Pre Market 07:15 - Oil firm at $47, Dr Copper at 333: BTC Check and Bounce after $3000 drop

- FTSE Futures point to a flat start relatively unchanged from yesterday's slight pullback of 0.5% mostly arising from ex dividends by the likes of PSN, IMB.The FTSE 250 gave back 1.2% again probably owing to ex div although the mid cap index drops the 8 EMA and is losing momentum. AIM All Share advanced 0.6% to revisit the high set on Tuesday.

- As the US was closed for holidays, there was no action from across the pond so the VIX remains at 21 although the Euro VIX has dropped to near 20

- Oil has slipped slightly to the $47 level but remains resolute in its breakout and bullish direction. Copper has paused at 333 after adding 10% this month at its highest levels since 2018. It is now entering a zone of considerably resistance so may pullback. Dr Copper is often touted as the health indicator of the market: the futures composite was below 200 in March and has now recovered to 333. Gold is hovering around the $1810 and lacks direction, likely building up energy for the next move: a sharp dip below $1800 and a bounce may signal a move higher.

- BTC returned to its old form yesterday dropping over $3000 from $19300 to lows of $16200 before retaking 17,000. As I suggested yesterday, this was a check on its 21 EMA level which held and the crypto bounced: this suggests a bullish rebound as this level was bought (assuming it is not retested with failure)

- Asia closed mixed awaiting the US half day trading today: as we are at month-end after a big run, there may be some turbulence ahead owing to profit taking and rebalancing

- Sentiment is bullish but overbought and showing signs that mean reversion is likely

BTC Pullback: Bullish 21 EMA Check and Bounce

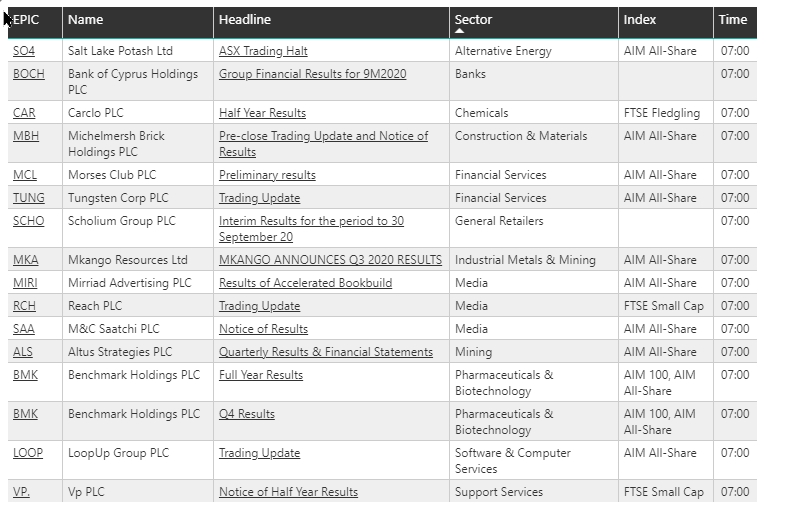

17 UK Companies Reported by 07:20