Contents: Click on Link to View

TogglePre Market 06:45 - Dollar Rise on Stronger PPI though Gold holds 5EMA, , Copper continues, Brent clears $85

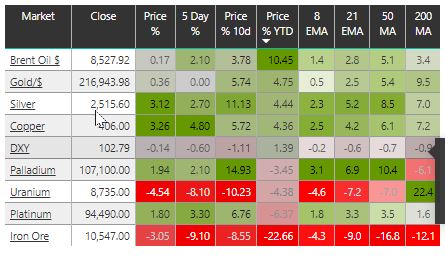

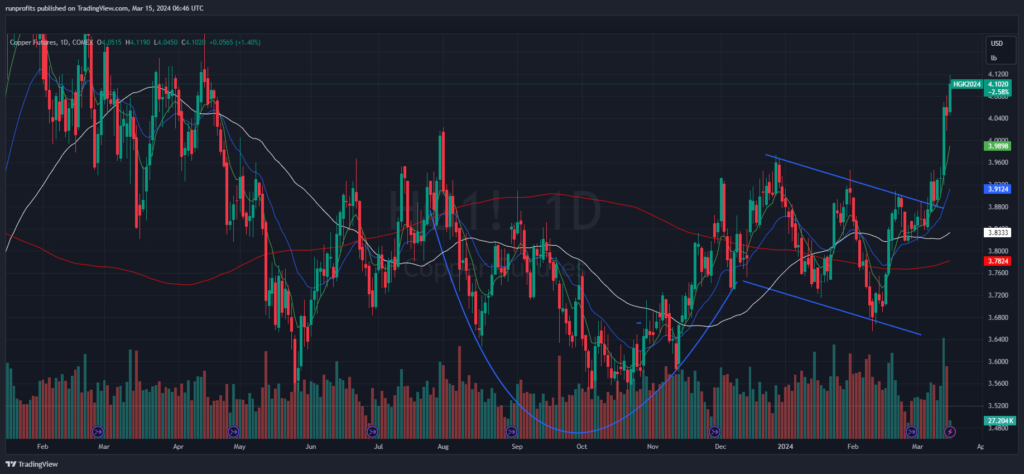

Dollar index rallied on stronger PPI numbers in the US yesterday but seems to have found some resistance at the 21EMA ( a reversion to the mean) - Gold fell to the 5EMA but seems to have found support there while copper, palladium and platinum stay firm suggesting the dollar strength may be of limited impact for now.

<all tables and plots can be enlarged by clicking: return to the article by clicking outside of the enlarged image>

Oil and Gas names outperformed int he UK yesterday on the highest Brent price since Nov '23 - Oil does seem to be encountering some resistance around the $85 level though were it to follow the current rising channel this may see the $87 level which will support oil and gas names further

Dollar rallies to 21EMA -

Copper maintains strength

Brent oil clears $85 at resistance to Nov '23 levels

One to Watch FAN - Volution Guides Higher

FAN Volution See RNS

strong results and guides higher see RNS cautionary tone on weaker new build demand likely offset by FAN's outperformance and refurbishment exposure

"Our strong performance in the first half, together with the tailwind from our three recent acquisitions, gives the Board confidence in delivering adjusted earnings per share for the current financial year slightly ahead of consensus1.

chart sets up to breakout from consolidation and takeout 460p high

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar