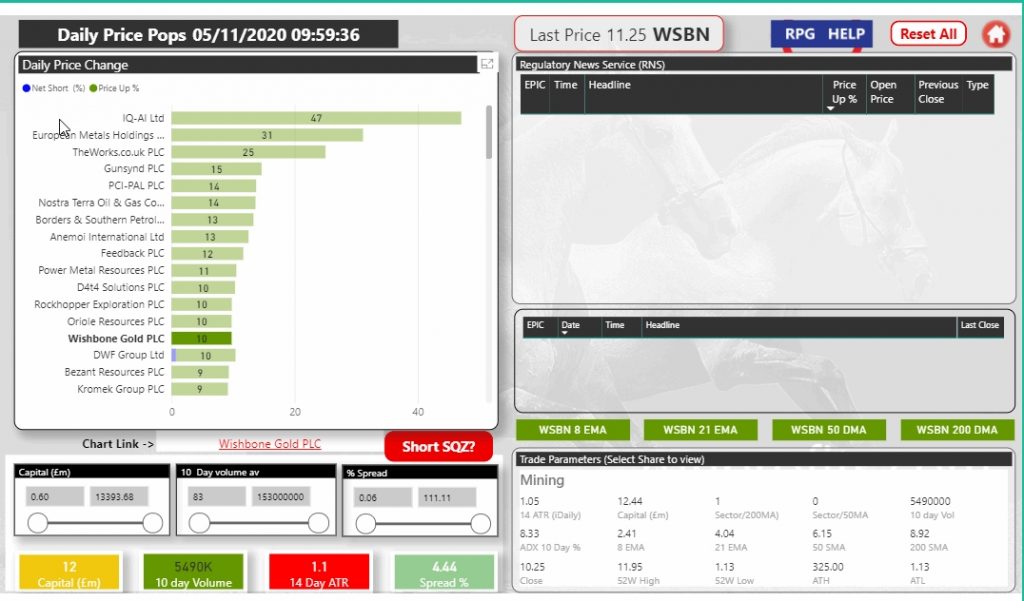

Pops-On the Move: IQAI. WSBN

Yesterday's stars, Wishbone Gold (WSBN) and IQ-AI continue their upward trajectories today : IQAI driven by further newsflow resulting in an extension of its parabolic move from 5p yesterday to almost 25p today at its high

click on the + to the right to expand the charts in the below tabs

AM Update

Market Macro BoE QE

BoE kept rates at ultra low 0.1% and announced a bigger QE programme of £150bn versus expected £100bn to offset expected hits to GDP from the Covid slowdown. This has further buoyed market sentiment as ultra low borrowing costs and increased monetary accommodation add to the tailwinds of the expected US fiscal stimulus.

Markets continued upward across the board with the Mid 250 led 0.6% higher as TRN and TATE gained over 5% on earnings while the FTSE 100 rose 0.4% initially with HSV and HIK gaining 3%.

Gold and silver have made moves to the upside

Given the sharp rise yesterday and continued uncertainty in the US, some profit taking and paring may be on the cards with volatility reasserting itself though the overall accommodative macro and stimulus remains highly supportive of a risk-on appetite.

Pre Market 07:15 Update

UK futures signal a positive open with the FTSE 100 expected to open around 28 points up at the 5900 level. Overnight saw gold strengthen as dollar weakened, oil pulled back over 2% to drop back below the 200MA and looks set to retest $40

Market Macro

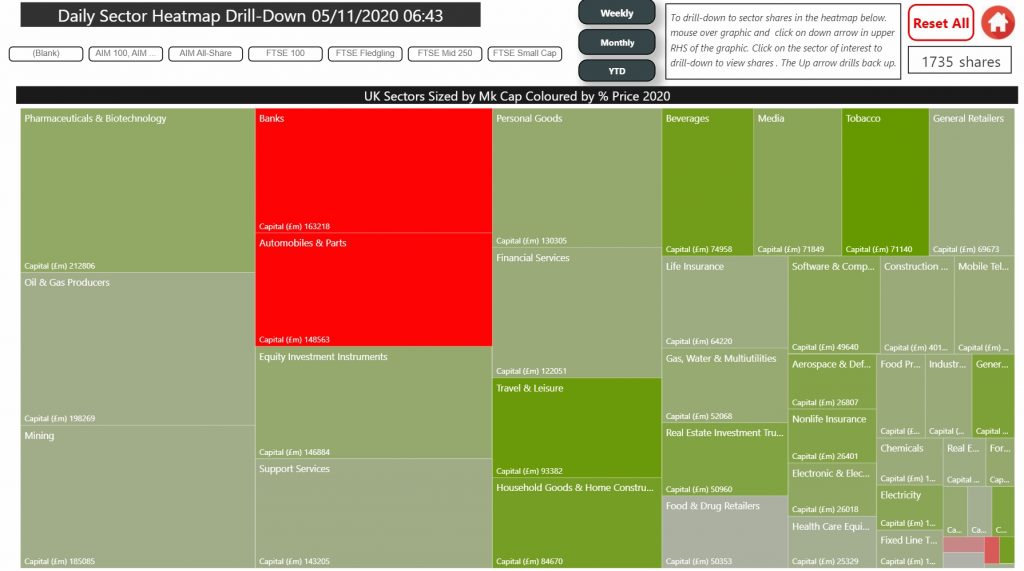

If yesterday started undecided, that resolved by mid market and ended with a day hugely in green as almost all sectors rallied : the FTSE 100 gained 1.7% closing near the high and just short of its 50MA. The mid caps roared north gaining 1.7% slicing the 50MA to close on a high for the second session while AIM took cheer from the NASDAQ outperformance and gained 1.6% asserting its uptrend once more. The below heatmap for all 1735 stocks covered by RP shows the breadth of the rally with banks pulling back in line with the US rotations.

The absence of a Democratic outright majority in both US houses was rapidly digested by the markets as tech surged on its higher growth, likely absence of the Biden tax on tech (Republicans hold the Senate) and the increased likelihood of a US lockdown under Biden as President. Banks and other cyclicals priced to do well under a blue wave pulled back while Volatility fell from 39 to 29 , a relatively huge move given the uncertain times ahead.

Below a heatmap of the US showing the impact of mega tech on the S&P 500: FB up 8%, GOOG and AMZN +6%: these take the NASDAQ back to levels it was at 10 days ago: the DOW and S&P gave back a lot of their gains into the close with the DOW dropping back below it 50MA but up 1.3% on the day.

Fiscal stimulus to boost ,liquidity and Covid will remain the dominant macro so Fed's Powell speech Thursday remains one of the dominant market movers this week.

Companies Reporting

29 companies reporting with numerous market movers including AZN, HIK, AUTO, RSA,