At the Half: T&L Still Rising while the Covid Trade Unravels

Huge outperformance in names like ARE, CINE and CPC all up 20-30% while Gen Retailers FCCn, CARD and SRY are playing catch-up

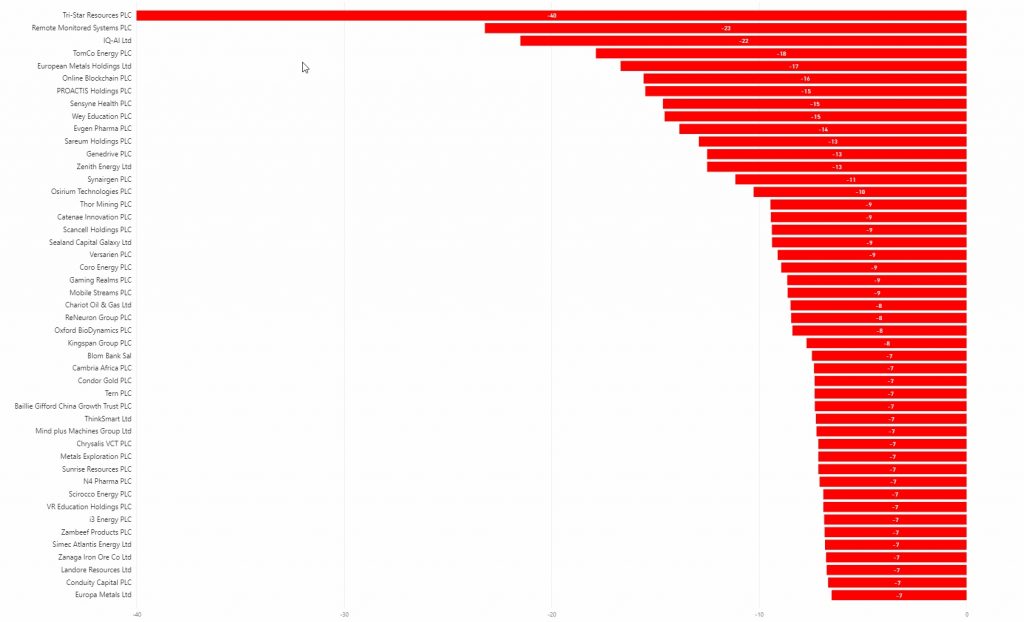

On the losing side of the rally: many of the Covid picks continue to fall as RMS, IQAI, AVCT and many of the other high fliers in the Pharm and Support Sectors continue to sell-off: RMS with more RNS on director dealings and warrants exercised to increase total shares issued

Gaming Realms also gave back 9% while many of the junior gold miners have slipped on yesterday's gold weakness and change in sentiment

Splats at the Half: Click to Enlarge

AM Update: Positive Momentum Follow-through

The mid and mega caps continued their positive momentum with the FTSE 100 and 250 up around 0.6% this am while AIM continued to show relative weakness.

IMM, NTOG, OMI, AMGO, PPIX, OXIG and 88E are all up double digits on market updates via RNS

Roll Royce continues to rally up another 14.5%: the current FCA short interest is still shown as 5.6% (as of EOD yesterday) but it is likely this is decreasing as shorters cover: this will be notified to the market in the coming days

Oil and Gas is outperforming this am with significant moves in big oilers such as RDSB and BP while PFC has broken out , TLW and PMO have large short interest components and may also join this rally as laggards

