Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

Brief Relief as Rally fades : UK Indices End in the Red as Sentiment Remains Fearful

The morning's enthusiasm turned into more selling in the afternoon as holders took the opportunity to sell out of positions at better prices than have been on offer over the past few days. This does reflect current fearful sentiment. It is probably too early to label this as bear market "sell the rips" (the opposite to the bull market "buy the dips"): where rallies get sold as the prevailing trend is downward. That said, it is certainly not indicative of a V shaped recovery. It is more likely we will see more choppy markets over the coming days if not weeks as the recent huge moves are digested and market participants look for more surety in either direction . Government interventions with fiscal and relief packages may help boost confidence: conversely, more draconian restrictions on mobility and economic activity may further dent confidence on outlooks and likely duration and impact of the coronavirus epidemic. Tomorrow will see the UK's chancellor, Rishi Sunak, announce the budget which must surely allow for the impacts of coronavirus while Thursday will see the ECB's Laguarde announce the next policy decisions and mitigations for the virus

In terms of sector moves today ,

on the rise were Equity investment and Alternative Energy sectors outperformed with Oil and Gas also staging a rebound as Brent crude rallied a further 2% to over $37:

falling were Tobacco, Utilities and Electricity

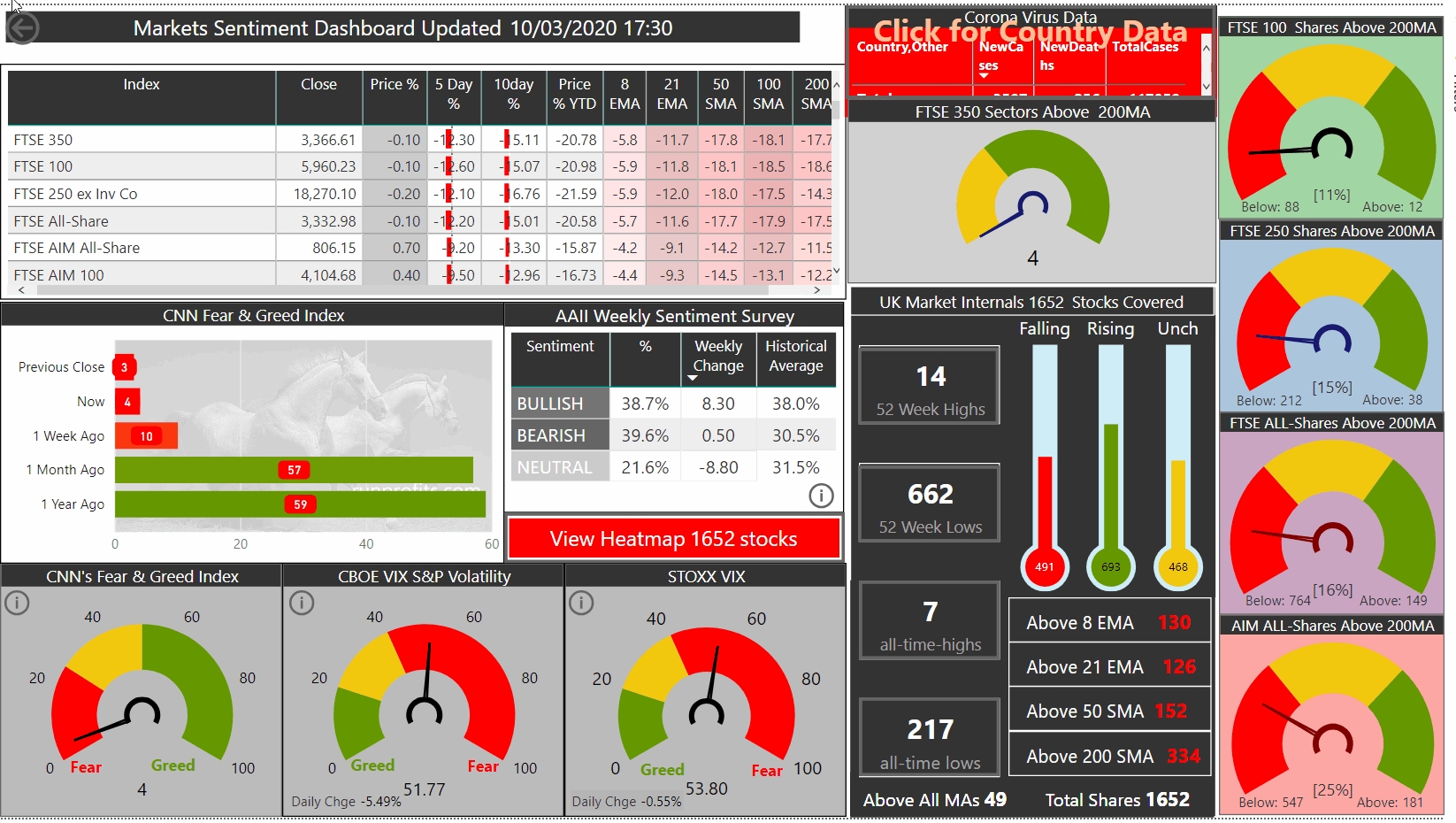

Comparing the changes in the sentiment dashboard from 11:30 this am to 17:30 after the close below highlights how the markets withered with the FTSE 100 failing to hang onto the 6000 level having exceed 6200 intraday. One third of the stock rallying turned red in the afternoon .

Elevated volatility looks set to continue for the foreseeable.

