Contents: Click on Link to View

Toggle

Next Data Update : 07:15 Pre Market News

Noon Update: Moderna Add to CV19 Vaccine Good News: T&L Rallies, CV19 Stocks and Gold Sell

Another announcement of a 94% plus vaccine efficacy announced by Moderna caused almost instant market reaction with all of the indices advancing sharply in minutes with Travel and Leisure getting the biggest boosts as IAG, CCl jumped double digits on the news, : the flip side was a sell-off in the Covid trade as NCYT, GDR, SNG.L, ORPH, TILS and BRH all dropped double digits in the same period.

The path of least resistance now seems to the upside "reopening trade" favouring the out of home, travel and leisure sectors with oilers, transport and retail looking likely to continue to make gains

[stock_market_widget type="inline" template="generic" assets="CCL.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]CAMBRIDGE, Mass.--(BUSINESS WIRE)--Nov. 16, 2020-- Moderna, Inc. (Nasdaq: MRNA), a biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines to create a new generation of transformative medicines for patients, today announced that the independent, NIH-appointed Data Safety Monitoring Board (DSMB) for the Phase 3 study of mRNA-1273, its vaccine candidate against COVID-19, has informed Moderna that the trial has met the statistical criteria pre-specified in the study protocol for efficacy, with a vaccine efficacy of 94.5%. This study, known as the COVE study, enrolled more than 30,000 participants in the U.S. and is being conducted in collaboration with the National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health (NIH), and the Biomedical Advanced Research and Development Authority (BARDA), part of the Office of the Assistant Secretary for Preparedness and Response at the U.S. Department of Health and Human Services.

The primary endpoint of the Phase 3 COVE study is based on the analysis of COVID-19 cases confirmed and adjudicated starting two weeks following the second dose of vaccine. This first interim analysis was based on 95 cases, of which 90 cases of COVID-19 were observed in the placebo group versus 5 cases observed in the mRNA-1273 group, resulting in a point estimate of vaccine efficacy of 94.5% (p <0.0001).

A secondary endpoint analyzed severe cases of COVID-19 and included 11 severe cases (as defined in the study protocol) in this first interim analysis. All 11 cases occurred in the placebo group and none in the mRNA-1273 vaccinated group.

The 95 COVID-19 cases included 15 older adults (ages 65+) and 20 participants identifying as being from diverse communities (including 12 Hispanic or LatinX, 4 Black or African Americans, 3 Asian Americans and 1 multiracial).

[stock_market_widget type="inline" template="generic" assets="NCYT.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

[stock_market_widget type="inline" template="generic" assets="SNG.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

Pre Market 07:15 Update: Digesting the Moves, Oil and Cyclicals Rally: Risk On

Pre market FTSE 100 futures set strongly green showing a lift of 50 points and an open around 6370

Market globally seem to be scaling the wall of worry digesting the big moves following the announcement of Pfizer's vaccine . The US finished in the green on Friday having shown some weakness mid week. Asia rallied overnight extending the cheer into a new week

The AIM All-Share sits at 999 and looks set to break the 1000 level and new post Covid highs while the FTSE 250 cleared its previous post Covid highs last week and looks set to break 20000 this week (see charts below) having made a golden-cross last Thursday (50 MA above 200 MA)

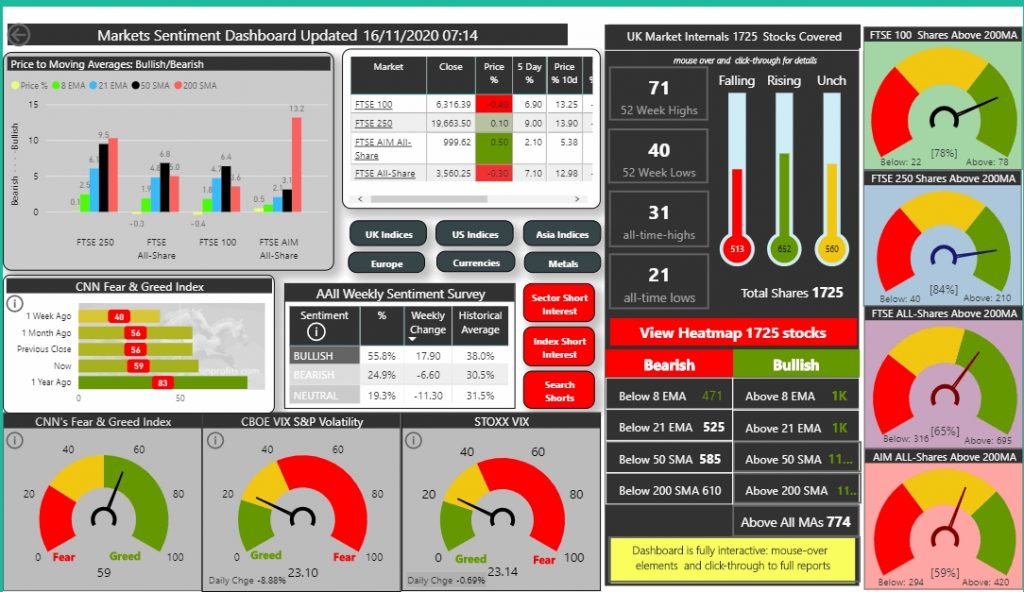

Market sentiment shows the VIX falling back to 23 , the Fear and Greed Index move to Greed at 59 while the AAII Sentiment index shows almost 56% of investors are Bullish compared to the normal average of 38% (these become contrarian indicators at extremes of sentiment and are mean reverting so caution if these become extended)

For now Risk is solidlay ON

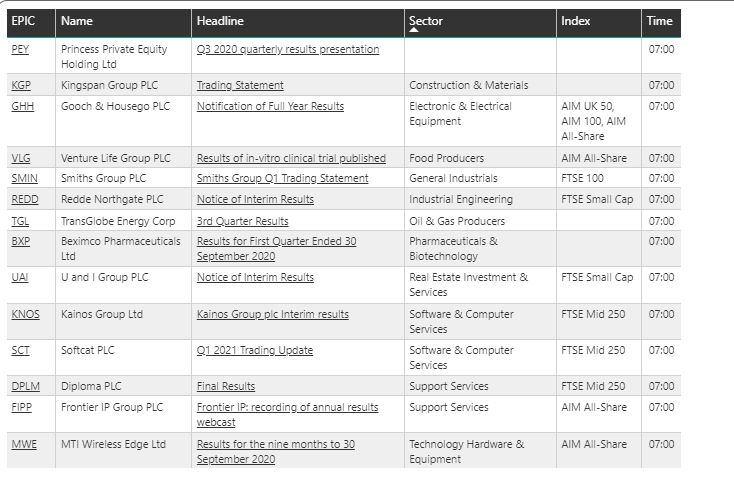

19 UK Companies Reporting

Companies reporting results include FTSE 100 SMN, FTSE 250 KNOS, SCT and DPLM

Read Friday’s RPG and View the Data Reports