Contents: Click on Link to View

Toggle

Sentiment Gyrations as Covid Trade Strikes Back

[stock_market_widget type="inline" template="generic" assets="RMS.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

[stock_market_widget type="inline" template="generic" assets="SNG.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

[stock_market_widget type="inline" template="generic" assets="BRH.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

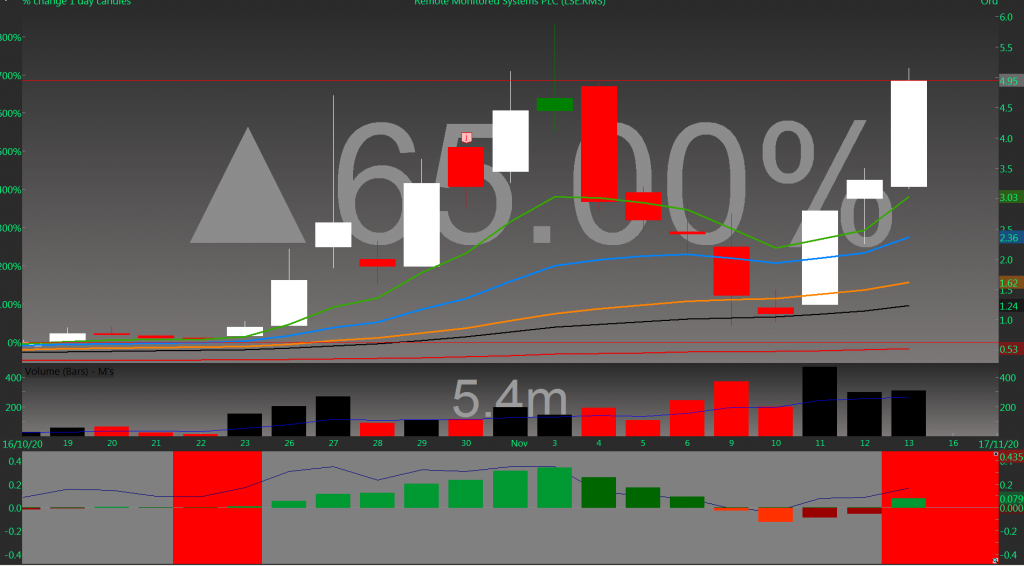

When the vaccine news broke, many of the names that were rallying in the gloom of lockdown sold-off sharply: so RMS, SNG, BRH all came off highs by 50% plus in a few trading days. Pendular swings like these tend to equilibrate as reversion to a new mean kicks-in. In this frenetic CV19 market everything seems to be accelerated even as everyday life seems to have slowed. So BRH was below 30p on Tuesday now back above 50: RMS was below 1.5p now back above 4p while SNG dropped below 90p on Monday and was at 140p this am. Meanwhile on the "normality" trade CINE rallied to 67p(its 200MA which it rejected) then puked back to below 40p this am (to its 8EMA where it bounced), RR rallied north of 140p then slumped to below 90p and so on

[stock_market_widget type="inline" template="generic" assets="CINE.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"]

These gyrations in price and sentiment do echo the age old adage coined by Ben Graham, in the short-term markets are voting machines, in the long-term they are weighing machines: though these days timescale just get more compressed.

That many of the transports (FGP, EZJ, TRN) have all captured , checked and held their 200 MAs suggests that normality, whatever that proves to be, is returning and the market is clearly signaling its view that the worst is now behind us.

