Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

FTSE 100, 250 Make New 2020 Lows: Travel & Leisure and Oil Services Sell-Off

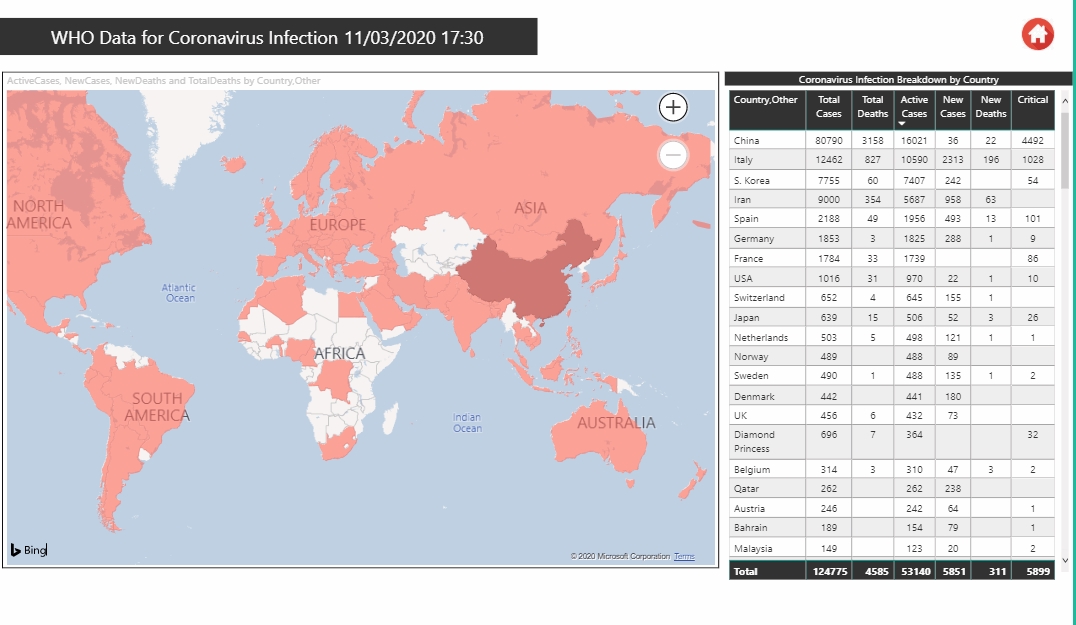

While the 50bps rate cut initially gave some cheer to UK markets this morning, all the UK indices sold-off despite the generous stimulus packages announced by the chancellor and the suspension of business rates. It would appear that the WHO declaration that the COVID-19 now constitutes a pandemic and the alarming increase in new cases and deaths in Italy, Iran,Spain and Germany held more sway. The UK now has 456 cases

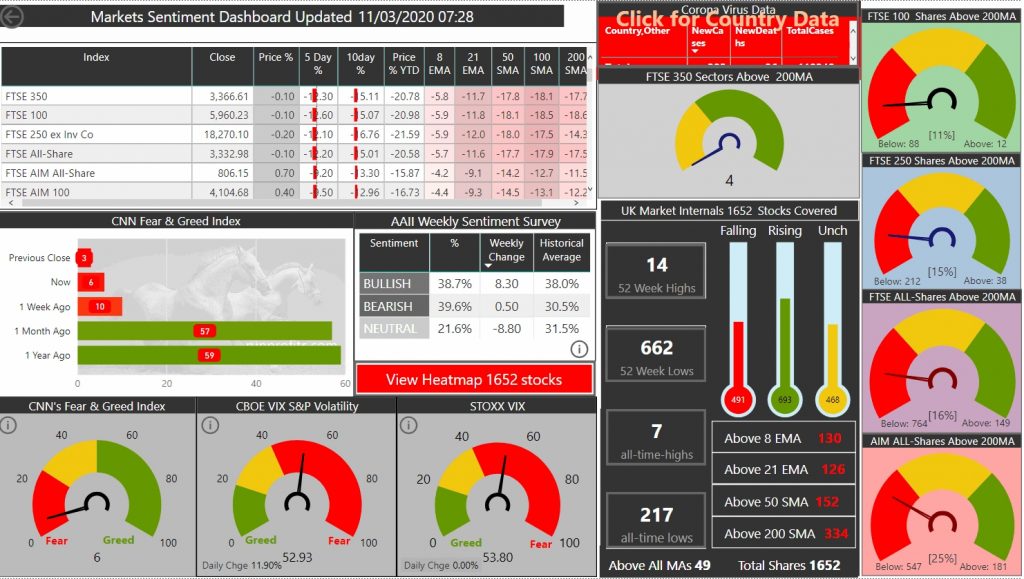

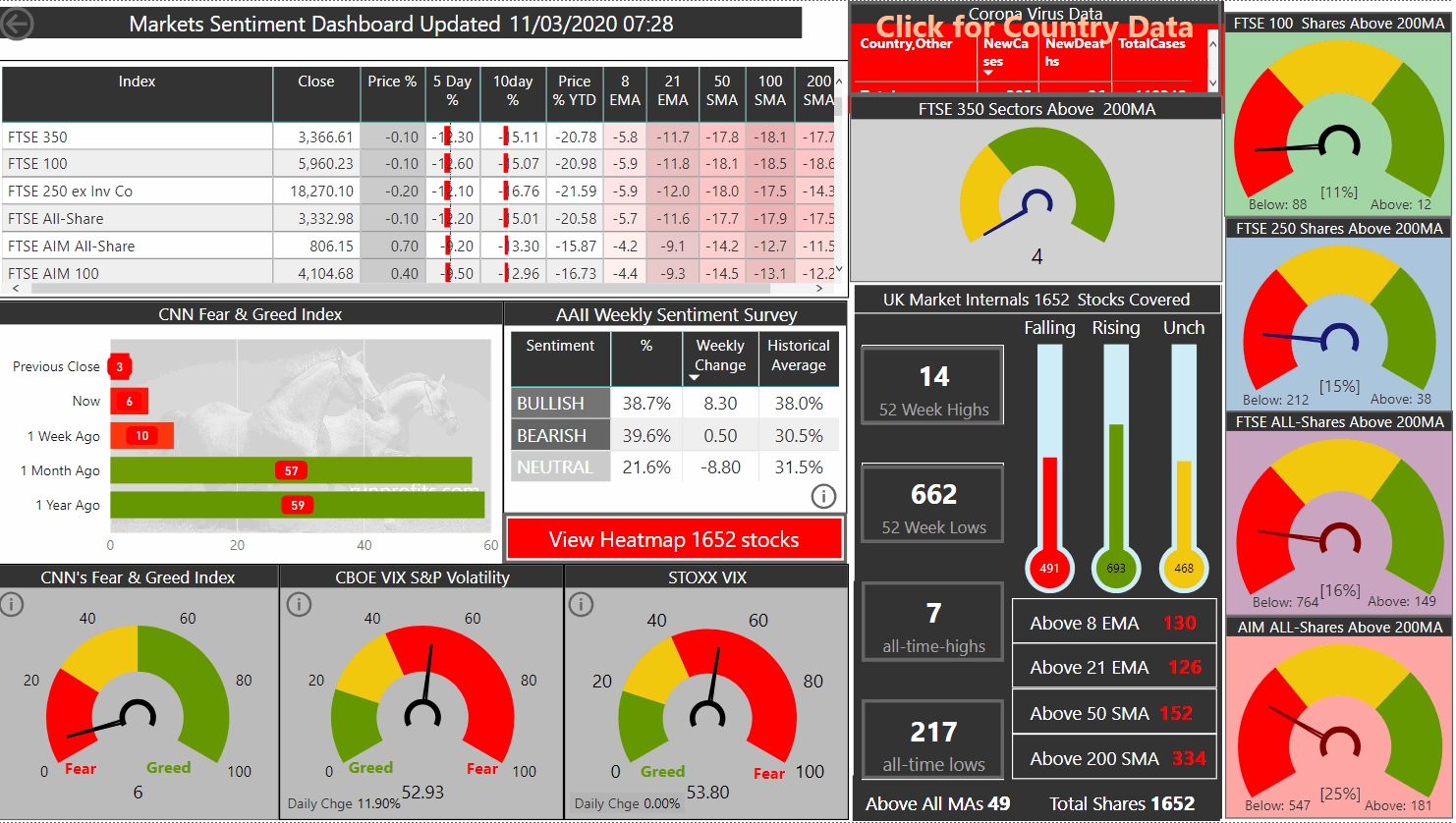

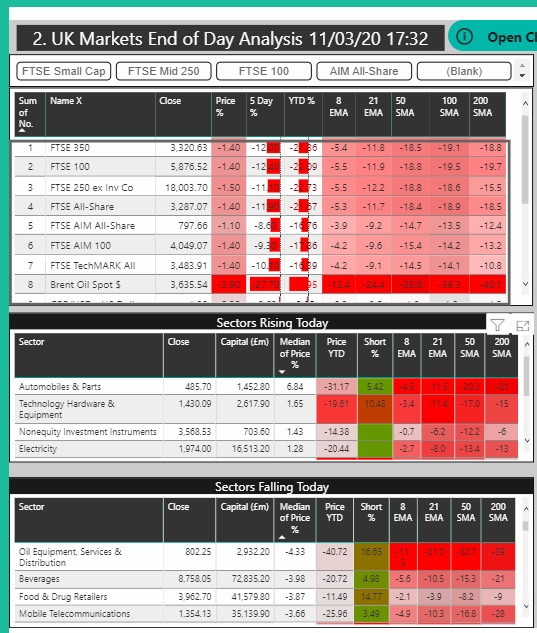

The Fear & Greed Index has now fallen to 3, the most severe reading in many years while the VIX remains elevated around 53. All of the UK indices closed down more than 1% today while Brent Crude slipped back over 4% to $36

Worst performing sectors today were O&G services down almost 5% with Travel and Leisure losing more than 4% while even Food& Drug retail lost over 3%. At pixel the US indices are selling heavily with the Dow Jones down over 5% testing previous lows

A few sectors did end in the green with Auto Parts, Tech Hardware and Non Equity Investments ending in green

Market Sentiment Wed 11 Mar 17:30 EOD

COVID-19 Declared a Pandemic by WHO

BoE Rate Cut , Oil and Gas Continued Weakness 12:00 Update

Market remained fairly muted though positive following the BoE .

Brent crude has about turned intraday and looks set to head lower having briefly visited highs above $39 it is now at $35.8 down over 4% on the day taking the O&G sectors almost 2% in the red and denting the FTSE 100 rally. Travel and Leisure has also continued to sell off after a brief reprieve yesterday which fizzled out.just about in the green

Sectors rising at the half include Life Insurance, Banks and REITs

We wait with anticipation for the budget announcements from 12:30 and the infrastructure stimulus which are expected. There may well be a boost to house-builders if new initiatives on affordable housing are announced.

BoE Rate Cut , Oil and Gas Continued Weakness 12:00 Update

Market remained fairly muted though positive following the BoE .

Brent crude has about turned intraday and looks set to head lower having briefly visited highs above $39 it is now at $35.8 down over 4% on the day taking the O&G sectors almost 2% in the red and denting the FTSE 100 rally. Travel and Leisure has also continued to sell off after a brief reprieve yesterday which fizzled out.just about in the green

