Pre Market 07:30: US Stimulus and Brexit Resolution Boosts Markets

Indices have been somewhat indecisive over the past couple of weeks but remain bullish as sideways churn looks increasingly likely to break to the upside. In the US, worsening Covid cases may pressure the stimulus impasse to give way before Christmas boosting markets (bad news is good news) while in the UK and Europe, smoke signals of an imminent Brexit resolution will remove this overhang from markets (good news is good news).

FTSE 100 futures suggest an open 20 points to the good at 6540

Indices

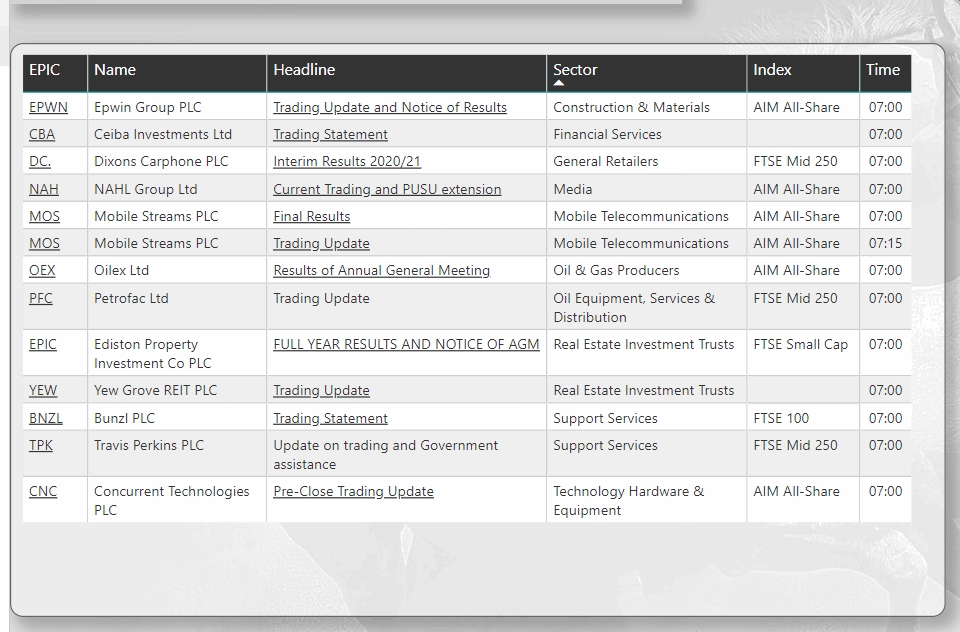

Yesterday saw the UK indices remain in the red for most of the day until rumours of a Brexit breakthrough boosted the bourses late in the day: GBP rallied while the FTSE 250 spiked into the close up 0.7% on the day : the chart below shows a classic pullback to the 21EMA and bounce typical of bullish trending charts. AIM rose 0.25% and is clinging to the 8 EMA in an ultra bullish manner though there are signs of weakening momentum

Commodities

Brent crude continues to hold above the $50 level and looks bullish though momentum is decreasing: Copper futures sit near the $352 levels still on multi year highs. Gold caught a bid and rallied over 1% yesterday to clear `1855 from a low of 1820 as stimulus hopes dented the dollar and stokes the inflation trade

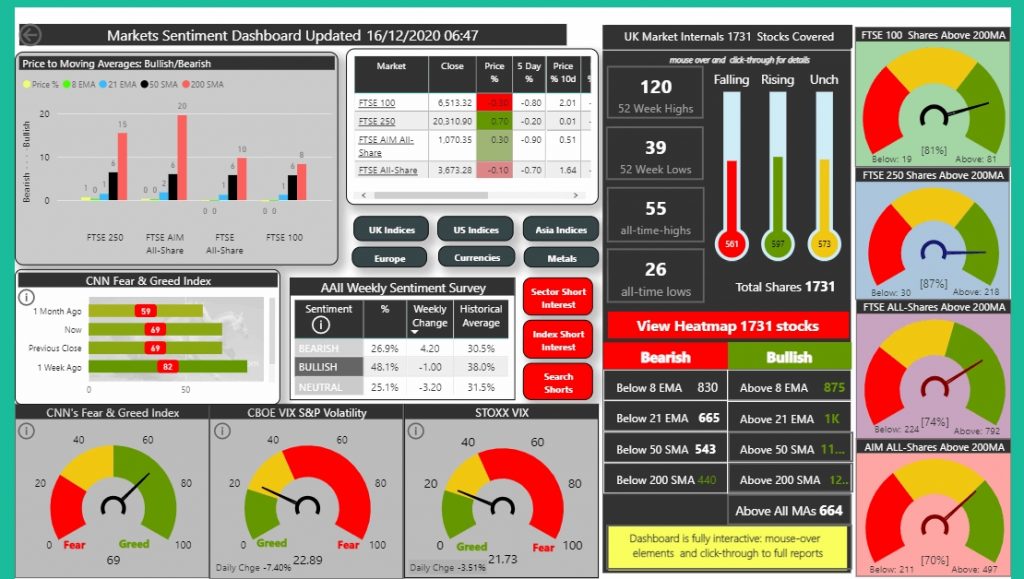

Sentiment

VIX remains hhad upticked to 25 before yesterday's session but has fallen back to 23 as juiced markets ar emboldened

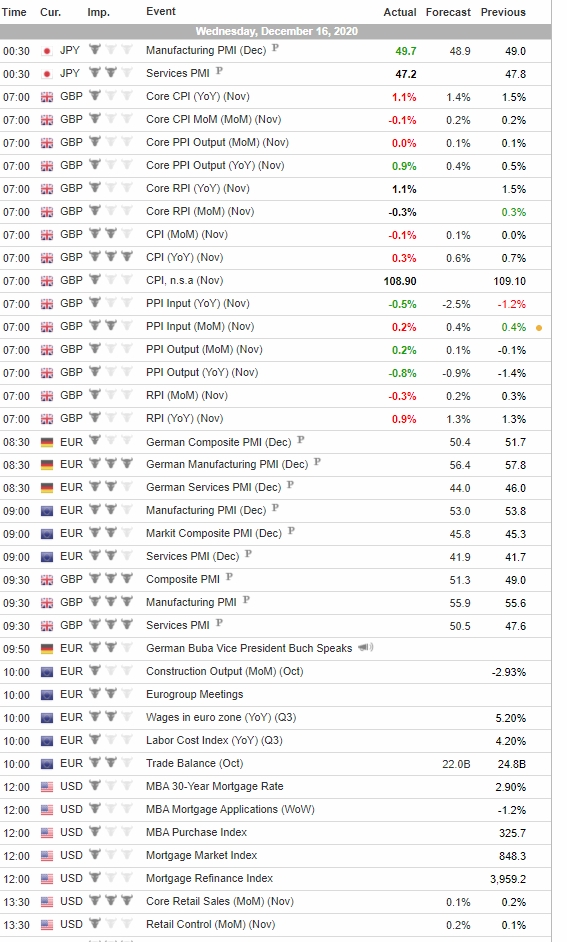

Economic Calendar

Huge economic data today with PPIs, PMIs, inflation reports and US retail sales: full details in calendar

Sentiment Dashboard Wed 16 Dec 20

FTSE 250 Pullback to the 21 EMA and Bounce