Market Sentiment Mon 10 Mar @ 17.30

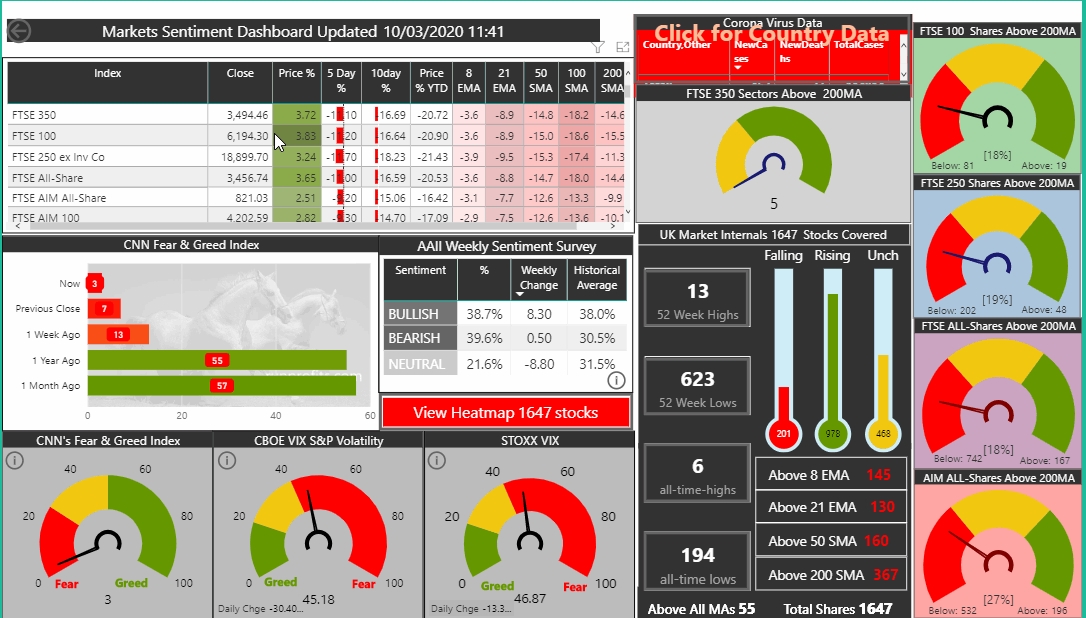

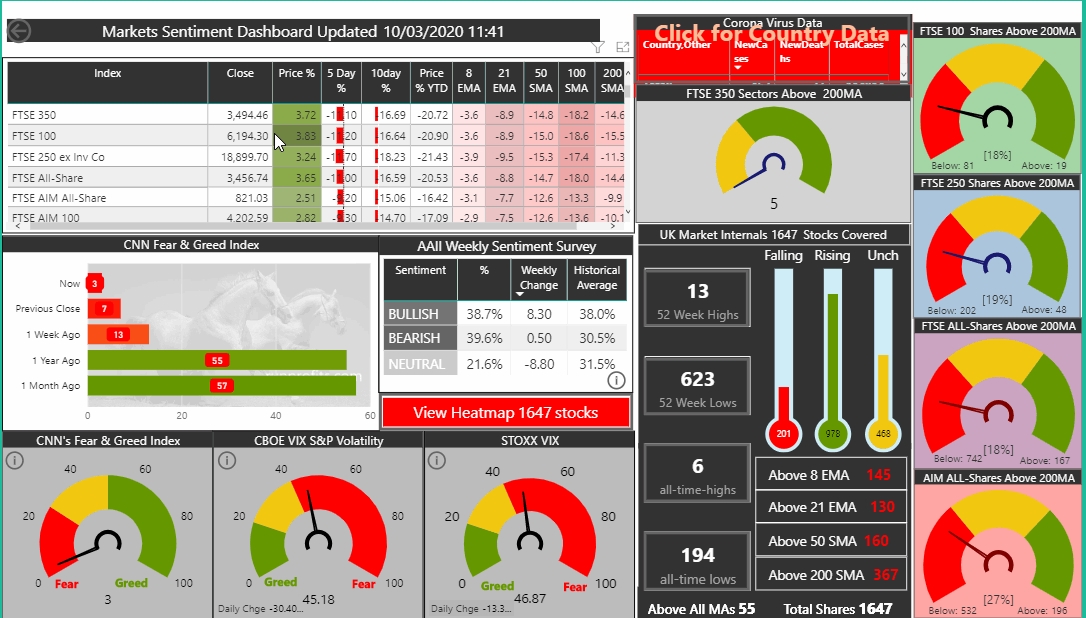

Market Sentiment Mon 10 Mar @ 11.30

Relief rally Led by Big Oil, Travel & Leisure as Crude Recovers Ground

The US indices staged a relief rally from deeply oversold yesterday as the FTSE 100 , 250 and AIM All-Share added in excess of 3% in morning trading. TUI led the recovery up over 11%

Crude oil recovered from yesterday's lows around $31.4 to over $37 an increase of almost 18%: this saw RDSB up over 10% and BP add over 8% while EZJ added 8%

Sentiment recovered slightly with the VIX dropping from over 51 to 45

As of mid morning, 978 stock were rising with 201 falling and 458 unch

Some Relief from Selling Oil+5%, FTSE Futures + 2%: US Avoids the Bear 07:30 update

Today should see some relief from the selling as futures signal a relief rally though only by about 2%. All UK indices are oversold by any measure and a bounce in oil prices off a floor around $31.5 to over $36 will help lift some of the beaten down oilers. We should see FTSE 100 north of 6000 today but what will be crucial is how well the 6000 level is held and whether there are any signs of at least a temporary bottom. With the US muting fiscal stimulus and bail-outs for airlines and the shale oil industry and an upcoming ECB meeting this week: there are potential catalysts to support a recovery rally.

After this violent sell-off, it will be intriguing to see which stocks and sectors emerge form the wreckage and what signals they give on the next stage in the business cycle.

The US session yesterday was eventful with limit-down circuit breakers enforced to halt selling. The US indices did sell-off hard but currently are not in bear territory . S&P is -19% from highs while NASDAQ is -18.6%

Sentiment overnight shows Fear & Greed near the extreme of 3 while the VIX remains north of 50 in a highly elevated fearful state