Pre Market 07:15 Update: Modena Vaccine Boots "Reopening" Trade

At pixel the FTSE futures signal a softer opening lower by around 25 points at 6400: overnight saw the VIX fall to 22 while the Fear and Greed Index rose to greed at 71. US closed strongly higher on vaccine news though Asia faltered slightly as all indices are stretched by newsflow. Gold remains range bound with the potential for weakness while Brent held around $44

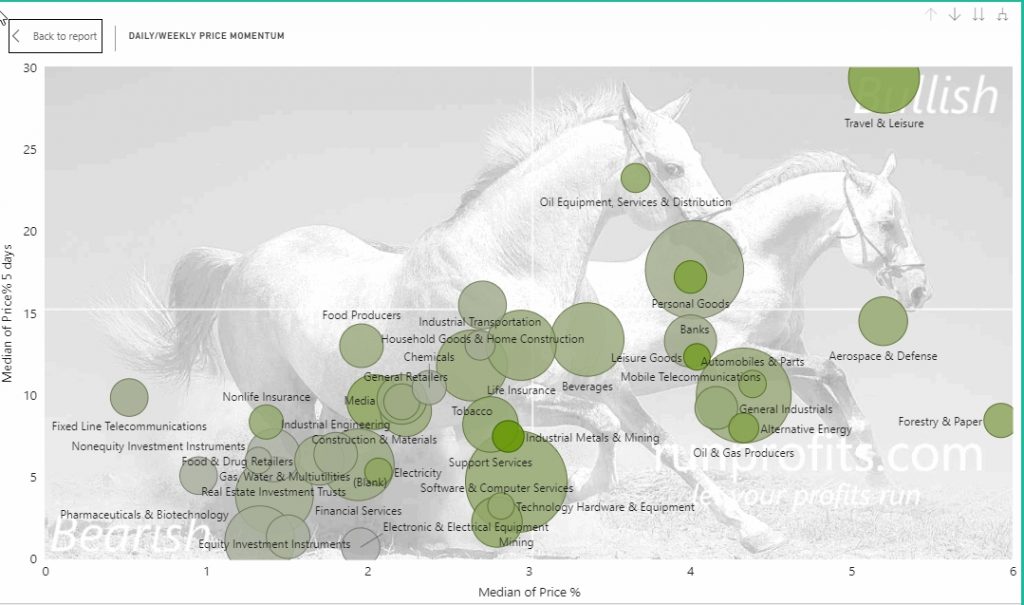

FTSE closed up 1.7% and close to it post Covid crash high of 6550 spurred by more positive news on another source of an effective CV19 vaccine this time from Modena. This uses a similar mechanism to the vaccine announced by Pfizer last week and adds to the chances that more variants of vaccine will be discovered and rolled-out in the near future. This stimulates the “reopening trade” where Travel, Leisure, Retail and Transportation all benefit as global economies start to normalise from the Lockdown hibernations: this has a knock-on effect on basic materials and energy. In the mega caps, the index was lifted in the main by titans VOD, RDSB, BP all with market caps over £30bn and all rallying by more than 6%. Travel and Leisure names WTB, IAG were up almost 10% while

The FTSE 250 was boosted even more given the number of names in this domestic index that are UK centric; the mid cap index broke 20,000 for the first time since 6th March 2020 and has now reversed the majority of the losses caused by the Covid crash. At its nadir, the FTSE 250 had fallen from a high of 24000 in January to a low of 12,600 on 19 March ; a decrease of 47.5%. It has recovered 30% of the loss to sit just 17% short of the early 2020 highs. CINE, CCR, JUST and RNK did most of the lifting all up 10% plus on the day

The AIM All-Share similarly took cheer today rallying 0.75% and finally breaking resistance at the 100 level with JET2 and FEVR doing much of the work while T&L outperformed. While the price of the AIM continues to increase, the RSI is showing divergence and not confirming the move north. This may be indicating that momentum is slowing and a pullback is due: given the relentless rise this would be a healthy phenomenon as part of normal market behaviour

UK Sectors Advancing

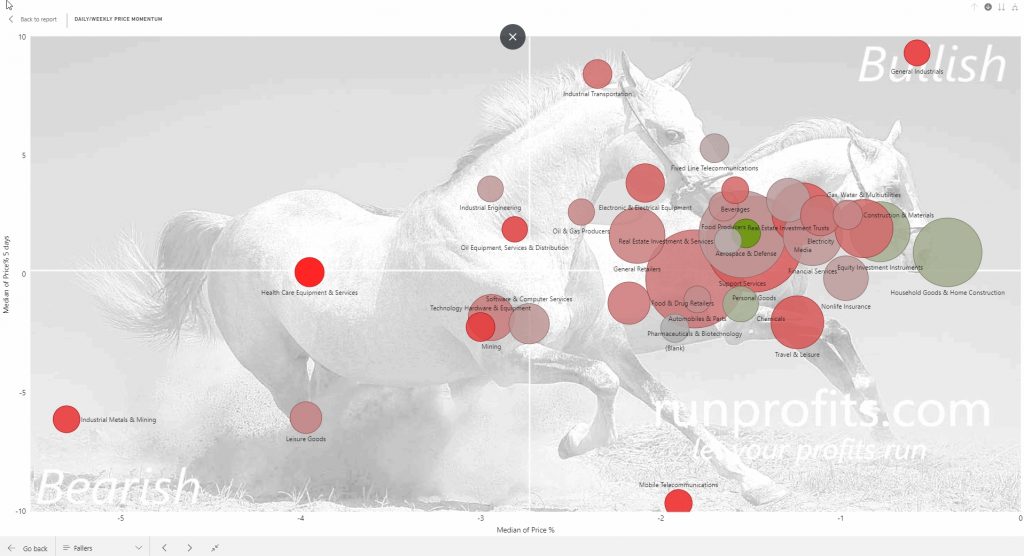

UK Sectors Declining

Pre Market 07:15 In Charts

As all the UK indices extended gains yet again, there are some signs of potential resistance and profit taking. The FTSE 100 is closing on the previous post CV19 high which may stimulate selling

The FTSE 250 is showing some signs of resistance to the previous strong support level in the index around 20100-20200 while the Aim ALl-Share is showing significant divergent RIS which may signal slowing momentum. Healthy markets require regular pullbacks and periods of consolidation to digest moves and internalise.

FTSE 100

FTSE 250

29 UK Companies Reporting