Pre Market 07:30 The Bull keeps Charging but Is Momentum Slowing?

FTSE futures suggest the mega cap index will open up higher by 20 points breaching the 6500 level after another strong day yesterday. The US indices were mainly positive though showed some weakness into the close with the DOW sliding below the 30,000 level by the end of trading. Today is the all important NFP employment number which can often be market moving. Charts below show how momentum is fading for the UK indices. Given our run in November, given the macro and now given some technical warnings, it's not a bad idea to book some profits though there are few technical compelling reasons to be short. Momentum driven markets can continue to rally even as the technical decay though often these scenarios do end in a sharp turnaround. Today will be revealing in the cash as the FTSE looks to break above the previous pre Covid high around 6510 set in June : if this holds with a close above that level then that is another bullish signal . Failure to keep this level into the close is likely to signal a pullback and some profit taking.The US is likely to lead this and the NFP number at 13:30 may prove a catalyst for direction either way.

Overnight oil continues to advance and is close to $50 after an OPEC resolution agreed to increase production by just 500k BPD from January so continuing to throttle supply and support price :copper remains around the 3.50 level, gold was flat Asia was mixed and non-committal. Resource stocks will continue to rally on commodity prices which will support the FTSE 100

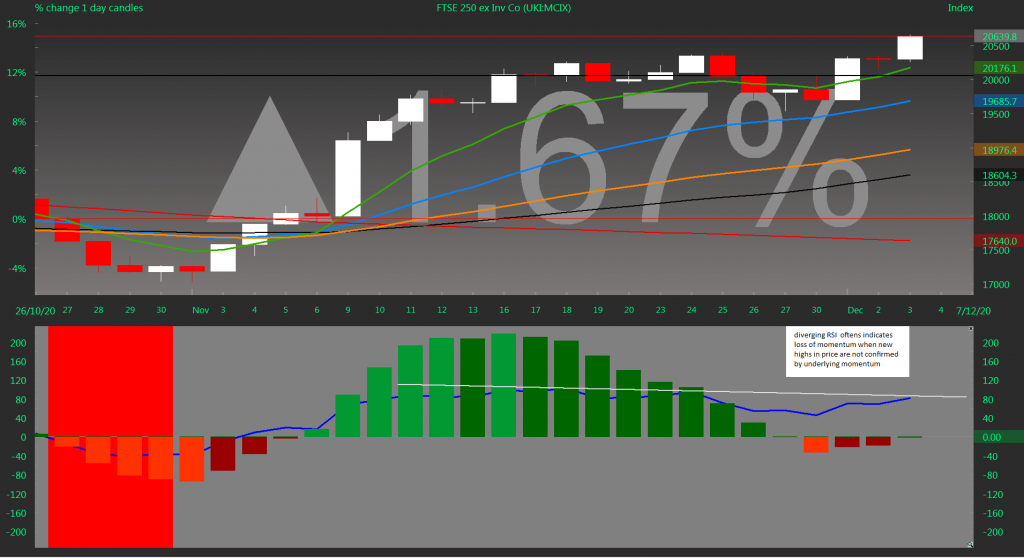

In the UK, the FTSE 100 continues to advance but is starting to look tired, resource stocks play a big role in the mega cap index so miners and oilers have been driving a lot of the price action of late . That said , even as price is increasing, momentum is starting to decrease and a markedly divergent RSI is suggesting that a directional change is on the cards. This may not be a big pullback, it could be a sideways consolidation as the big moves of November are digested

Sentiment shows the F&G at extreme greed of 85, VIX showed a slight uptick to 21.3

FTSE 100 Momentum Decreasing as RSI Diverges

FTSE 250 Divergent RSI

13 UK Companies Reported by 07:30