Contents: Click on Link to View

ToggleToday's trading opportunities from RNS newsflow catalysts that trigger trend changes

Pre Market- 06:45 Gold Continues North to $2022 Levels as DXY Softens Slightly: Oil at Resistance: BTC $52400

US on holidays today - economic calendar light while FTSE futures sit at 7700 almost unch on Friday's cash close of 7011

Gold continues its move off lows last week and proceeds to the 21EMA at $2022 - I had questioned whether it would find resistance at the 8EMA in the weekly wrap so this move is welcome. My original trade from last Thursday was based on a reversion-to-mean : that is normally the 21EMA so I'll take some profits here and watch the price action around this level CHART

Gold rallies to the 21EMA target

Meanwhile Brent remains rangebound and finds resistance around the area of supply north of the $83 aread - see chart

Brent encountering overhead resistance

Bitocin continues its moves north after a check-in around the 8 EMA - it does look bullish but does need to clear and close the $53K area of resistance: watch ARB and UK based crypto names - I remain long

Daily RPG Reports: 09:00 Update Posted Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar

Ones to Watch MONY , CURY Rejects Offer

MONY Strong results and mantains expectations with record revenues and an increase in dividend : chart is turning bullish with 21EMA around 251p area to watch - -expect a positive reaction today and a move north given recent volume build and vol squeeze on daily and monthly CHART

Financial highlights

· Record revenue at £432m, despite no material revenue from energy switching

· 11% revenue growth led by exceptional trading in Insurance, supported by efficient acquisition and retain and grow strategy

· EBITDA up 14%, ahead of revenue growth, to £132m with margins expanded to 31% demonstrating continued robust cost management

· Adjusted basic EPS up 12%

· Operating cashflow before tax increased 7%, following the increase in tax rates operating cashflow after taxes are down 2%

· Full-year dividend up 3% to 12.1p, £65 million distribution to shareholders

CURY rejects an all-cash offer - expect soem firewoerks today as specualtion over who's next wo make an offer? is likely CHART

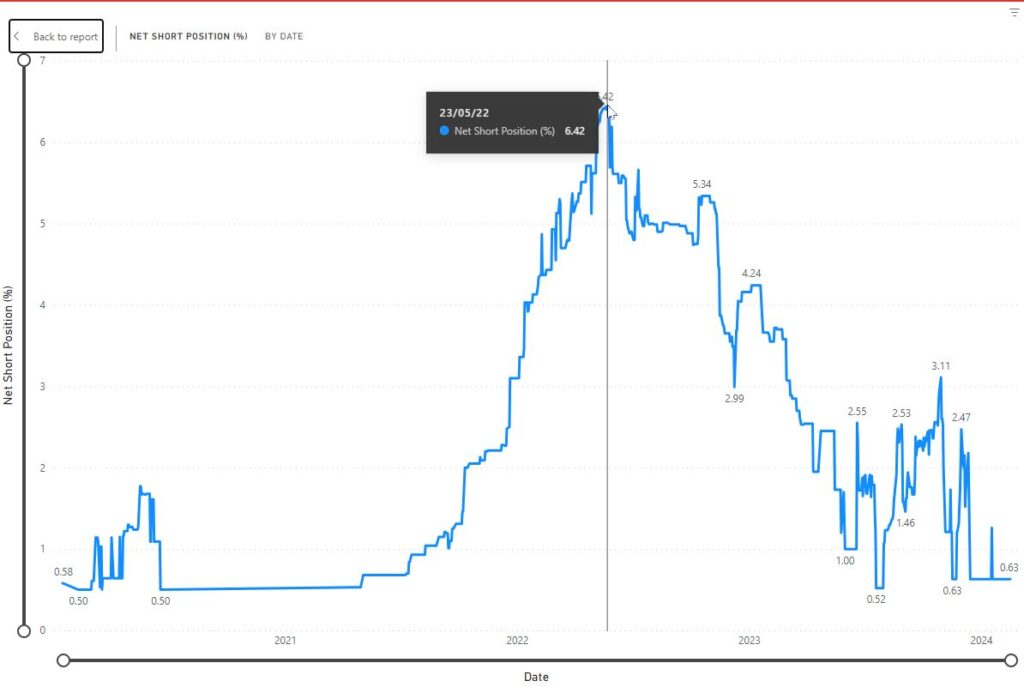

worth noting Curry's used to be on one of the most shorted shares in the UK with a peak around May 22 of 6.4% short but now just 0.63%

Curry's short interest history