Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

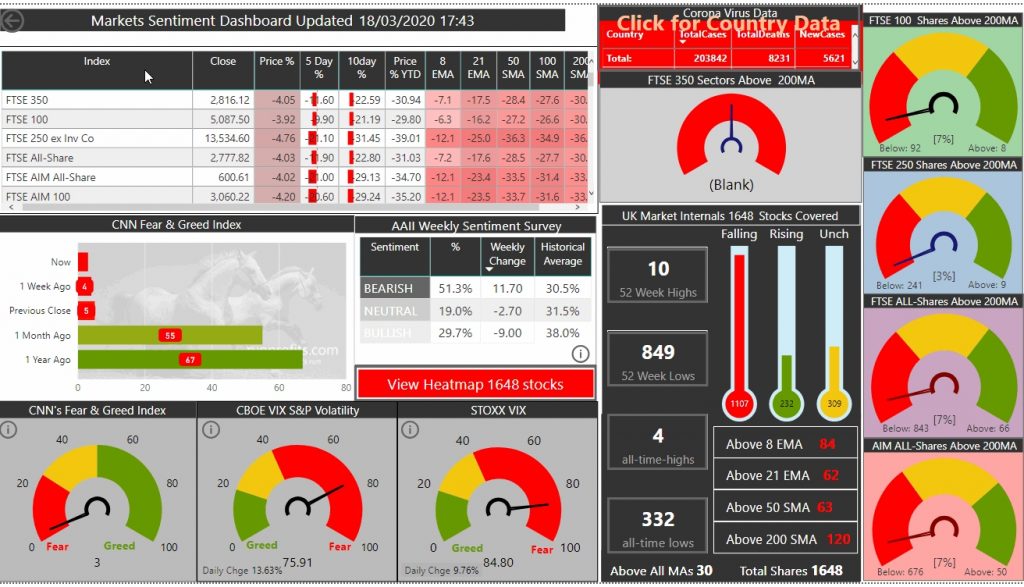

GBP at 35 Year Low to USD: Oil at $27. Gold Sells Off

Selling returned in force yet again today and seemed even more indiscriminate as gold, oil, GBP, EUR, and European bonds all joined the selling rout. US dollar gained strength as the safety play of choice

Brent crude fell by over 10% to a low of $26 per barrel taking BP and RDSB down by similar amounts.

GBP has fallen to levels not seen since 1985 losing almost 5% today in a dramatic move south. This adds to the general disquiet about market stability and extreme dislocations.

All of this makes trading and investing very challenging: the bright spots in supermarkets today did provide tactical long opportunities that have been well signalled over the past couple of days.

While shorting many stocks using spreadbetting has proven lucrative, there are rumours the the FCA will temporarily suspend short-selling in line with most European countries . Indeed short covering probably explains the dramatic share price movements today in heavily shorted shares like CINE and MARS which rose 150% and 43% respectively

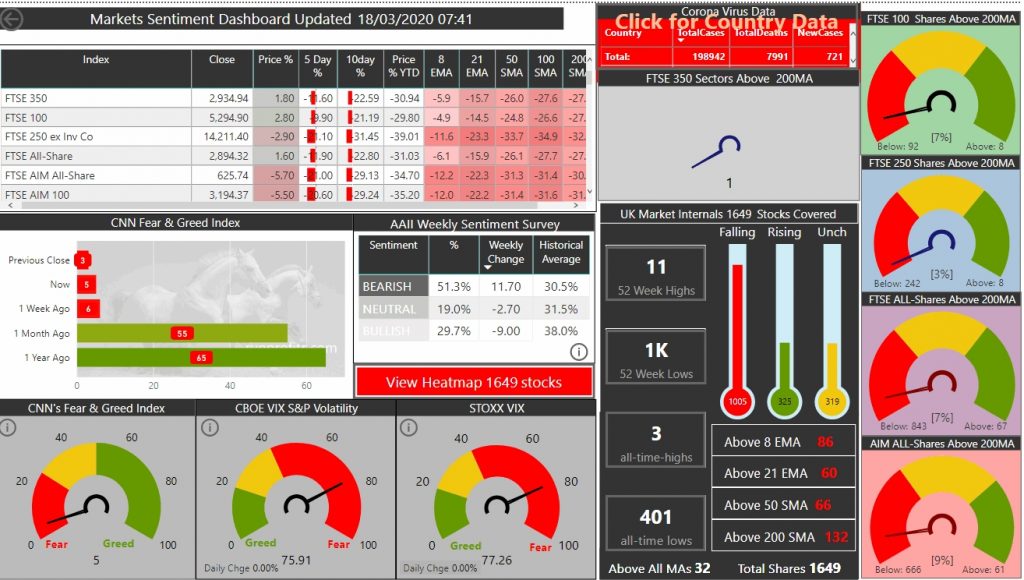

FTSE Futures -3.7% As Rallies Fade: Gold Sells 07:30

As highlighted yesterday, all rallies tend to be short-lived in the current bearish conditions where stimulus packages and interventions are shrugged off by the markets. Only a peak in infection rates or some signs of abatement int he crippling hold that CV-19 has on world economies is likely to cheer markets and allows any sustainable rallies.Gold has given back much 0f its gains and reverted to the $1500 as even this safe haven gives little shelter in current conditions

VIX remains highly elevated at 76 only a slight improvement on yesterday's 78