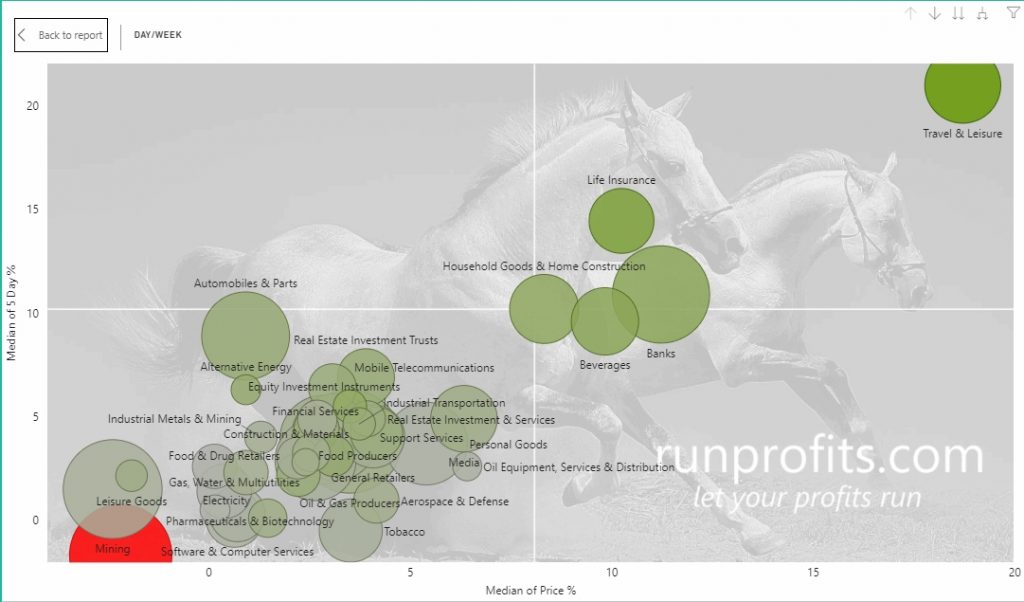

The below plots summarise the moves yesterday across all UK indices: there is some catch-up occurring in many of these sectors this am but equally a lot of paring of profits and some rejections of first tests to 200MA levels (FGP, LLOY, GRG,)

Travel and Leisure led the charge followed by Banks, Beverages (DGE presumably boosted by outlook for the pub trade), Household Construction, Life Insurance

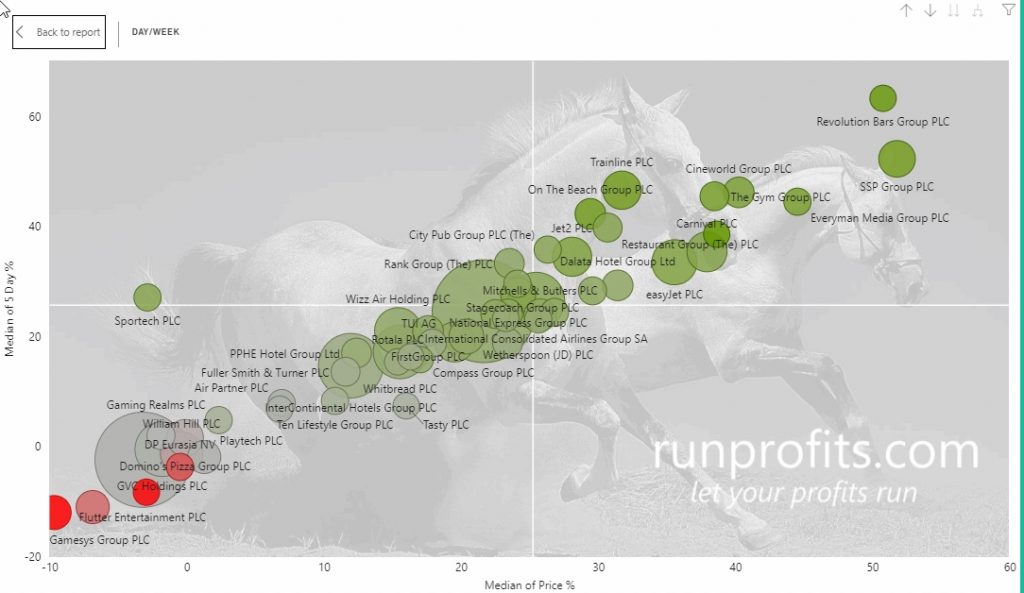

Drilling into the T&L sector there’s a clear separation between the out-of-home and stay-at-home sides of the sector with a good distribution along the axis. Bearing in mind the market was up around 5% on average across the mid and mega caps, the vast majority of the sector outperformed the market. So CINE, GYM, TRN all gained 30-60% while gambling, gaming and home delivery sold-off.

