Pre Market 07:30: Bitcoin Breakout to New ATHs: Brexit Boosted GBP

FTSE 100 futures suggest the cash will open 30 points higher around 6590

Indices

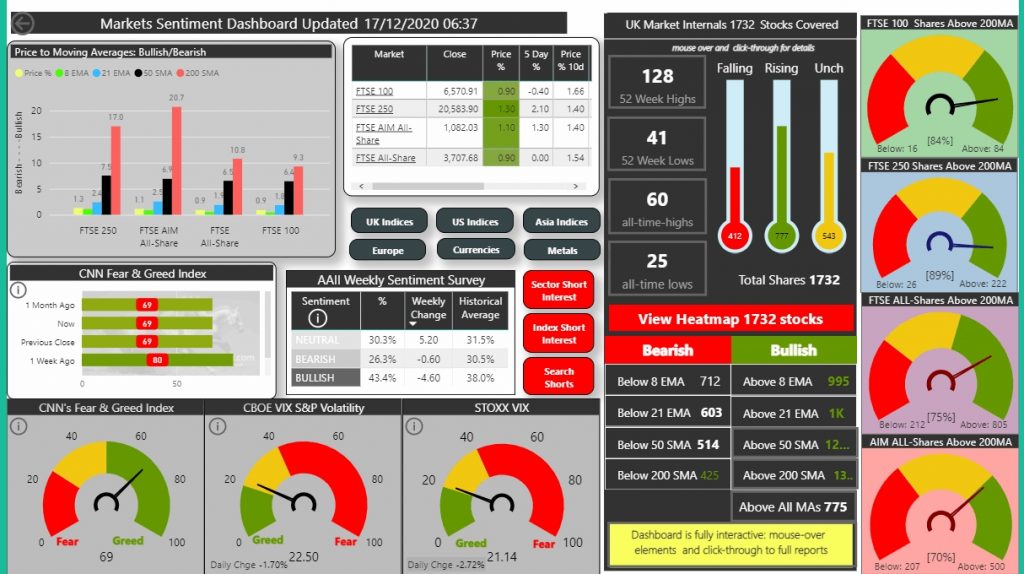

Pre Christmas cheer pervades in the markets if not in the high streets as all the UK indices rallied with the FTSE 250 outperforming yesterday closing up 1.35% but not yet clearing the new post Covid high set last week. AIM All-share rose 1.3% and set another post Covid high. Brexit bullishness boosted GBP to new multi year highs which weighed to some extent on the mega cap FTSE 100 which rose 0.9%. The US finished with the techs up 0.6% while the DOW lagged at -0.2% and the S&P up 0.2%. Overnight saw Asia finishing positive with China outperforming up 1.1%

Commodities

Oil remains strongly bullish and clears the $51 level in Brent : copper is consolidating around the 8 EMA at 354 while iron ore pulled back from record highs but remains elevated around the 153 level . Gold appears to have broken out of its consolidating channel (see post ) and is eyeing the 1900 level.

Bitcoin has broken out to new all-time highs with a bullish clearance of the previous high see chart below. I highlighted Argo Blockchain, the UK listed crypto miner on Nov 5 when it was priced at 7.4p as a way to play the BTC trade with less volatility. Since then ARB has risen to clear 12.5p, up 180% and has broken-out to new multi year highs ([stock_market_widget type="inline" template="generic" assets="ARB.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size: small" api="yf"] ) Both gold and BTC are bellwethers for stoked inflation fears as more stimulus is injected into global economies

Sentiment

VIX remains unchanged around the 22 level : F&G index is at greed 69 while AAII bullishness has dropped back marginally from 48 to 43% which is elevated compared to average

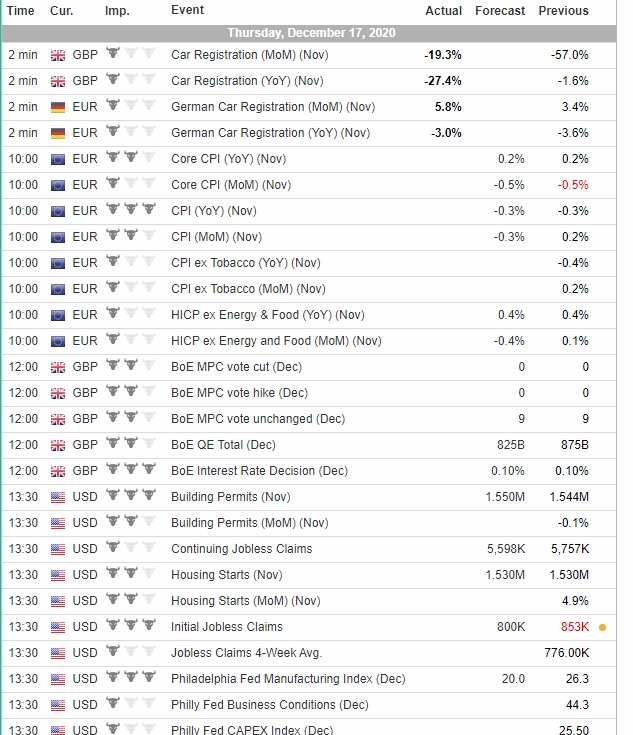

Economic Calendar

Another big economic calendar with EUR CPI, UK BoE , US housing and initial jobless

Sentiment Dashboard Thurs 17 Dec 20

Bitcoin at All Time Highs