Pre Market Sentiment and Charts Influencing UK Markets 06:35 (3 mins read)

FTSE futures -40 on cash close from a red US close .UK markets spent yesterday consolidating – the FTSE100 still below its 200MA following Monday’s test and rejection: it does maintain a bullish bias for now although RSI is declining

The FTSE250 checked back on the 100MA and held down 0.32%

AIM All Share dipped 0.6% to the recently crossed 50MA, the level held for now. This may be a bullish sing although it needs 3 or more closes above a major MA to signify trend may be changing

Brent crude continued to slump and has moved back to the 91 level: it is showing some signs of potentially moving south form here with a RPVOLb on the daily: I favour a check of the 50MA at $91.8 for more clarity on direction

Gold has stayed firm despite moving $100 in 4 trading days: it looks to be consolidating ready to move further north

US markets blew off some of the recent steam with a drop of 2% in the S&P, 2.4% IN the NAZ. The DOW which had just spent 2 days north of the 200MA dropped 2% losing the bid level but pausing at the 8EMA which may be telling

The failure of the crypto ETX exchange may be unsettling given potential contagion: bitcoins drop of 16% was mirrored by a similar drop in MicroStrategy which holds 130,000 BTC on its balance sheet in a much-publicised Saylor leveraged long

The big number today is US inflation at 13:30 – that’s likely to have an impact on direction. The DXY has rallied back above the '22 trendline after a brief slip below.A hot CPI will boost this north and inversely affect equities and risk. We tread nimble into binary risk events

Market Dashboard and Sentiment

VIX picked up just 2% to clear 26 and remains supportive of risk-on for now

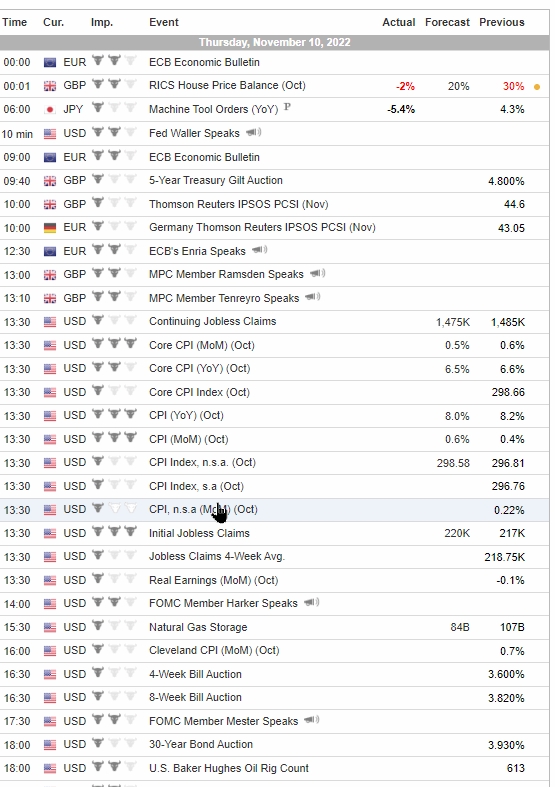

Econ Calendar

Today's economic calendar US inflation at 13:3

0