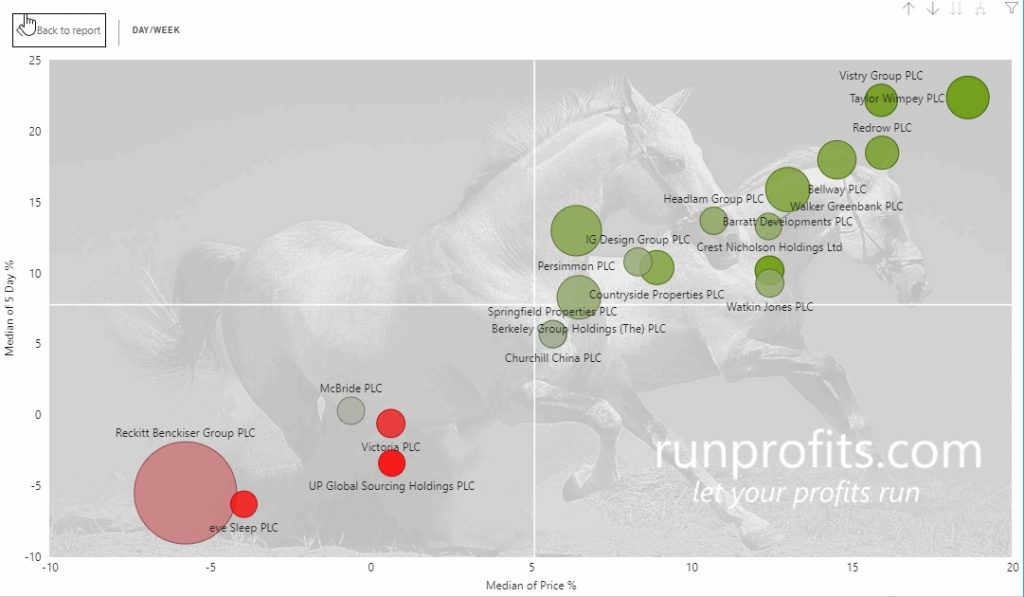

Household & Construction outperformed with the likes of TW gaining almost 20% (reporting results yesterday). RDW, BWY and BDEV also gained double digits

