Contents: Click on Link to View

TogglePre Market- 0645 : US S&P New ATHs Nvidia +16% : German GDP at 0700

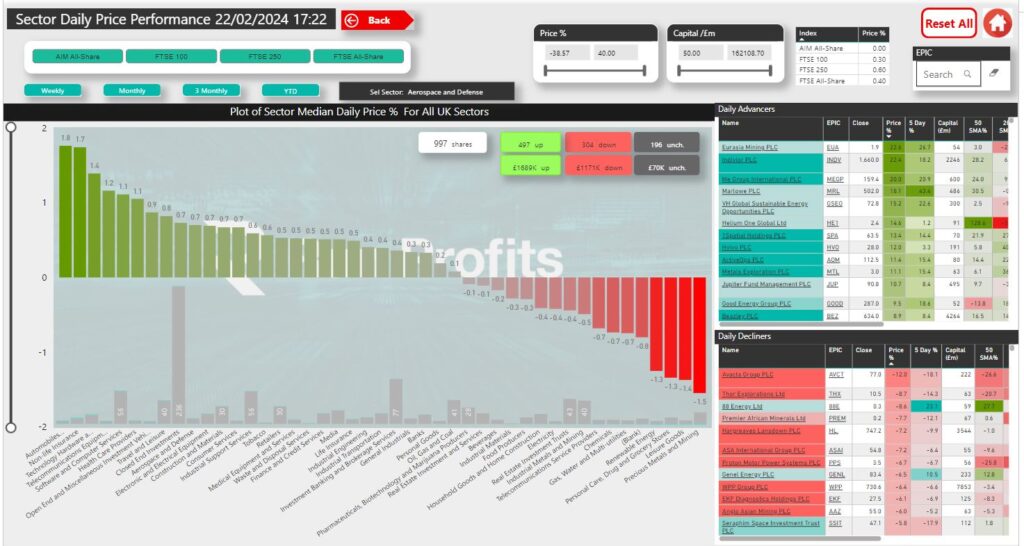

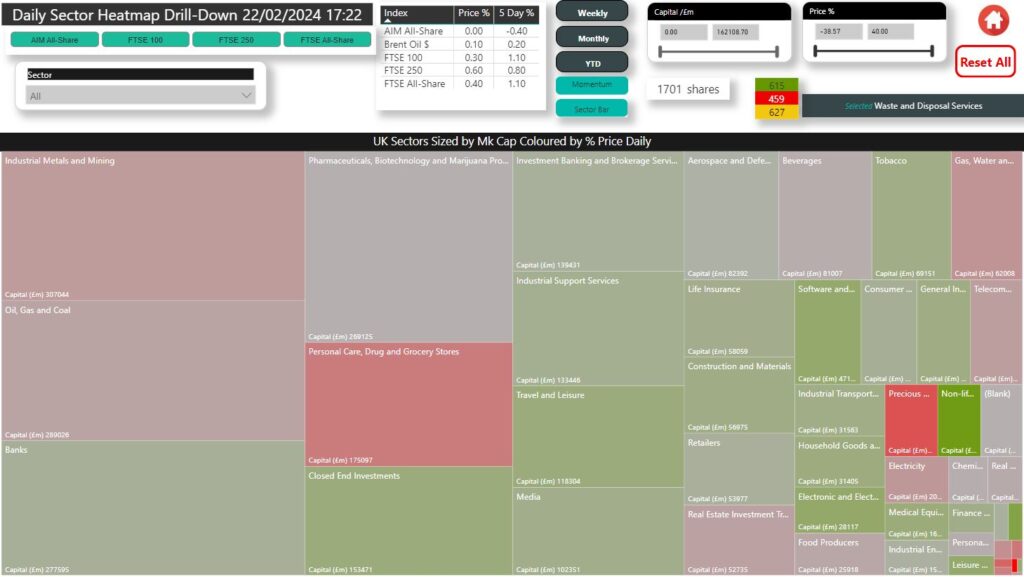

In the UK yesterday out performance from the mid cap FTSE250 up 0.6% - a lot of this down to the +22.5% pop in INDV : second in line was FTSE100s at 0.3% and AIM was unch on the day if you see below on the heat map we had about 600 buying, 450 selling and 630 doing nothing.

Selling concentrated in Miners, Oilers , Personal Care while many of the other Pharmaceuticals didn't have a good day (AVCT lost 12% , POLB 10%) nor did Utilities and Precious Metals Miners had a particularly bad day with the likes of VAST, SLP selling off.

in the green we had Banks again as LLOY reported and popped 6% , Construction, Software and particularly outperformance in the Non Life Insurance so it's good sector to have a look in there's tonnes of strength in there.

The below is from the Market Dashboard it's under sector rotations) and this gives a summary of the main advancers and decliners which you can segment by the indices and that gives you a very quick view on the best performers and the worst performers. Indivior dwarfing the other major movers with an enormous difference in market capital

In the US markets closed in at record highs for the S&P +2.1% and in Japan and Germany - US saw most green in the semis and technology

The dollar Dollar index briefly dipped below 200 day moving average yesterday but recovered and is continuing to trace along the 21 EMA the blue line in the below chart Just shy of the 104 level

In commodities , Brent crude remains rangebound Into resistance above the $83 level, gold struggled with resistance at the 50MA and has pulled back remaining in a tight range ,

Similarly copper remains in a tight range With the platinum group metals similarly relatively unchanged while uranium spot has slipped below the $100 mark.

Bitcoin continues sideways but slips below its 8 EMA

Dollar index

Oil remains resistance above $83

Gold finding resistance at the 50 MA level

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar