Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

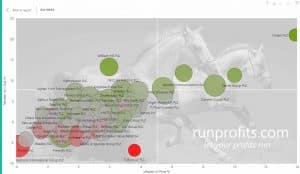

FTSE 250 Outperform Up 0.75%

Has broken--out of a bull flag yesterday and seems set to test and exceed previous all-time-highs set in December 2019.

Leadership from DNLM, SNN, FNN, SP, VMUK and SPI

Do your own analysis using the RP Scanner - in Section 4: Sectors D/W/M/YTD you can analyse each index by sector over the four timescales then drill into each sector and examine all sector constituents over those timeframes: this gives great comparative analysis of the relative strength of the sectors and their individual components over time: much better than any RSI!

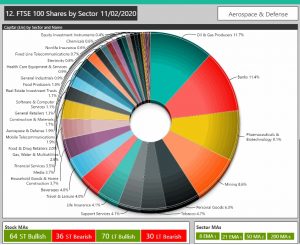

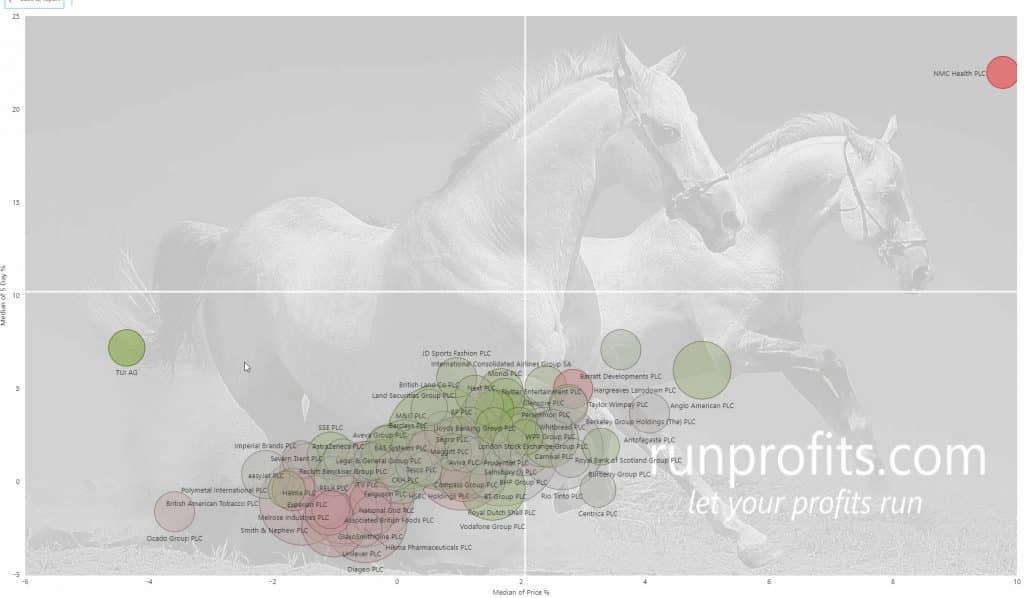

FTSE 100 adds 0.5% and Reasserts Uptrend

FTSE retunrs with bullish form and resumes its uptrend after the end January pullback.

Leadership from NMC with AAL , BDEV , TW., HL, BRBY and RBS all outperforming

Do your own analysis using the RP Scanner - in Section 4: Sectors D/W/M/YTD you can analyse each index by sector over the four timescales then drill into each sector and examine all sector constituents over those timeframes: this gives great comparative analysis of the relative strength of the sectors and their individual components over time: much better than any RSI

ARB Rallies 20% from 6 Feb Highlight as BTC Breaks $10,000

We highlighted the BTC breakout in Market Musing on Thurs 6 Feb 20 as the cryptocurrecny was looking set to break above the $10,000 level (see article). ARB , the UK quoted crypto miner, was highlighted as a potential long given its fundamentals and technical set-up with a forming cup-and-handle reversal pattern . ARB has rallied some 20% since and is at 7.6p at pixel .

RP Scanner's Trade Ideas - IQE Rallies another 14% Intraday

RP Scanner has been highlighting IQE (among other ideas) as a potential short squeeze since end January: IQE has rallied over 10% intraday today and is up almost 20% since RP Scanner first highlighted the opportunity on 31 January at 50.95p.

RP Scanner compares price momentum with open short interest and highlights potential trade ideas when heavily shorted shares start to rally: these can be found in Section 18 - Shorts Trading Ideas of the RP Scanner report and are updated twice daily.

Click on image to the left to expand

Oil Relief: US Flat: Asia in the Green

After an inside day yesterday where oil came off its multi year lows, today sees the black stuff recover and up 1.7% before the UK open. How price will hold-up in the face of US inventories later today will be telling on whether a bottom has been reached for now or if the slide continues. This will help the much beaten-up oil and gas sector in the UK which has also weighed heavily on the FTSE 100 owing to the sizes of RDSB and BP which make up almost 12% of the index by cap (see Figure).