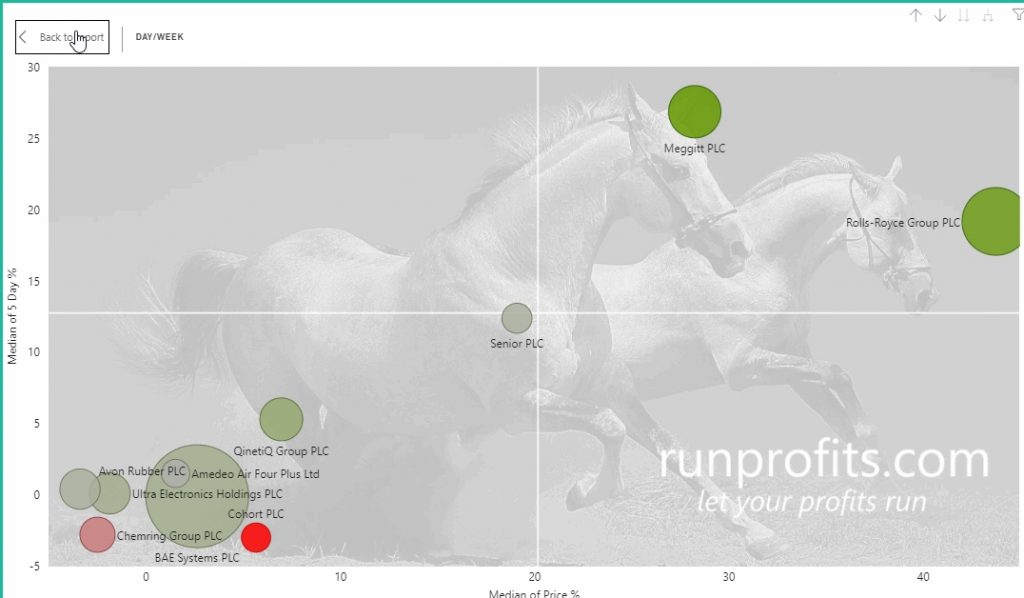

The A&D sector was propelled higher by RR and MGGT

(you can do similar sector plots yourself by using the RP Scanner report in RP and choosing Page 4 : Sectors D/W/M/YTD use the drill=down arrows in the upper right corners of the plots to view sector shares0

Travel and Leisure

Household and Home Construction

Aerospace and Defense

Pre Market 07:15 Update: Relief, Short Squeezes and FOMO

- as highlighted in yesterday's pre market update, the FTSE 100 and 250 did breakout with the Pfizer vaccine news being the major catalyst and news the market was surprised by. I highlighted yesterday how many of the big winners on the day had significant short interest so it is highly likely we will see some paring of those gains in the coming days

- The domestically focused FTSE 250 rose over 6% with the 100 up 4.7% while AIM All Share lagged at 0.2% with an intraday price inversion and suggesting a reversal: this is consistent with an rotation form the Covid trade (which has propelled the AIM to out performance since March) to a "new normal" trade with the mid and large caps starting to benefit.

- The ensuing price action over the next few days will be telling in supporting the growth to value rotation

- Oil popped 8% yesterday while gold dropped almost 5% but has recovered some ground overnight

- In the US, the S&P gave back much of its early gains while the NASDAQ fell 2.2% as some of the Covid "stay at home" winners pared gains while the Dow Jones gained almost 3% to new record highs

Futures signal some give-back with the FTSE 100 set to open down around 80 points at 6140 at pixel

