Contents: Click on Link to View

TogglePre Market 07:30: Commodities on a Rip Iron Ore and Copper at Decade’s Highs

UK Futures suggest FTSE 100 opens flat at 6600 which has become a magnetic level of late. The boom in commodities combined with weak dollar is supportive of the resources-heavy FTSE 100 as is a weak pound weighed on by Brexit uncertainty. This should result in the big cap index continuing to outperform

Indices

Yesterday saw the FTSE 250 and AIM retreat by 0.9 and 0.7% while weak GBP drove the FTSE 100 higher by 0.5%. Despite all of the "no deal" Brexit rhetoric, the markets don't seem much worried and instead took cheer from better than expected manufacturing and GDP data.

While the 250 yielded its 8 EMA, the AIM checked its 8 EMA and bounced as any dips continue to be bought

The US Nasdaq recovered some of the previous day's losses while the DOW and S&P were only slightly negative. Asia was similarly noncommittal overnight

All indices across the globe remain bullish though momentum has slowed. This may simply be consolidation before a next leg higher and rally into year end OR it presages a pullback to internalise some of those recent gains. However, the speed at which the Nasdaq bounced off its 21 EMA suggests we are firmly in the "buy the dips" and not "sell the rips" . Today's price action in the shadow of an uncertain Brexit outcome over the weekend will show how risk appetite fares in the face of uncertainty: although quite how serious much anyone takes the ongoing sabre rattling will also become apparent.

Commodities

Brent has cleared the $50 mark which should continue to lift the O&G and OIl Services sectors. Copper remains elevated at $3.51 in the futures and looks like it could be setting-up for a breakout to the $3.80 . Iron ore is on fire and pushing towards $150 as supply constraints in Latin America meet infrastructure demands from China's post pandemic infrastructure recovery bid. Gold is muted and remains in its sideways to down channel

Sentiment

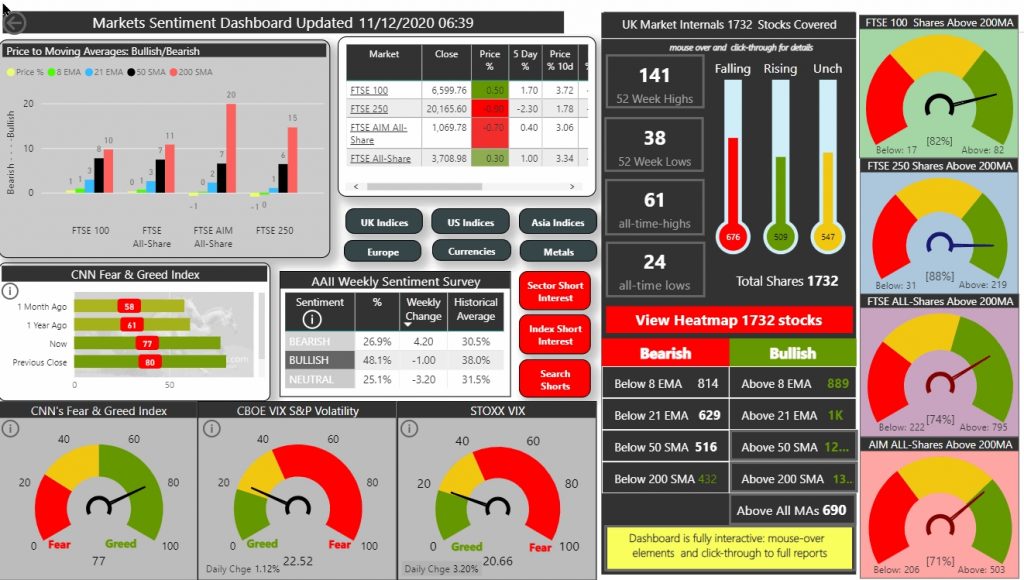

VIX remains low by recent standards but up slightly at 22.5, F&G is at Greed 77 while the AAII remains 48% bullish which is highly elevated

Iron Ore Goes Parabolic

Read Previous Day’s RPG and View the Data Reports

Select Report by Tab: If Report Appears Incomplete Hit “Reset All” to Refresh