Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

Intraday Weak Recovery in Large and Mid Caps as Small Caps Suffer 14:35

The 6900 in the FTSE did hold as of 14:30 with the index back around the 7000 level with the US opening up 1% in the green. FTSE 250 has retraced some of its daily losses but remains down around 1% while AIM is suffering the most down -2.5%. This echoes the fallout in the US small caps last night.

All of the indices look weak and the rally at best nascent and at worst temporary before a resumption of selling

Gold is pulling back and remains around the $1630 level despite what looked like an imminent attempt at $1700 just days ago when it was closer to $1690

Of the 1644 stocks covered only 164 are in the green with 1069 fallers

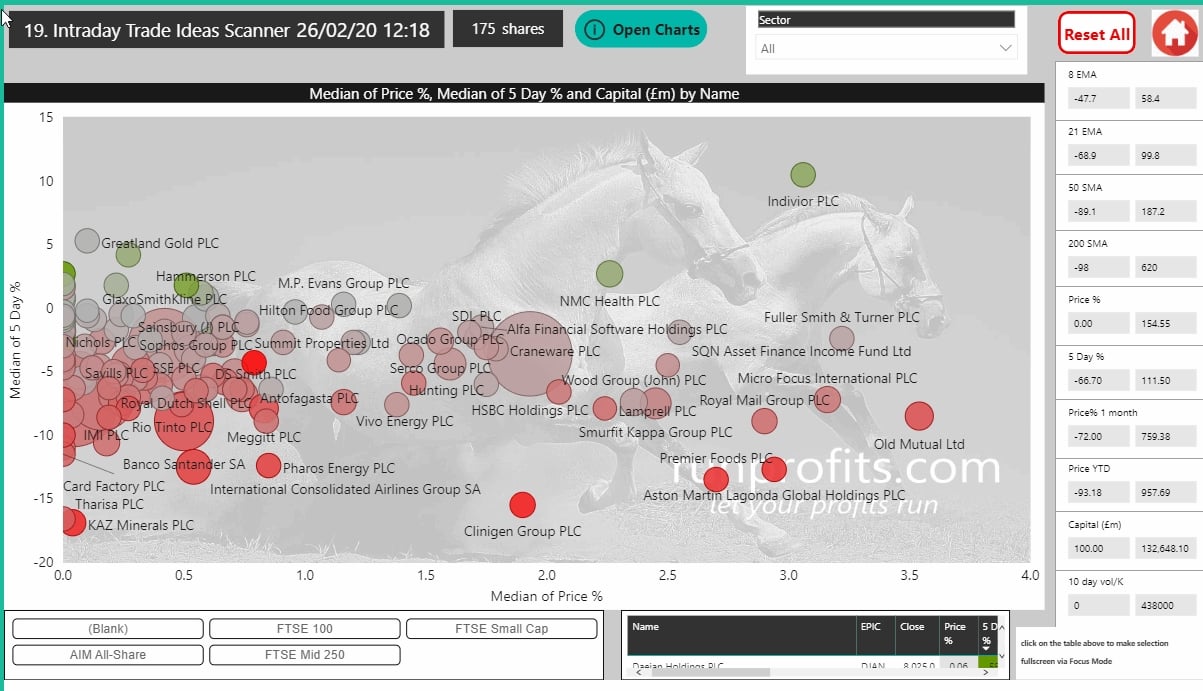

Of the 175 stocks above £100m which are unch or in the green today WEIR is leading the charge up 7% while many of the Banks and Pharms are spending a day in the green.

The plot below shows 172 of those excluding WIER and DJE outliers

WG continues to attempt a staged comeback despite its dependence on the moribund oil and gas sector