Sectors rising at the half include Life Insurance, Banks and REITs

We wait with anticipation for the budget announcements from 12:30 and the infrastructure stimulus which are expected. There may well be a boost to house-builders if new initiatives on affordable housing are announced.

BoE Rate Cut 50bps VIX at 53: Update 07:30

The Bank of England's decision to drop interest rates from 0.75% to 0.25% did boost FTSE futures around 50 points which are currently hovering around the 6000 level signalling a positive start to the open. Given the reaction is relatively muted, it is likely that this was expected and so was already in the price as the FTSE was at 6200 yesterday. The UK budget announcements later will no doubt contain details of measure to support the economy during the ongoing epidemic. This will likely make for a choppy day with potential boost to infrastructure and homebuilder stocks depending on the stimulus packages announced.

The US closes strongly yesterday adding almost 5% to all of the main indices . These sold-off after hours as Asian markets continued to fall, currently the US futures have the Dow Jones down over 700 points and back below the 25,000 mark

The VIX remains stubbornly high at almost 54 suggesting that those seeking protection have continued to expect volatility and further price falls. Gold has rallied overnight up $14 to $1663 while crude oil has held above $37.

It would seem that we have not yet reached the bottom or at least that more upside is not expected until some clarity on the nature and extent of the CV impact is known or the stimulus packages being offered in the US and Europe offset the greater unknowns of the economic impact of CV.