It's Winter, all the Bears Have Hibernated

Premarket shows FTSE to open flat as US pulled back with the Nasdaq trimming 2% as big tech gave back some more of the recent record gains: Asia was cautious overnight so markets likely to remain muted to negative as PM Johnson's trip to Brussels seemed to have achieved nothing more than yet another extension of the resolution deadline to Sunday of this week. The buoyancy of markets suggest that a resolution is priced-in already with room to the upside but some hedging and trimming of gains given the extended uncertainty may well be on the cards today and tomorrow.

Oil has held firm overnight at around $49 while gold has paused its sell-offaround 1836

In sentiment VIX has ticked up mildly to 22 while the F&G remains elevated as Extreme Greed of 82

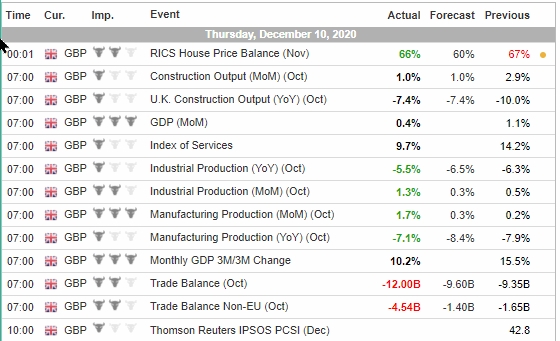

Today's ECB meeting may prove market moving though more accommodation is expected . In the UK economic calendar, beats across the board on manufacturing data may boost optimism on economic recovery post pandemic

Given the record rises in November across global bourses and new record highs in the US, this Winter has proven to be one for the bulls with no sign of any bears. Whenever it seems this safe , when one can almost feel sure that all the bears are safely asleep until next year , when it seems so unlikely that any bear could be lurking .. often these are the very times to be wary. Personally I have booked some great profits over the past week but have resisted the urge to go short these markets: with a binary output like a Brexit resolution it's too much of a crap-shoot despite all the previous visits to this over familiar "last chance salon".. All of my instincts tell me the last throw of the dice is just another pantomime scene to keep the baying voters in all constituents satisfied: that a deal is probably in the slow cooker if not the oven and that rabbit and hat will separate in a final "saved the day" grand gesture with much lauding of the opponents great zeal and how hard we all worked to get here. Maybe we've all got a bit cynical .Maybe we are sleep walking into a no deal because wolf has been cried so many times that no one believes in any lupine menace let alone an ursine one. Faced with his level of cognitive dissonance I focus on trading strength and avoid second guessing the known unknowable. I'll trade the reaction.. and so to the tangibles

FTSE 100 continues to struggle around the 6600 level as significant overhead supply from the March 2020 sell-off. This was also a key support level stretching back to 2019 when the market sold-off from its ATH of 7600 set in May ’19 as it dropped 20% into the lows of Oct 19. All of the UK indices remain bullish and the close flat on the day remains constructive for a break-out of this range and a move further north . The catalyst for this is likely to be a favourable Brexit outcome with the anticipation that tonight’s Brussels meeting between Johnson and von Der Leyen will provide a green light if not a clear path. Given the sticking points in the negotiation it appears that political goodwill and statecraft is the last resort for the break to the logjam.

The FTSE 250 also held its 8EMA and looks overall bullish if frozen in time awaiting the outcome while the AIM All-Share continued to rally unabashed making it 23 positive days in the last 28 trading days

The US and Europe has similarly been uber bullish as all indices have continued to rally making record moves over the past month. There is a brilliant reinforcement of the adage, the stock market is not the economy and is testament to the forward-looking nature of markets which have digested the pandemic, absorbed the monetary stimulus and is now evaluating the expected recovery in 2021 and the size and extend of fiscal stimulus. While many will argue these markets are priced to perfection, price is indeed the metric of merit and the one by which to set one’s trading compass

Gold has reacted to the overall bullishness by selling off back to the 1830 level as the precious metal sees some flight of capital in these heady risk-on markets. I highlighted the channel in the previous post and today's price action underscores its veracity as the yellow rock lost almost 2% today.

VIX remains cheap around the 21 level : copper continues to signal economic recovery as it remains around the $3.50 level in futures but looks set to pullback.

When everything is this bullish it is always good to keep an eye to exits and remain flight of foot. A meaningful pullback is over due especially in the US markets so watch for some profit booking and rotations over the next few days with potential catalysts from Brexit or fiscal stimulus disappointments. Sometime no excuse is needed to hit the sell

Gold Range Bound in Consolidating Channel

FTSE 100 in Hurry Up and Wait Mode