Trainline

FirstGroup

Cineworld

Read Yesterday’s RPG and View the Data Reports

Pre Market 07:15 Update: Pullback Continues, BTC holds $16,000

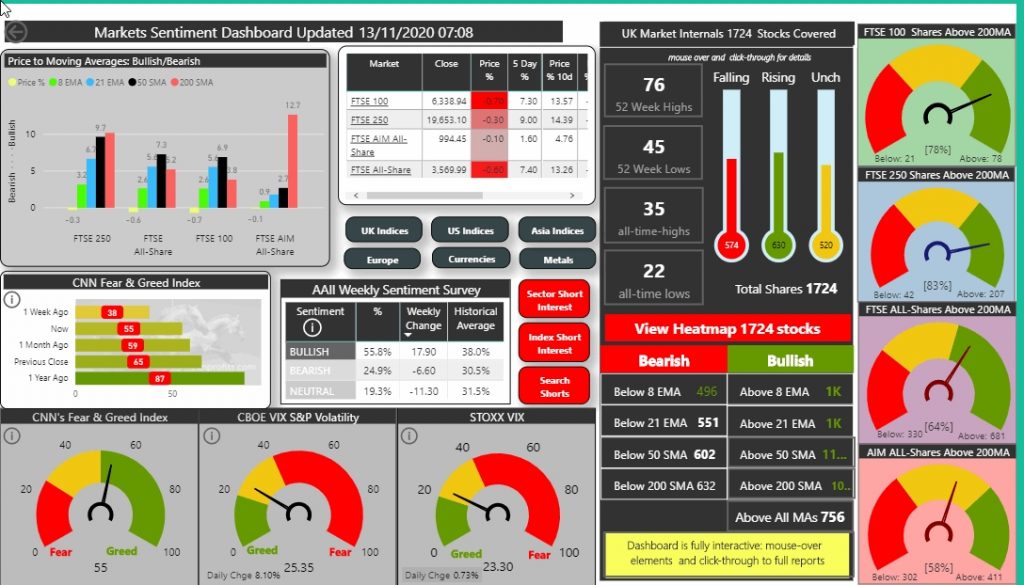

FTSE 100 futures signal cash will open some 60 points lower at 6280 continuing yesterday's pullback after the recent sharp vaccine rally with the US paring gains across all indices. Asia followed suit.

- VIX has retaken the 25 level as protection is sought while the Fear and Greed index remains at 55 a neutral to greedy rating

- Gold is muted mid 1870s after a brief rally yesterday while oil continues to digest the recent sharp reflation move hovering around the $43 level

- Bitcoin breaks out to multi year highs clearing $16,000

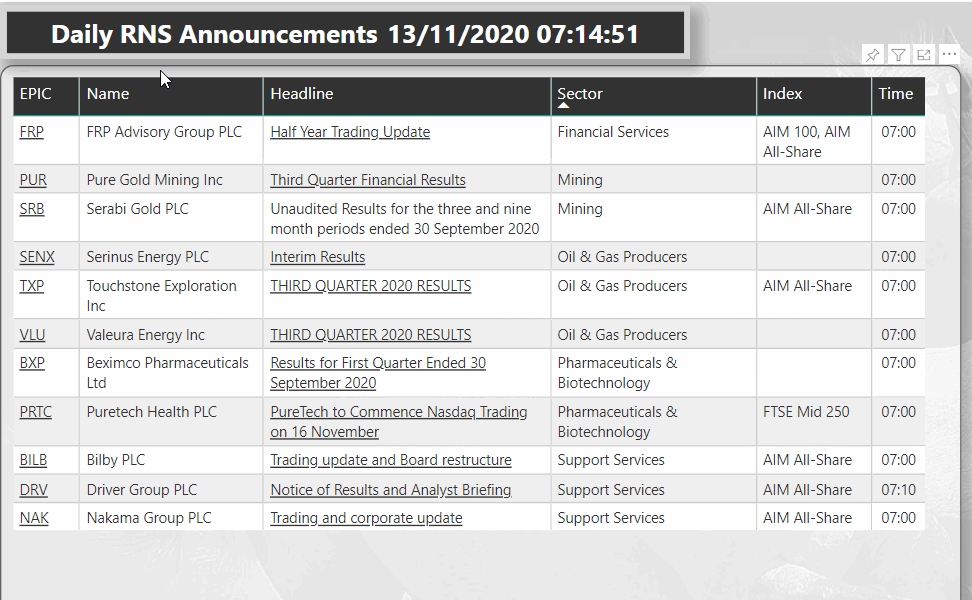

15 UK Companies Reporting

Companies reporting results include gold miners SRB and PUR which may give a read-across to other precious metal miners