January 2020 a Bumpy Ride

The first month of 2020 has been a tumultuous start to the year after the soaring heights of 2019, (see 2019 in review from January). Any big run up like that of Q4 2019 normally requires a pullback to digest the gains and calibrate market sentiment. Indeed, we gave particular mention to this in the article of 8 Jan 20 highlighting the extremes of market sentiment evidenced at the time with a Fear and Greed index north of 90.

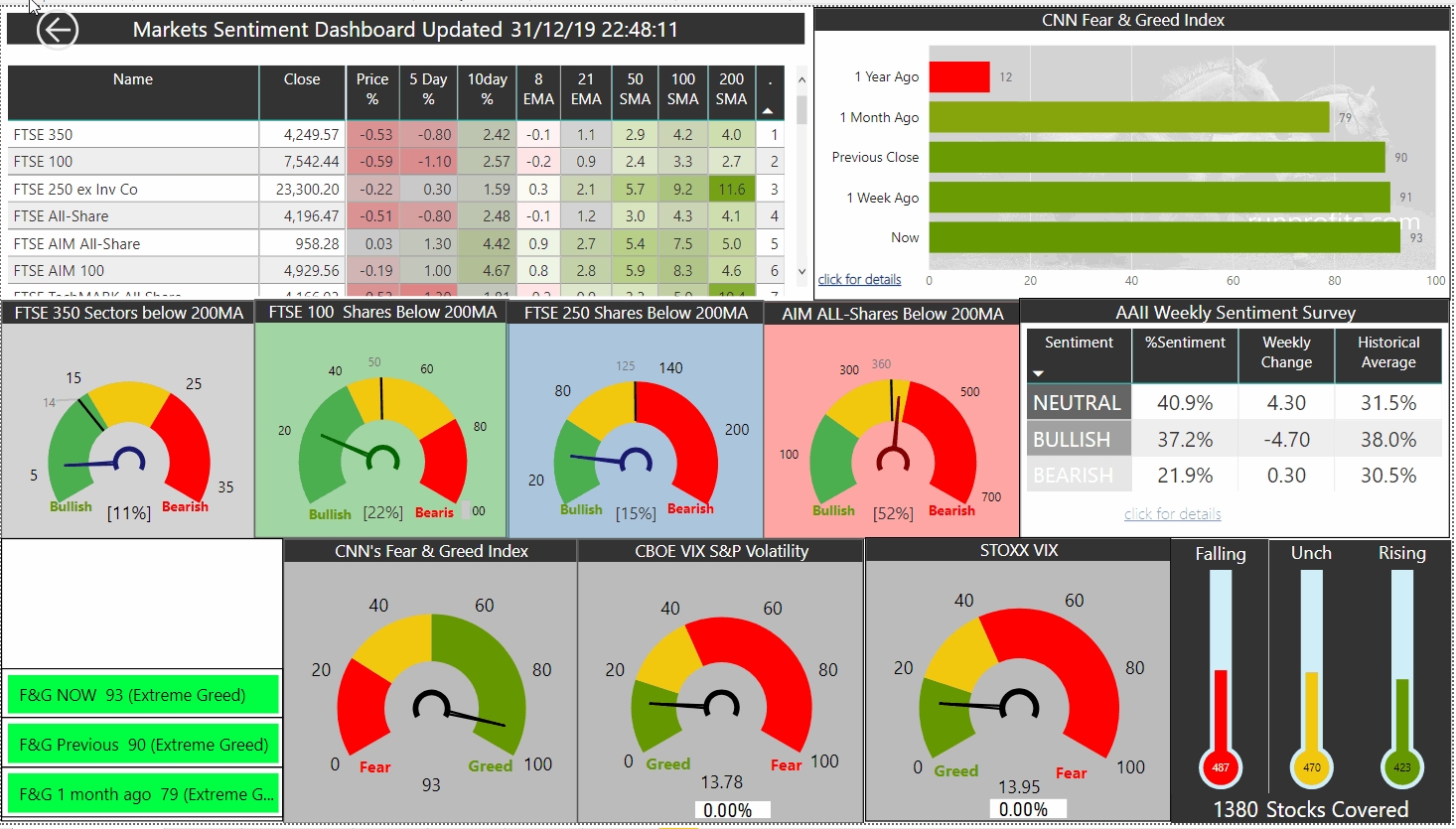

Figure 1 below compares market sentiment from 31 Dec 19 with 31 Jan 20 with the following observations

