Pre Market 07:30 - Christmas Cheer as UK Indices Rally To Recent Highs: US at New All-Time Highs

Futures call for a paring of some of yesterday's gains with The FTSE 100 set to open down 20 points and stubbornly below the 6400 level which seems like a key decision point. Clearing and closing above this is bullish;another rejection is likely to signal a pullback and/or correction. The latter would be healthier to take some froth off these markets while the former makes a much more dramatic correction more likely. The gravitational pull of mean reversion always wins: the further the distance the harder the fall. Speaking of all-time-highs the US S&P and Nasdaq completed these manoeuvres yesterday setting new records

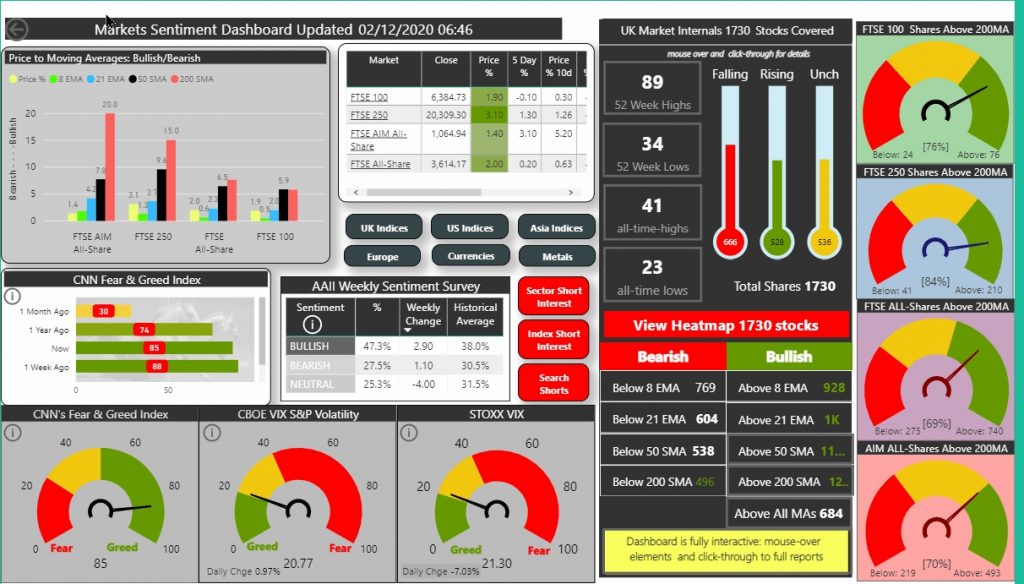

The first day of December saw robust trading with the FTSE 100 gaining 1.9% while the 250 made over 3% with both rallying to near their recent November highs: what happens next will be very telling. Either a breakout to new post Covid highs and an early Santa rally or a pullback to book profits and rotate and then a possible rally into year end. I tend to favour the latter but in these crazy times, anything is possible so we follow the data and position accordingly. All of the UK indices are very bullish - the AIM All Share made new post CV19 highs yesterday advancing another 1.4%. This looks set to challenge the previous ATH set in 2018

As highlighted yesterday, gold did indeed rally gaining $36 dollars to clear the 1800 mark and take back the 200 MA: it now sits consolidating around the 8 EMA.

Lower than expected inflation in the Eurozone yesterday may have taken some of the wind out of bitcoin's sails as the crypto hit an all time high and again retreated

In commodities, continued uncertainty with OPEC's (and OPEC+ )controls over production may have contributed to oil stalling and retreating from the $48 level: supply constraint is key to current price levels, any deviation on the coordinated control of supply is likely to impact price given the lower economic demands imposed by global Covid restriction

In sentiment. the Fear and Greed index has retreated to 85 signalling some concern on these giddy heights but the VIX is benign at under 21 suggesting limited protection is being sought and a level of complacency at these index highs. It may well be that US stimulus and a favourable Brexit outcome are being factored into current prices so any upsets may be greeted with a rapid adjustment.

17 UK Companies Reported by 07:30