Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

Daily Roundup 17:30

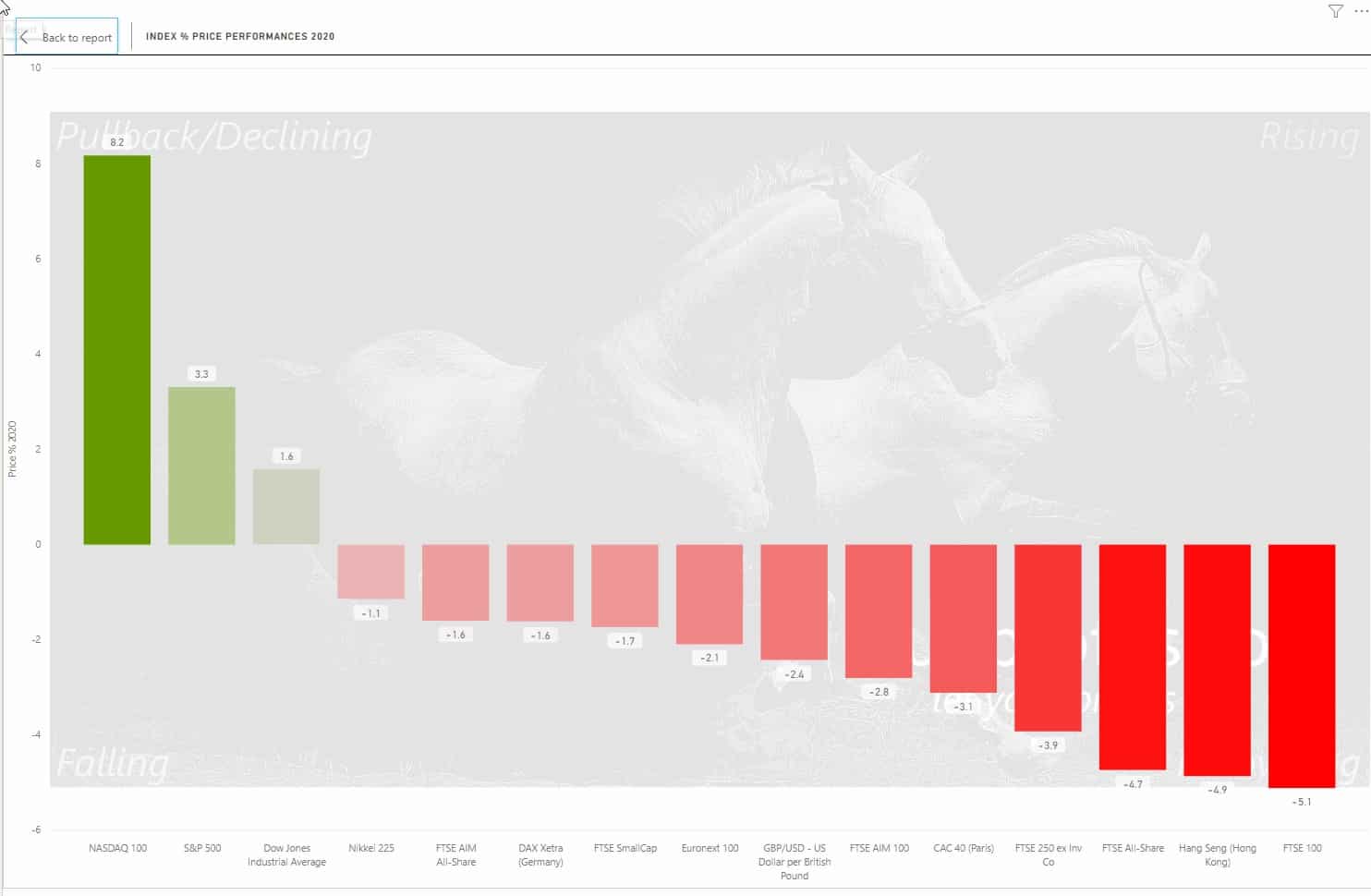

The UK markets closed off session lows but heavily in the red as all the major indices lost more than 3% today in the single biggest one day move since the Brexit referendum result in 2016. Both the CAC and the DAX lost even more while the US was also deep in the red at pixel with the NASDAQ down over 3.6% but off session lows of over 4%.

