Contents: Click on Link to View

Toggle09:00 Tharisa THS - Add on Breakout Above key Resistance

As suggested pre market - Tharisa formed a breakout gap above the 50MA (black line in chart) on the open this am following news of a share buyback of up to 10% of shares issued. Considering that institutions and other tight hands hold 69% of shares issued, this is should underpin the current price level and support further price levels- especially if platinum price also improve. The RNS today highlighted that it was the PGM commodity environment that was impacting THS's share and not reflecting the value of the chromium co-product

Consensus price target for THS is 182p (4 brokers) , has $221m in cash with $126.6m in debt so net $94.9m on the balance sheet , pays a dividend just shy of 6% with over x3 cover. As well as poor PGM prices, the commitment to the Karo platinum mine has weighed on sentiment given the high capital requirements

Having taken a trade at 50.5p, here this is a potential opportunity to add to a position - THS is up 6.3% at pixel

Chart shows price breaking above the long term trendline : it's highly likely to close above this which should then form support with resistance at 62p and the 200 MA at 66p

07:45 Ones to Watch THS share buyback Builds on Mom : Shorted with Catalysts: ASOS beats: D/B Reversal: OCDO & Wood Group Set-up for reversals

THS Tharisa

Trade posted here on Thurs 14 March - announces a share buyback of up to 10% of float see RNS

This should add to recent positive momentum and may gap above the 50MA around 56.6p which would form a bullish breakout gap

At the annual general meeting ('AGM') of Tharisa held on 21 February 2024, shareholders approved a special resolution authorising the Company to undertake a general repurchase of ordinary shares up to 10% of the 302 596 743 ordinary shares in issue at the date of the AGM.

Tharisa is dual listed on the Johannesburg and London stock exchanges. The Board believes that the Company's shares are trading at a significant discount, having been negatively impacted by the PGM commodity price environment while not reflecting the strong co-product contribution from its chrome sales.

The Company has appointed Peel Hunt LLP ('Peel Hunt') to manage and carry out on-market purchases of ordinary shares as principal on both the Johannesburg and London stock exchanges, up to a maximum amount of US$5 million (the "Repurchase Programme") (excluding associated expenses).

