Contents: Click on Link to View

ToggleOnes to Watch : Potential Reversals in CHAR, TGA, FARN

CHAR chariot Limted - RNS

potential positive catalyst of transactional power business sale for a reversal trade set-up with a volatility squeeze firing on the daily

Thungela Reports - See RNS

likely a lot of the bad news already in the price so potential for a bounce on rising oil prices though revenue down 40%, profits -73% , EPS -70% with net cash down 31%

Resilient performance underpins strong cash generation and net cash* position, supporting total returns to shareholders of R3.3 billion for 2023 (49% of adjusted operating free cash flow*)

• Profit of R5.0 billion, including contribution of R448 million from the Ensham Business for the four months since completion of the transaction

• Strong cash generation and balance sheet position maintained, with adjusted operating free cash flow* of R6.8 billion and net cash* of R10.2 billion

• Commitment to superior shareholder returns honoured with a final cash dividend declared of R10.00 per share, taking full year dividend to R20.00 per share, or R2.8 billion, in dividends returned to shareholders in relation to 2023 performance

• Share buyback of up to R500 million announced

BYIT strong results albeit overshowed by former CEO's insider trading investigation which may dent sentiment and trust ..

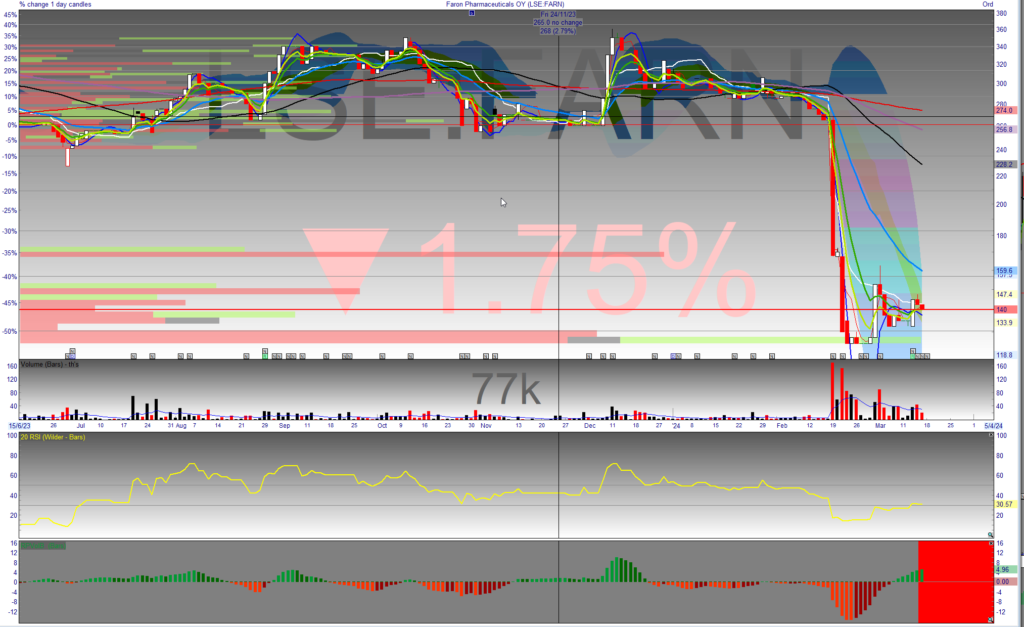

FARN reports positive trial sets up for a bounce - see RNS

very low volume name

Pre Market 06:45 -dollar into resistance around $103.5: Brent firm above $85 looking bullish , Gold pullback below 8EMA

Dollar index holding into a key week of economic data including 14 central bank meeting and 6 of the G10 with a focus on the Fed

Gold showing some weakness slipping the 8 EMA to the $2148 level

Brent oil holds its bullish bias into some resistance around the $86 level which will support oilers this week but dent travel and renewables

FTSE 100 futures +20 on Friday cash , EU CPI at 10.00

Dollar above 21EMA

Dollar above 21EMA

Gold pullback below 8EMA

Brent oil bullish into resistance around $86

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar