Contents: Click on Link to View

Toggle0900 Moving on Catalysts : INDV +18% on results: SLP Slips on Results : ARB recovering lost Ground +9%: RR +9% on Results

Indivior +18%

Highlighted in the weekly wrap 7 see here INDV did indeed surprise to the upside and this made a significant move plus 18% to the upside and going through the 200 MA, see the pre market analysis below:

INDV Especially has a bullish chart which is showing a cup and handle pattern with a volatility squeeze on the handle from fairly tightly clustered moving averages. This is often the precursor to a breakout. Indivior is set to report on Thursday 22nd of February-...

It had shown some weakness in the past couple of days given overall market sentiment and a pullback in the sector in general. This is fairly reflective of the current state of the markets which is lumpy at best and does make it difficult to maintain swing trading positions without making good allowances for a fair degree of volatility.

Relative to the sector, INDV has been holding up reasonably well especially if you compare it to the likes of ONT, AVCT or SYN which are down double digits on the week. AVCT being one of the more hyped names of late which has serially underperformed despite the narratives and Twitter/bulletin board buzz.

SLP Sylvania Platinum which I highlighted last week as a potential reversal case has continued to sell and gapped down this morning on its 4th quarter results though it is recovering intraday. This does highlight not just the danger of trying to catch falling knives but the broader state of the precious group metal mining sector. I could find no catalyst to take a position in SLP. I am however long Pan African resources which continues to show strength and in turn highlights the importance of buying strength in this market. On a broader level I remain of a view that many of the precious metals are bottoming and this is a very underloved and under owned sector so I would anticipate there will be significant opportunities when recovery begins. The problem is given the negativity of the sentiment it is best to wait for technical indicators before trying to guess where that bottom is and great care is needed in any early picks given the cost of capital and debt loading of many of the junior miners . SLP isn't among them in terms of debt (its MCAP/EV is +71%) and does have good fundamentals -its price just keeps going in the wrong direction

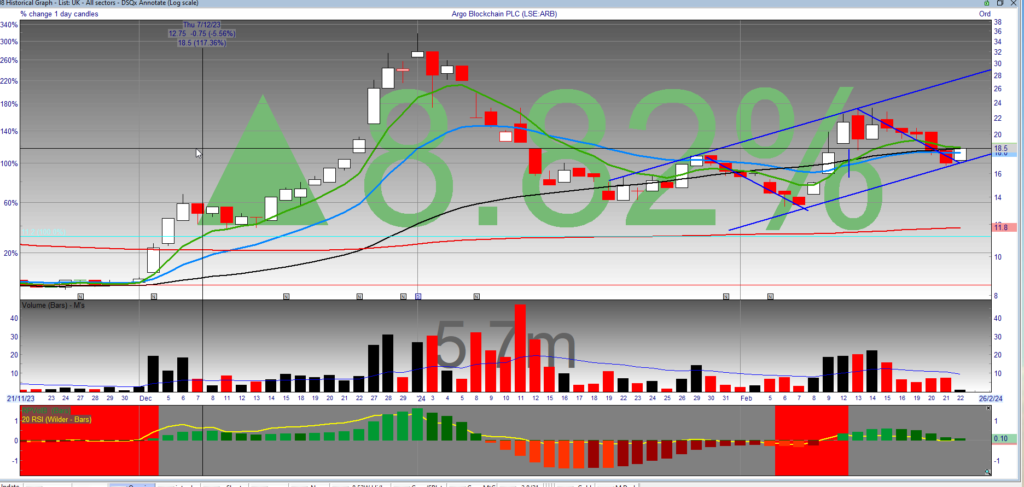

I continue to hold some ARB which as commented before, tends to be a volatile ride : it has kept with my rule of no greater than 2 closes below the 21EMA as a signal of trend change though in the case of very high beta names, I tend to give this some slack : instead I keep position sizes low to manage the risk

It is following a fairly symmetrical Price pattern of now I will see you in a channel with similar moves to the downside followed by recovery of the lower channel line. Assuming this pattern continues to hold which in turn assumes that Bitcoin maintains its overall bullish trajectory then I'll continue to hold the position and leave it some wiggle room

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar

One to Watch INDV Turns Profitable and Guides for double digit Growth : Move to Primary US Listing in ’24

Indivior INDV RNS

Highlighted in the weekly wrap as one that might move to the upside although it has shown some softness in between as the Pharm has sold off in a cooler market this week. Good set of numbers and the promise to list on the main US market should see a move north today - chart below showed recovery of SP into today in an overall down market

• Achieved 21% net revenue (NR) growth; expanded adjusted operating margin while investing for future growth

• FY 2023 SUBLOCADE® NR of $630m at top end of range and +54% versus FY 2022

• FY 2024 guidance introduced - expect to deliver 18% NR growth and ~300 basis points of operating margin expansion at the mid-points

• Initiating shareholder consultations to potentially transition to a primary listing in the U.S. in 2024 while maintaining a secondary listing in the U.K.

Comment by Mark Crossley, CEO of Indivior PLC

"At our December 2022 Capital Markets Day, we laid out Indivior's strategy and medium term financial goals targeting double-digit top line growth, operating margin expansion and strengthened cash flow. By executing against our strategic priorities, we delivered strongly against these goals in 2023. We grew SUBLOCADE and PERSERIS® net revenue by 54% and 50%, respectively, we acquired Opiant and launched OPVEE®, and we expanded our pipeline of innovative potential treatments for substance use disorders. Furthermore, we converted 21% net revenue growth into adjusted operating profit growth of 27% (reported operating loss of $4m), despite significant incremental operating costs from the acquisition of Opiant and targeted investments in our U.S. commercial organization. Among other highlights, we listed our shares on NASDAQ, continued to de-risk legacy liabilities, and we initiated a third $100m share repurchase program. 2023 was a year of considerable achievement and I want to thank all Indivior employees for their efforts."

"Our guidance for 2024 builds off this momentum with expected double-digit net revenue growth and meaningful operating margin expansion. We are also excited to announce that we are initiating consultations with shareholders on potentially transitioning to a primary listing in the U.S. in 2024 while maintaining a secondary listing in the U.K. I look forward to reporting on our strong progress in 2024."

Period to December 31st (Unaudited)

Q4

2023

$m

Q4

2022

$m

% Change

FY

2023

$m

FY

2022

$m

% Change

Net Revenue

293

241

22%

1,093

901

21%

Operating Profit/(Loss)1

60

(258)

NM

(4)

(85)

-95%

Net Income/(Loss)1

54

(183)

NM

2

(53)

NM

Diluted EPS/(LPS)1 ($)

$0.38

$(1.34)

NM

$0.01

$(0.38)

NM

Adjusted Basis

Adj. Operating Profit2

66

40

65%

269

212

27%

Adj. Net Income2

61

39

56%

223

169

32%

Adj. Diluted EPS2 ($)

$0.43

$0.27

59%

$1.57

$1.16

35%

INDV Chart

Pre Market- 0645 : Nvidia Surprises to the Upside Overnight : Gold $2030 Brent above $83 : UK PMIs at 09:30:EU CPI 10 am: EIA Inventories 15:30

Yesterday was a red day and UK markets with the FTSE100 pulling back over 1% at one stage but finding support at the 8 EMA. A lot of the damage being done by HSBC which disappointed on earnings and dropped over 8% on the day. While the miners also had a red day.

The FTSE 250 closed unch on the day with many of the pharma names staging a bit of a comeback including Genus and INDV while the AIM has dipped below its 21EMA with outperformance by Telecoms and Renewables though Pharm Medical Equipment underperformed.

In the US markets closed in the green for the S&P as the index touched the 21EMA and bid: while it was red for the Nasdaq , Nvidia’s results after-hours have lifted the whole index futures +0.7% to more than repair the losses on the day and put the tech index back above its 21EMA if the cash opens at these levels.

In commodities, Brent crude looks set to attempt another move north pushing above the $83 level, gold is back around the $1830 level following a brief dip yesterday into the FOMC minutes: EU CPI later today may have an impact on the yellow stuff via the dollar index which is back to test the 21EMA having dipped below it yesterday

Dollar index dips below $104

Oil into resistance above $83 and looking set to move north

Gold bullish at $2030 but into resistance to the 50MA

Copper remains firm and may be setting up for a move to the upside. Bitcoin continues to consolidate just below the $52,000 level and is testing but respecting the 8 EMA support