- Fear and Greed had halved from an extremely greedy 93 to a neutral 47

- AAII sentiment shifted from Neutral/Bullish to Bearish

- In the UK, the FTSE changed from 80% bullish to 60% bullish while the FTSE 250 changed from 85% Bullish to 64% bullish

- Only AIM All-Share improved from 48% bullish in Dec 19 to 49% bullish by end Jan

As a general principle, extremes of either Fear or Greed are never sustainable for prolonged amounts of time since these reflect either demand or supply imbalances that always tend to an equilibrium or mean reversion. Put more simply, the market runs out of buyers or sellers depending on the extreme.

While much of the punditry sets the reasons for the sharp pullback to coronavirus, in truth the market needed a sell-off and an unfortunate pandemic provided the catalyst. This did translate to the FTSE 100 and 250 dropping almost 6% while AIM All-Share lost just 2% as it has lagged the other indices in the 2019 rally.

Commodities Have Been Smashed: Dr Copper's Warning?

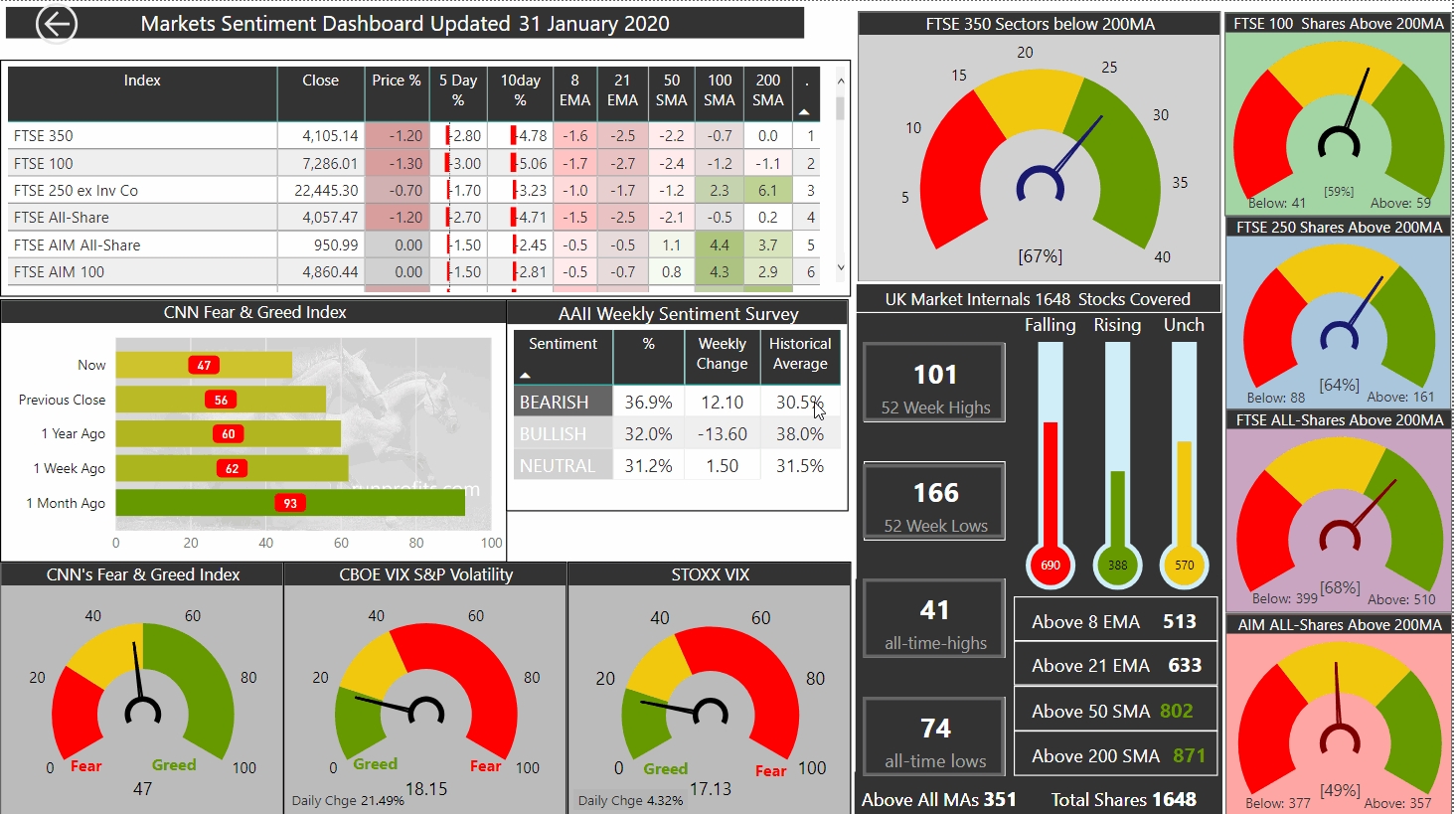

Figure 2 shows indices and commodities in 2020 so far. Oil finished 2019 up 20% around the $67 mark: this has collapsed by almost 17% in one month of 2020 with Brent crude revisiting lows not seen since Dec 2018 and below $55 yesterday. Copper often termed Dr Copper as it is taken as a leading indicator of global economic health, has collapsed by over 10%, losing almost all of its gains from 2019 and threatening to make multi year lows. It is currently probing a double bottom reversal with the 2019 Sep low which in turn was new multi year low from 2017.

Iron ore has also lost almost 14% adding to the macro view that global economic activity is slowing and recessionary fears may be justified

