Contents: Click on Link to View

TogglePre Market Sentiment and Charts Influencing UK Markets (3 mins read)

Expecations for chop with back and filling of recent moves: overnight poor retail BRC reading may catalyse soem profit taking in retail names after recent strong run (sector is up 10% on the month)

Sentiment remain supportive of risk-on but in bear markets, this can turn quickly as trigger happy take-profits truns rips into dips

FTSE250 rejected the 100MA yesterday so will likely see some selling potentially in Retail and Travel names given recent run

FTSE 100 Futures

FTSE Futures at 7266 off yesterday's close of 7300 after the mega caps failed to hold the 200MA at 7030. However this digestion of Friday's big move is a healthy sign in in an upward move that should see 7500 to reach the top of the channel in play since the start of 2022 assuming continued support from commodites and oil .

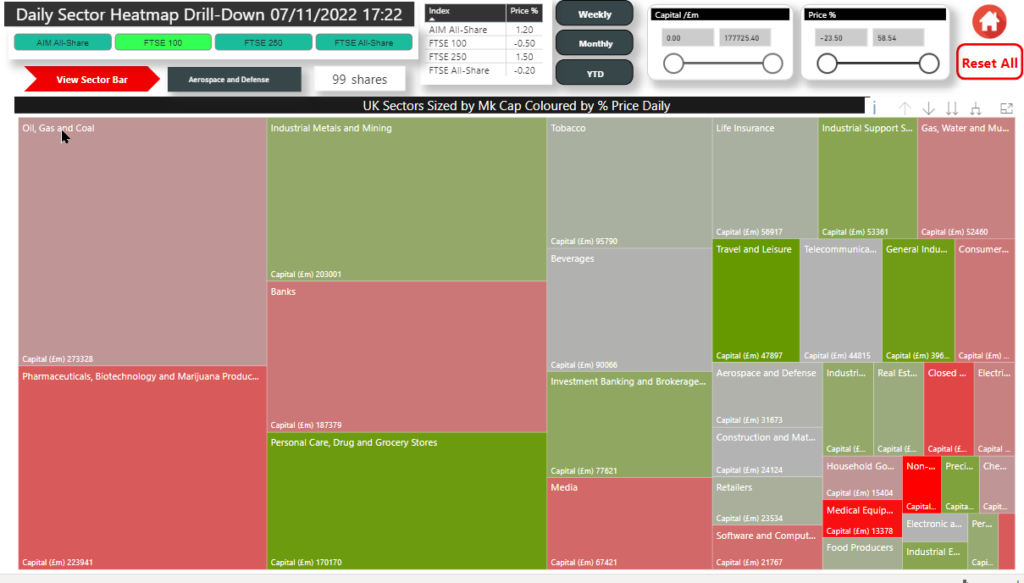

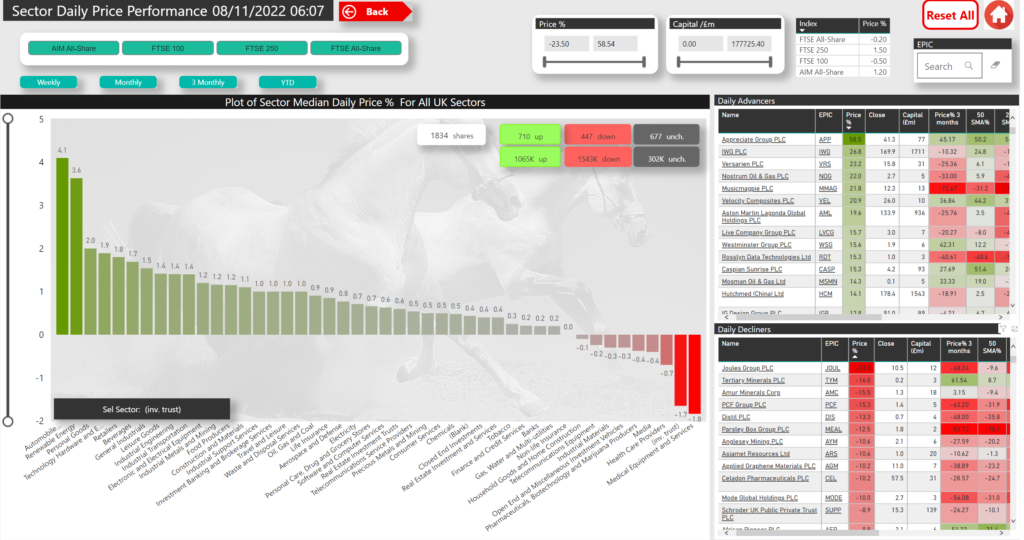

The daily sector heatmap shows Mining, Travel and Personal care/grocery in green while oil and gas took a pause