Other mega caps in the green include RDSB , GSK, RIO

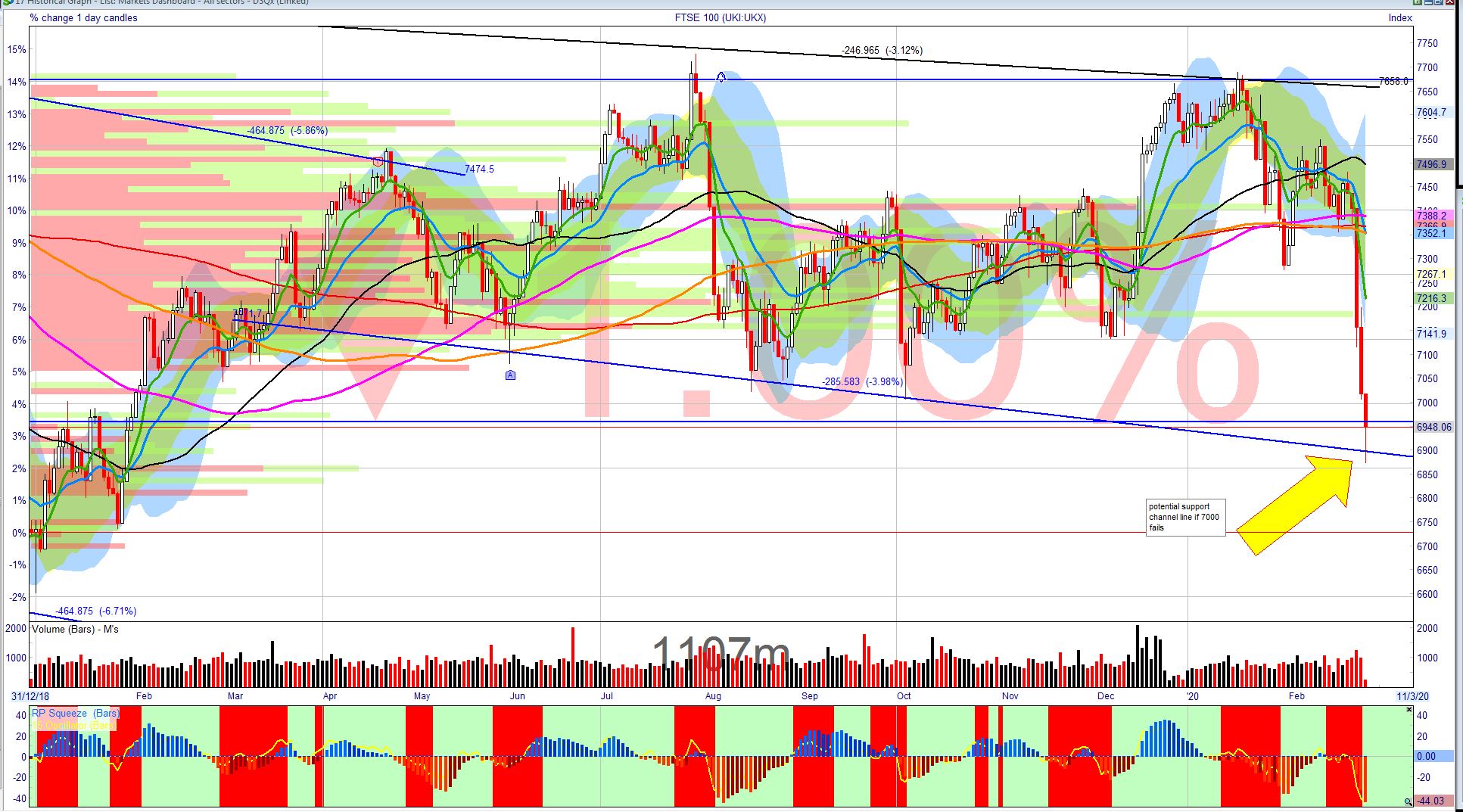

FTSE 100 Potential Bounce at 6900?

Yesterday's post on the FTSE 100 suggested a bounce either around the big round 7000 or the lower channel line around 6900. Yesterday evening the FTSE futures resoundingly tore through 7000 as the US continued to sell. The next logical point for support came at the longer-term channel line around 6900 (see Figure below) . Channel lines are not some weird voodoo postulates: rather they link areas of previous demand and supply where price found support or resistance. Effectively these are inflection points with some history of having relevance in terms of price action. Like everything in trading, and most things in life, it's good to see some proof that a channel line is holding before making a commitment.

This morning saw the UK market continue the selling theme with the FTSE 100 down over 1.5% before reaching an inflection point just below the channel line and then rallying. This does provide a good mark in the sand for support and may well translate into a relief rally today especially if the US participates. Worth noting that the FTSE 250 was down almost 2% this am but has yet to test its 200DMA. Given the overall trend remains downward, it seems more likely this will also be tested.