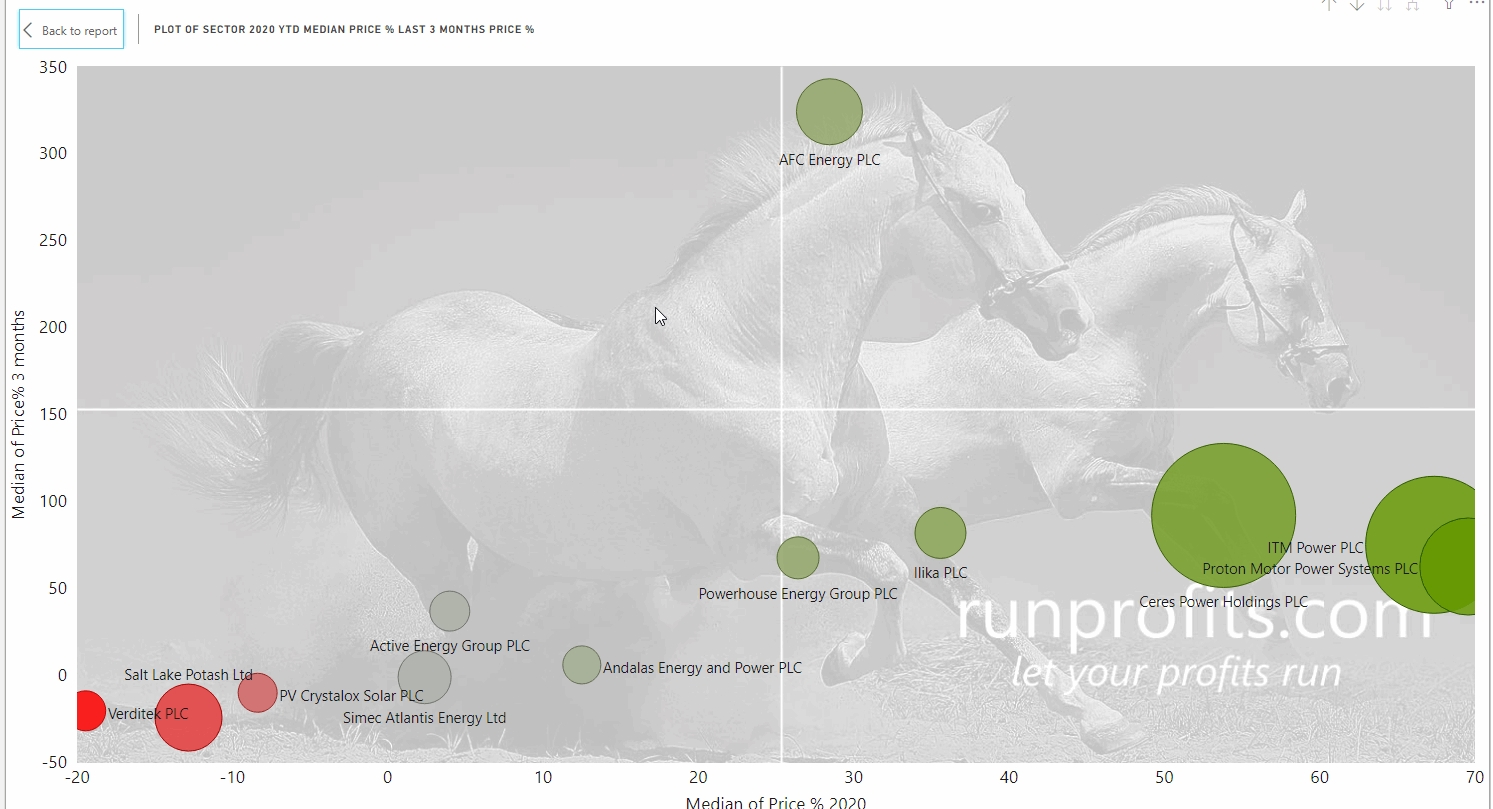

Old Energy vs New Energy: ESG in Action

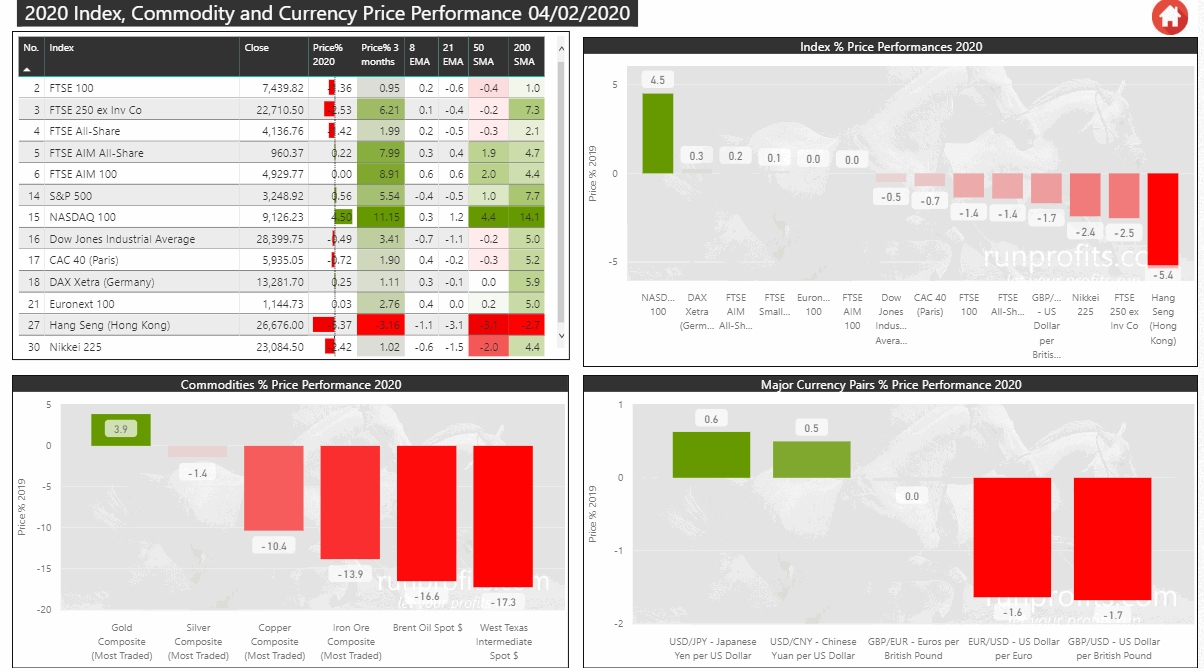

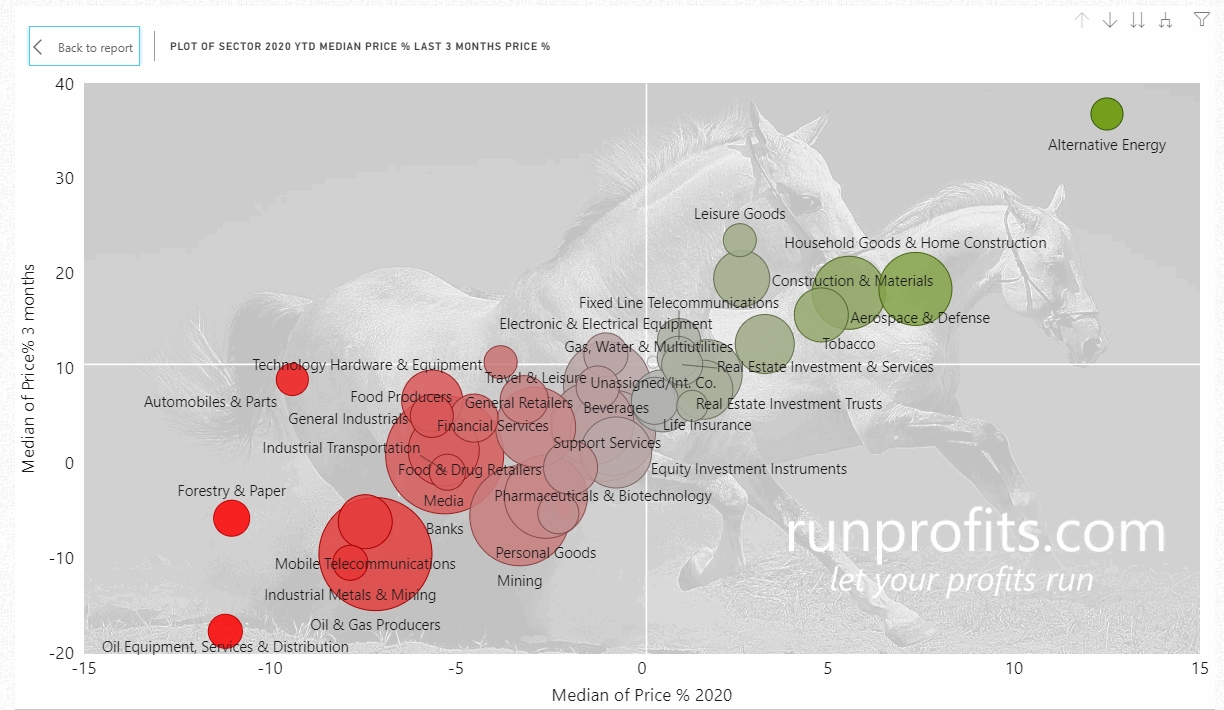

Figure 3 shows sector performance YTD : O&G Services is the worst performing sector so far down over 11% while O&G Producers are down 7% with Industrial metals off 8%. In the FTSE 250, 3 of the four O&G Producers are already down double digits with Tullow lower by 25%

By contrast, and in keeping with the 2019 trend, Alternative Energy continues to outperform all sectors and is up 12.5% YTD with PPS up 70% and ITM and CWR up over 50% YTD

The continued inverse correlation between old and new energy has been striking and may be set to continue : this is worth deeper research to qualify those candidates with highest potential