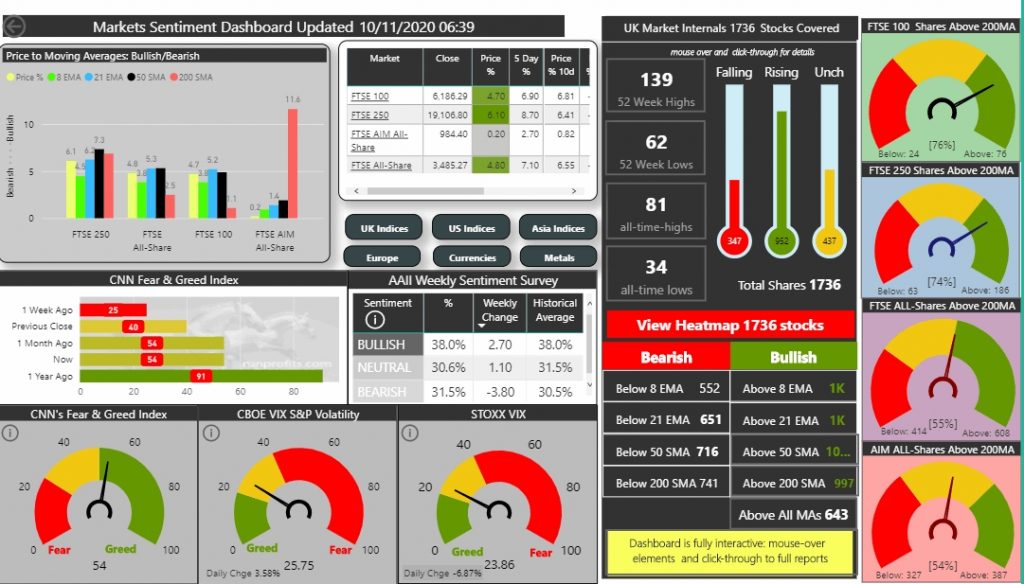

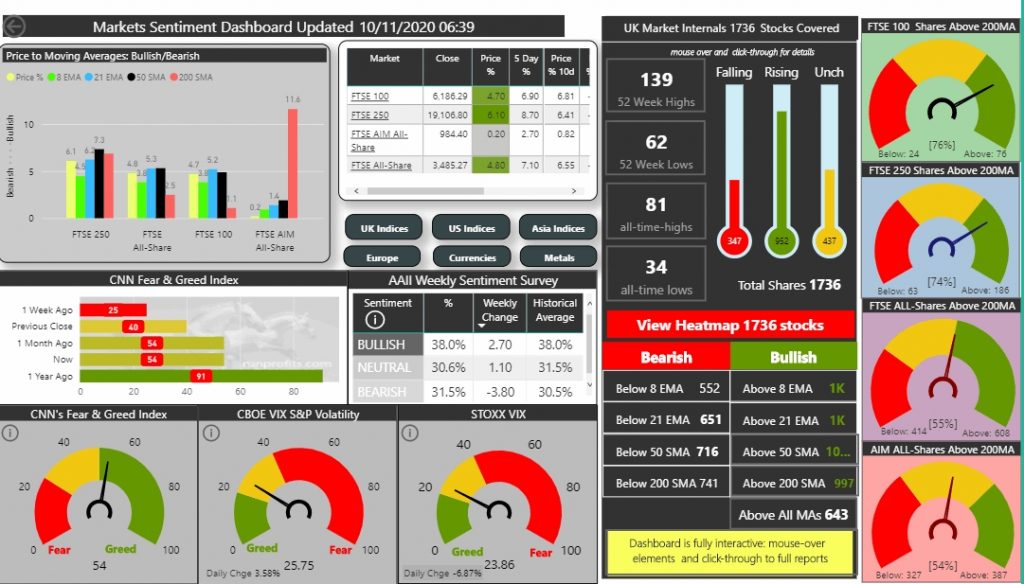

VIX remains close to 26 while the Fear and Greed index has relaxed to 54 showing improved sentiment from the 40 level yesterday

Companies Reporting Tues 10 Nov 20: 24 companies reported

24 Companies reported by 07:15 below

Pre Market 07:15 Update: Relief, Short Squeezes and FOMO

- as highlighted in yesterday's pre market update, the FTSE 100 and 250 did breakout with the Pfizer vaccine news being the major catalyst and news the market was surprised by. I highlighted yesterday how many of the big winners on the day had significant short interest so it is highly likely we will see some paring of those gains in the coming days

- The domestically focused FTSE 250 rose over 6% with the 100 up 4.7% while AIM All Share lagged at 0.2% with an intraday price inversion and suggesting a reversal: this is consistent with an rotation form the Covid trade (which has propelled the AIM to out performance since March) to a "new normal" trade with the mid and large caps starting to benefit.

- The ensuing price action over the next few days will be telling in supporting the growth to value rotation

- Oil popped 8% yesterday while gold dropped almost 5% but has recovered some ground overnight

- In the US, the S&P gave back much of its early gains while the NASDAQ fell 2.2% as some of the Covid "stay at home" winners pared gains while the Dow Jones gained almost 3% to new record highs

Futures signal some give-back with the FTSE 100 set to open down around 80 points at 6140 at pixel

VIX remains close to 26 while the Fear and Greed index has relaxed to 54 showing improved sentiment from the 40 level yesterday

Companies Reporting Tues 10 Nov 20: 24 companies reported

24 Companies reported by 07:15 below