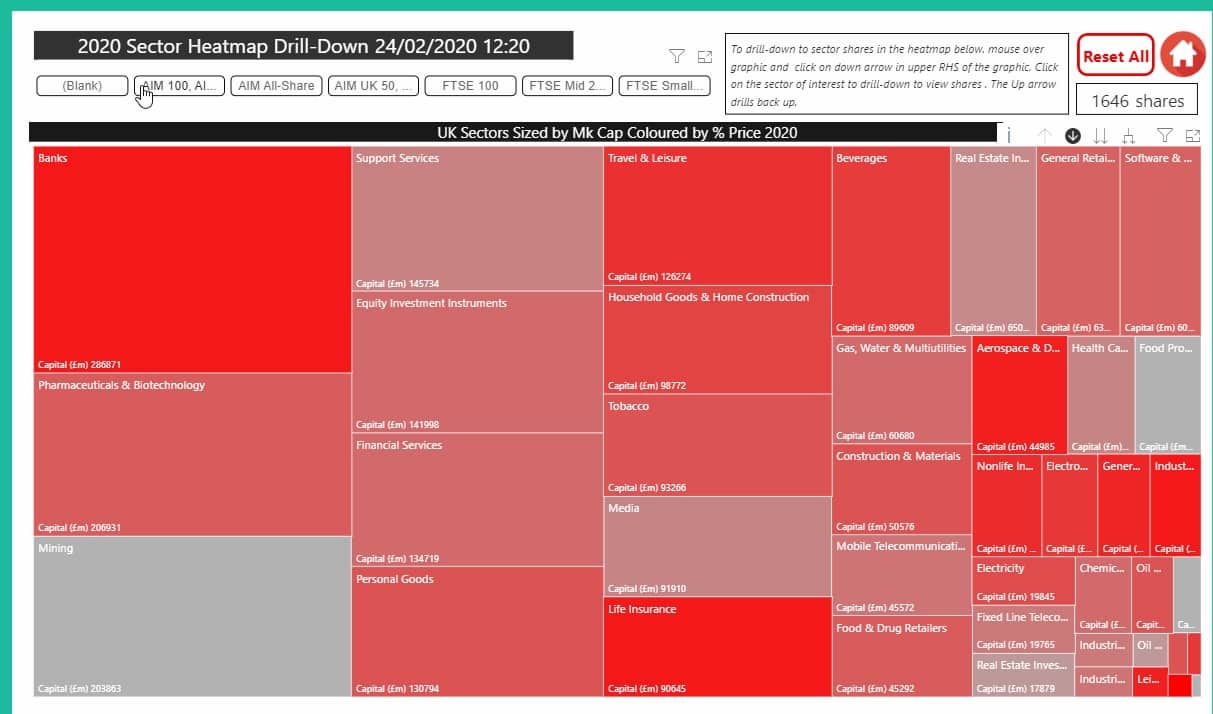

The markets were struggling today to discount the potential economic damage that the coronavirus may enact and given the severity of drops in the T&L and Airlines/Transportation sectors, there appears to be some concern over a potential pandemic. There wer double digit losses in many of the airlines including EZJ and WIZZ while TUI and PPH lost 10% or more.

The heavy weighting of basics resources in the FTSE 100 has meant it has under-performed all major global indices YTD and is currently down over 5% on 2020 returning some of the 12% gains from 2019.

Selling Intensifies as US Opens 14:50 Update

The US markets did little to calm nerves as the US indices opened down 3% or more with the NASDAQ off 3.6%. This further catalyzed selling in the UK with the FTSE 100 down 3.7% at pixel and the 250 and All-Share -3.4%

The heatmap below is now available via the Sentiment Dashboard and allows a quick overview of sectors across all indices: selection of an individual index button shows the sector changes for that index while using the drill-down arrows in the upper right allows investigation of the individual shares in each sector.

UK Indices Take a Pounding Down Over -3%

Market opened sharply down this am as Italian news of the spread of coronavirus amplified worries of a global pandemic of the disease. Stock markets had been complacent of the threats over the past couple of weeks as QE backstopping was seen to be the panacea for risk assets. Gold which had rallied hard over the past few weeks seemed to be telling a different story especially given US dollar strength. Oilers were also given very strong warnings on global economic activity as their share price fell to 52 week and multi-year lows alst week ...Specific coronavirus related warnings were issued by the likes of RDSB on the impact of China's shutdown on LNG availability. If traders had been complacent to date, that changed overnight with 70% increase in VIX to move north of 22 for the first time in months. It is often said that markets rise on stairs but descend on escalators, today was more of a lift shaft descent.

Oil slumps almost 3% as virus spread to Italy shakes confidence in airlines, hotels and basic resources

FTSE 100 -3.2% Biggest Fallers EZJ -15%, TUI -8%,

Many of the largest caps down over 6% including AAL, ANTO, IAG, CCL, BHP, RBS

FTSE 250 -3.1% Biggest Fallers in T&L, |Mining, Construction