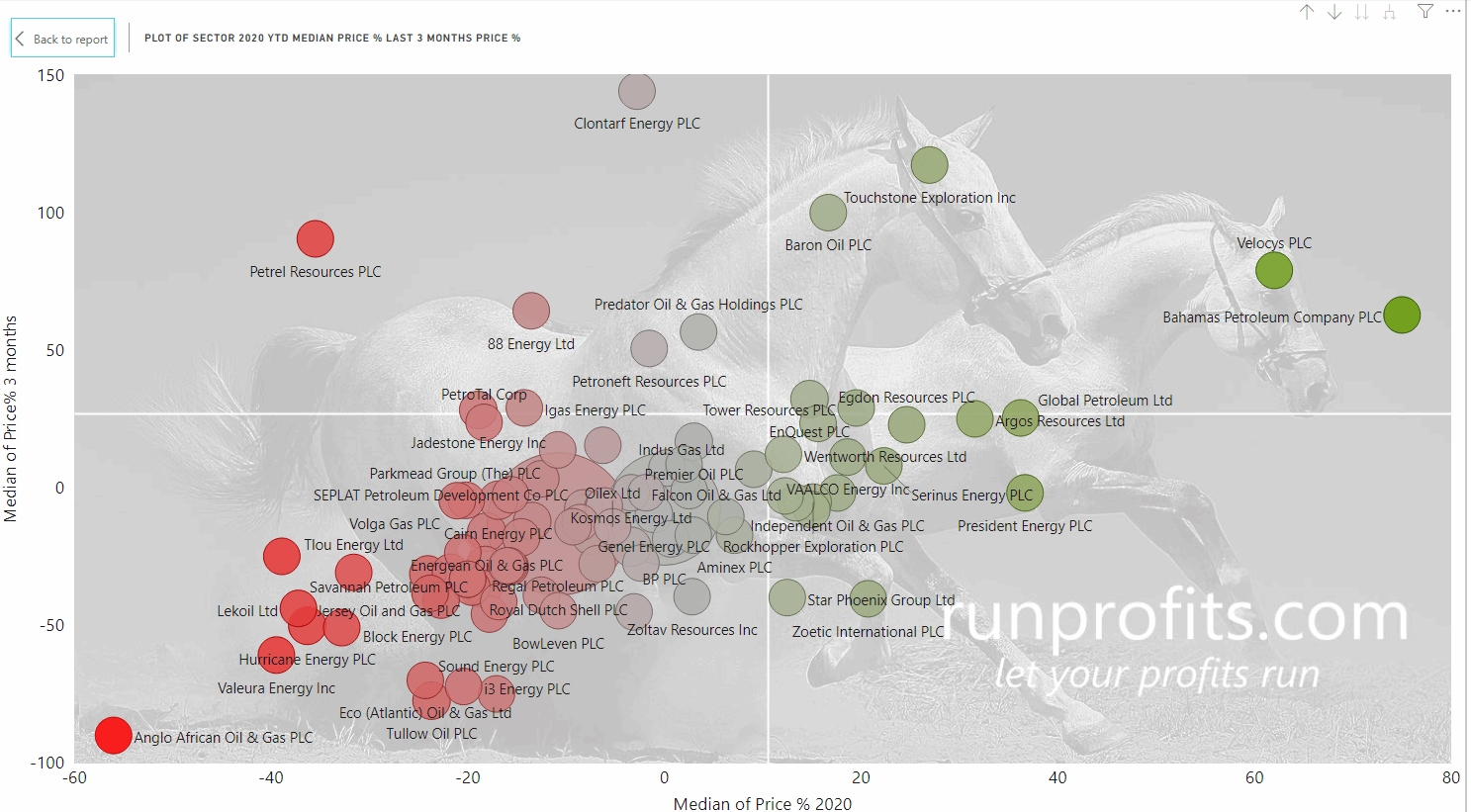

The Biggest Losers in Oil and Gas

There are 103 O&G producers quoted on the UK markets, of those 63 have lost value in 2020. Many of thee are junior oilers but even among the majors and super-majors, there are very few in the green with just ENG , PMO and INDI showing some green

In fact even the likes of RDSB has suffered double digit losses YTD with TLW and HUR down 24% and 26% respectively.

O&G Services which are heavily dependent on E&P are all in the red with HTG down over 25%

And the Winners Are

The Alternative Energy sector is made up of 14 companies currently, all of them in the AIM All-Share and ranging from the micro cap Andalas Energy to the mid cap Ceres Power with an market cap of £621m. The share price performance of these names over the past year has been outstanding with AFC up 325% and PPS, PHE, ITM, IKA and CWR up between 50 and 90% in the past 3 months.

Clearly alternative energy is a sector worthy of a much deeper dive and will be the focus of an upcoming article on momentum plays

For now the best trades appear to be short oilers and long alternative energy.

A very significant change in oil price would be needed to change the directional bias against most oil and gas shares at the moment. On that basis, the O&G services sector would also be expected to under-perform as decreasing revenues in upstream result in operations shutdowns.