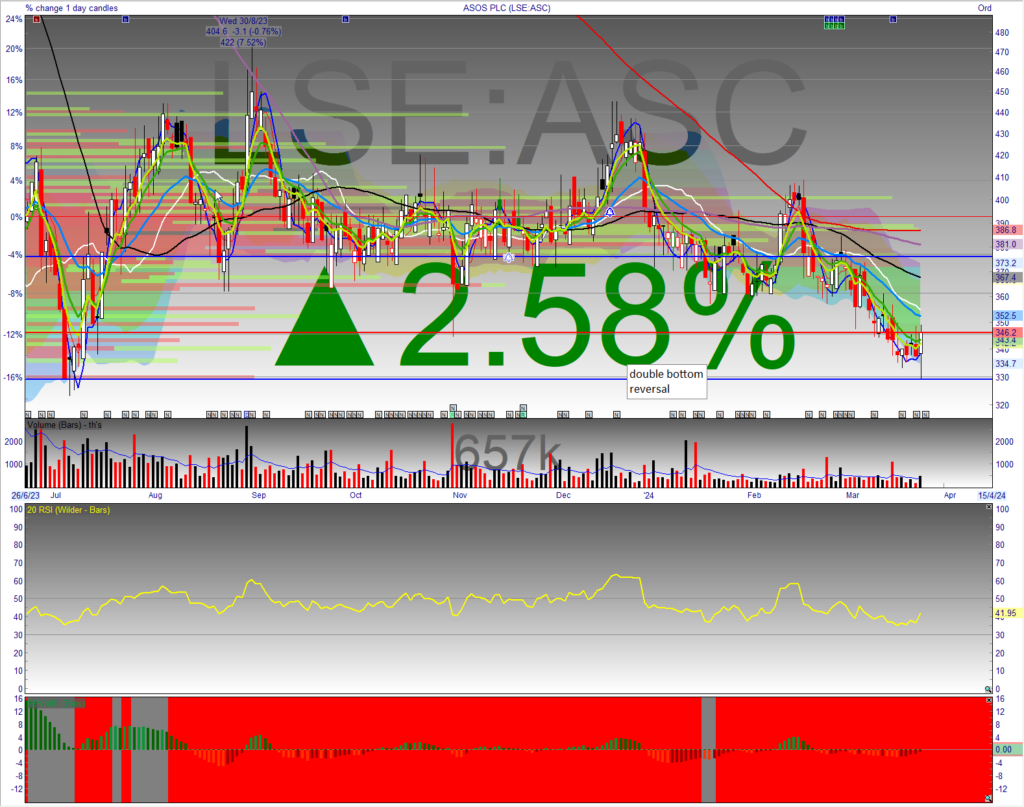

ASOS ASC - See RNS

Chart sets up with a double bottom reversal to Jul '23 from yesterday (whispers into today's TU?) - results look to have beaten expectations with better FCFC and a higher cahs balance : ASC has over 6% short interest which should add to the price reversal

· Sales1 declined by c.18%, broadly in-line with guidance that P4 FY23 trends were expected to continue through H1 FY24 as we annualise actions taken during FY23 to improve core profitability under the Driving Change agenda and with H1 intake c.-30% yoy as we right-size stock levels.

· Good progress on implementing the Back to Fashion strategy, including action to clear aged stock and transition to the new operating model by FY25. Ahead on plan to improve stock efficiency and reduce inventory to c.£600m by year end. Test & React is now tracking at c.5% of own-brand sales, bringing high-fashion product from design to site in 2 to 3 weeks increasing our agility in responding to rapidly evolving customer demand.

· Free cash flow improved by c.£240m compared to H1 FY23 due to improvements in underlying profitability and the clearance of aged stock. Despite the sales decline, H1 free cash outflow2 of c.£20m represents a strong outcome in a period typically characterised by significantly negative working capital (see chart below) and represents our strongest H1 cash performance since FY17.

· As a result of this performance, we closed the half with a robust cash balance3 of more than £330m, an improvement of more than £20m from H1 FY23.

· Full-year guidance is unchanged, including: 5-15% sales decline, positive adjusted EBITDA, inventory back to pre-COVID levels, and positive cash generation, reducing net debt.

Ocado Ocado 4.1% Short - See RNS

Volumes (total items) grew 8.1% year-on-year, driving Q1 Retail revenue growth of 10.6%, to £645.3m.

● Ocado Retail online market share (Nielsen) rose to 13.5% at the end of February, up 0.7% over the year.

● Average orders per week of 414,000 grew 8.4% compared with Q1 2023, reflecting strong growth in active customers, up 6.4% to 1.02 million at the end of the quarter.

● Average basket value was up 2.1% while basket size (number of items) was stable year-on-year.

● Continued focus on pricing strategy resulted in ASP growth of just 2.2%, significantly below the market - this has translated to improvements in customer value perception

Wood Group WG 1.3% - See RNS

Upgrades 2024 outlook

Strategic progress and strong growth in the first year of our strategy

· Delivered results in line with expectations

o Revenue growth across all business units

o Strong adjusted EBITDA growth, in line with guidance

· Continued momentum

o Fastest growth in Consulting and across sustainable solutions

o Order book up 4% to $6.3 billion, up 7% like-for-like14

o Double-digit growth in our factored sales pipeline

o Improving pricing trends across pipeline, order book and in margin performance in 2023

o Adjusted operating cash flow improved to $194 million, up $260 million on last year

· Growing our sustainable solutions business to $1.3 billion15

o Sustainable solutions revenue up 15% and represented 22% of Group revenue

o 43% of factored sales pipeline now in sustainable solutions

09:00 Update Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

06:45 Pre Market- Dollar back below $104 Oil Rallies, Copper support at 21EMA, Gold holds the 8EMA

UK equities gave back some of last week's gains yesterday with the FTSE250 dropping most to check back to the 8EMA level and find support . DLG dropping over 11% as hopes of the Ageas offer ended

as highlighted in the weekly wrap, Oil rallied off the 8EMA (see chart ) lifting oilers while miners also advanced

Dollar has pulled back from the $104 level, Gold has responded and is tracing the 8EMA maintaining its bullish bias while copper has pulled back tot he 21EMA but found some support at this level

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar