Contents: Click on Link to View

ToggleToday's trading opportunities from RNS newsflow catalysts that trigger trend changes

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar

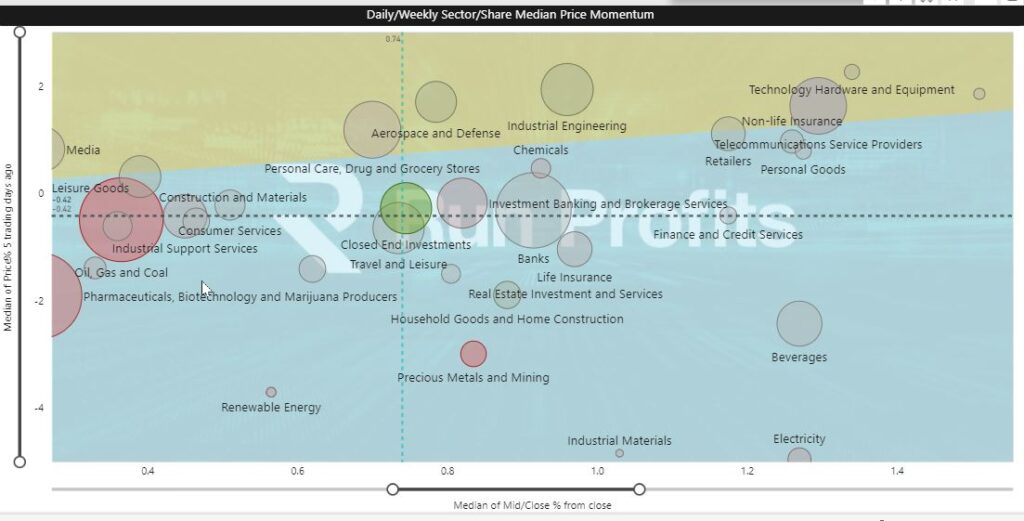

PCU - Using the Sector Momentum Tab to Find Sectors Advancing on the Daily and Weekly ; Tech Hardware, Retailers, Telecom SPs

Upper right hand quadrant has Tech Hardware, Non life insurance, Telecom SPs, Retailers and Personal Goods performing well this week

use CTRL to select multiple sectors in the Drop-Down Tab then use the Drill-DOWN arrow in the upper right to expand all of the sectors into individual names

Drilling down into these sectors and highlighting the leaders give the following names with IQE, BOO JET and AWE in green indicating good technicals - this is a quick way to scan for short term strength - selecting the date buttons above the plot will highlight any names which have had news on the dates - so isolating names moving with a catalyst

15:00 Update Gold Finds Support: ARB Pullsback - Allows an Add around 20.5p

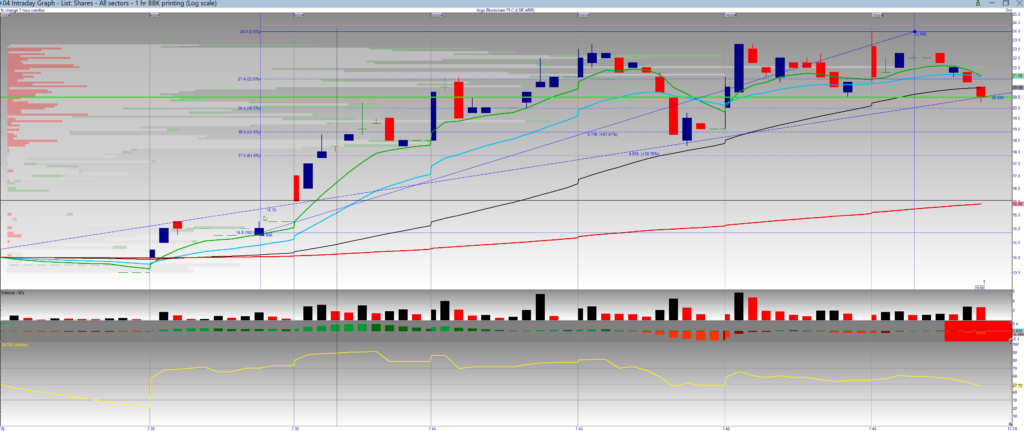

Pullback in ARB likley to be bought and gives an opportunity to enter around 20.5p assuming BTC remains bid - likely to be volatile trades so position size accordingly - looking for a positive price reaction from the 20-20.5p level with some volume though a pullback to the 5EMA (19.6p) or even 8 EMA i(18.75p) s possible

Gold found some support around the 100MA (mauve line in below chart) and has rallied intraday to clear the $2000 - sufficent support to add a small long from $1995 tight stop below $1984 as a very short term trade with an initial target around the 8EMA at 2013 with the potential to make the 21EMA at $2023 : this is a small stake reversion to mean trade as the dollar encounters some resistance - the medium-long term direction is still downward (although still above the 200MA) so manage trade accordingly.

Gold stays weak and slips below the 100MA level : one to watch as this was previous support - may yet see a dip to the 200MA at 1965 level before any meaningful recovery CHART

Pre Market-0645 UK GDP at 0700

Dollar pulling back slightly but remains firm post CPI breakout CHART at $104 level -

Gold stays weak and slips below the 100MA level : one to watch as this was previous support - may yet see a dip to the 200MA at 1965 level before any meaningful recovery CHART

Copper remains firm and relatively unch while platinum rallies slightly above the 8EMA and seems to be respecting the trendline that was resistance in the downtrend channel and is now support

Brent gaps lower on surprise inventory build CHART

Uranium holds $102 levels CHART

Dollar consolidating recent moves but looks bullish

Brent crude drops below the 200MA on surprise inventory builds

Brent crude drops below the 200MA on surprise inventory builds

Ones to Watch : JET2 Ups Guidance: CNA Divi and Buyback : BHP WDS Impairments: BTC $52k ARB

JET2 RNS bullish update and raises guidance - CHART looks set for a break out

Against a 20.5% increase in on sale seat capacity, Winter 2023/24 forward bookings have performed well with passenger sectors booked currently up by 17% and average pricing for both flight-only and package holiday products robust. The mix of higher margin per passenger package holiday customers is slightly ahead of last Winter at approximately 60%, which is particularly pleasing given the resurgence of City Breaks in this period. With February and March 2024 bookings displaying similar trends to recent months, plus the benefit of an extra day's flying in February and an earlier Easter, we tighten and slightly raise our guidance for Group profit before FX revaluation and taxation for the financial year to between £510m and £525m (previously £480m to £520m), which remains dependent on no material extraneous events in the balance of the financial year.

Year ending 31 March 2025 (FY25)

Cenrica RNS strong results , increases divi and launches a buyback

chart is in a consolidating pattern off recent highs with support aroudn 130p tho 21EMA resistance - a positive reaction may see price gap above the 21EMA - as ever wait for the market reaction

Biliton BHP reports a significant markdown on Western Australian Nickel assets of $3.5bn pre tax while Woodside updates on reserves and impariments of $1.5bn