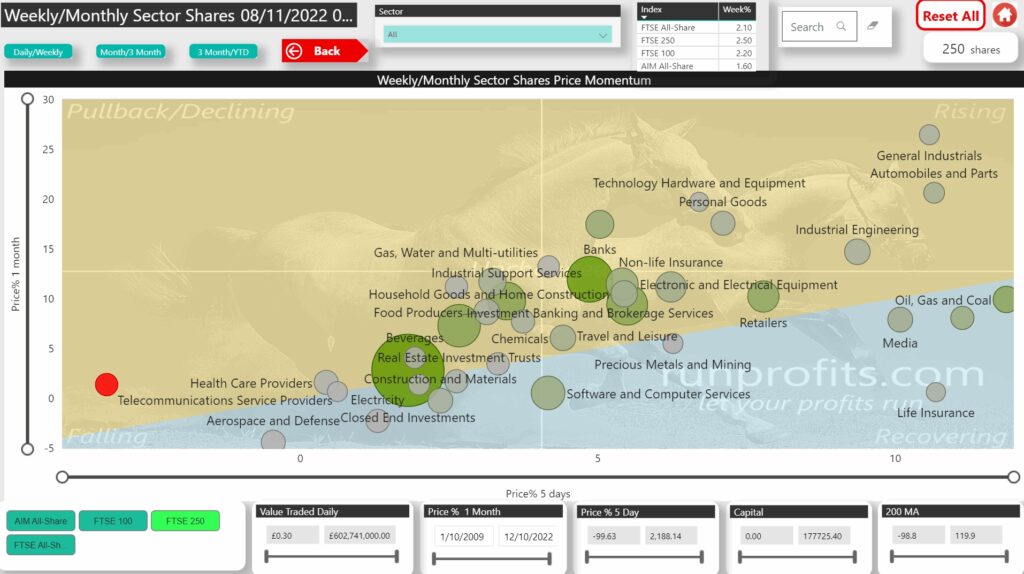

Mid and Small Caps FTSE 250 Looking Stretched: AIM Targets 50MA

Mega cap positive momentum from Friday spread to mid and small caps: FTSE 250 rallied to the 100MA and rejected the level which may signal a pullback from the recent strong run: this may check back on the 50MA see chart

The move has been pretty broad - see sector momentum plot with outperformance in Industrials, Oil and Gas, Tech Hardware and Retail

the AIM 100 index takiing out the 50MA yesterday for the first time since August 2022. AML jumped 20% while Renewables as a sector gained 3.4% with PODP +11% and CWR +11%

US Stockmap Close

US Closed In green driven by a bounce in tech with Meta gaining 6.5% on rumours of significant cuts in employees this week : TSLA loses 5% in a much touted sell-off that looks set to become a crowded short

Econ Calendar

Today's economic calendar is pretty light but saw a disappointing BRC Retail's sales number overnight at 1.2% vs Expected 1,5%: this may take some of the wind out of the sails of the recent rlaly in retail names with the sector being up over 10% in the past month.

Gold Chart

see resistance at the trendling back to the 2022 highs of : this is likely a consolidation of the 3% move last Friday before a renewed upthrust to break $1700 althugh a pullback to the 21EMA at 1652 wouldn't invalidate the breakout. Gold has very much mirrored the dollar moves : the DXY is at a key support trendline after pulling back sharply, a renewed upthrust in DXY will likely challene gold's rally although a decoupling would prove very bullish gold . I am long from the breakoout last Thursday so my bias may be skewed but I remain mindful of the broader trend and I am always happy to change my mind and book profits.

DXY Chart

Dollar indext is back at the support trendling to the start of this major move: if this fails it is likley to be a very decisive moment for gold and risk assets though the macro favours it holding and the greenabck to move

back north

Brent Oil Chart

encountering overhead resistance around $97,which is proving a stubborn level : may pullback and consolidate around the 21EMA at $94.6: Oil is below its 200MA around $103 so may be prone to sharp downside moves

Copper Chart

Consolidating last week's breakout though a pullabck to the 21EMA may be on the cards

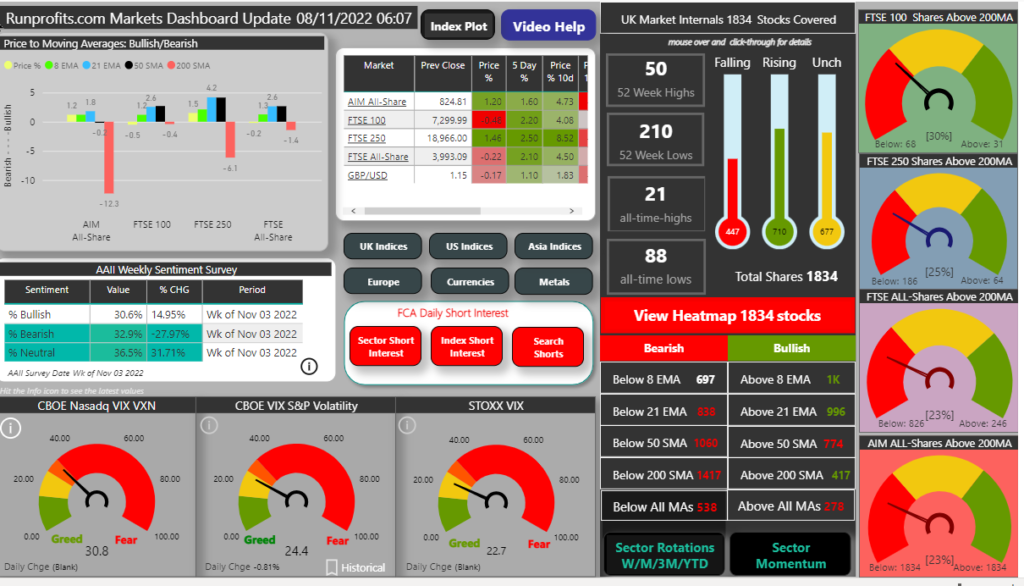

Market Dashboard and Sentiment

VIX at 24 remains supportive of risk-on as the S&P 500 cleared the 50 day movign average yesterday