Contents: Click on Link to View

Toggle

Pre Market 07:30:

FTSE 100 futures suggest the cash will open

Indices

As highlighted yesterday, the FTSE 100 did indeed breakout form resistance and made over 3.5% as the post Brexit relief rally sets-in and the mega caps plays catch-up on the rest of the world indices. The FTSE 100 is now just 700 points off last March's high . Biggest gains were in Banks, Construction, Oil and Gas and Mining rallying 6-8%. The FTSE 250 was up 1.5% and challenging the previous post Covid high set in Dec 20. AIM lagged up 0.35% though the small caps are at highs not seen since 2007 before the GFC

Commodities

Brent crude continued its upward trajectory and added almost 2% to the $54.7 level. Gold as suggested did sell-off and exceeded the target of 1510 selling to the $1901 level where it should find some support especially aroudn the 8 EMA at 1906. There is a gap around the 1900 level so a brief dup to the $1890 level would not be surprising

Sentiment

The VIX remains elevated around 26 while the F&G index has dropped to 52 as concerns over the Georgia election weigh on US investors

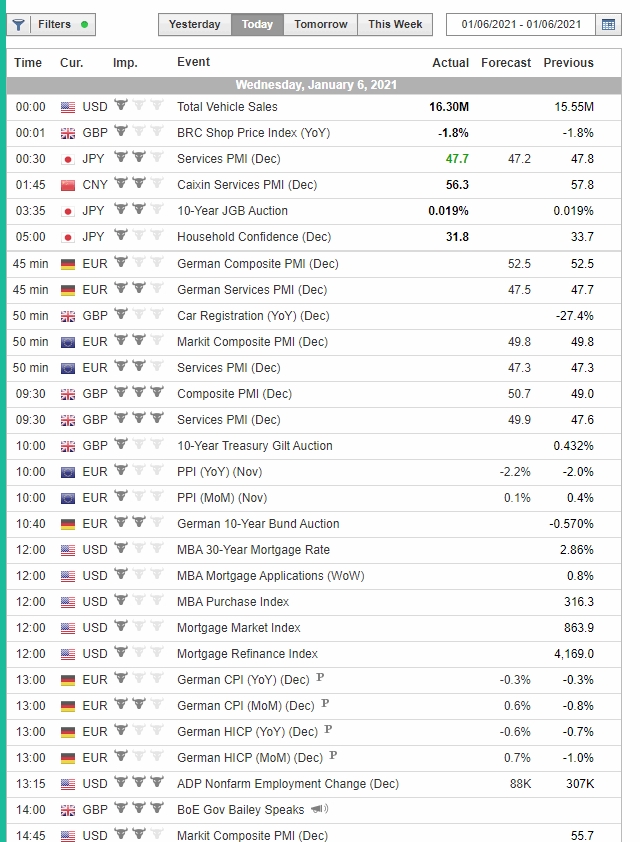

Economic Calendar

Busy calendar with PMIs in UK and Europe: .German Inflation

Open a chart using the opposite Search Box (add .L to the EPIC to specify UK): covers every asset class and most markets incl. US : redirect basic charting pages.

Search by Company/EPIC Below

[stock_market_widget type="search" template="redirect" color="#23282c" url="/stocks/{symbol_lc}" target="_blank" api="yf"]

> Post a Comment or Ask a Question <<

Lovely book