Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

Global Indices Crash Despite Extraordinary Intervention: Fastest Bear Market in History

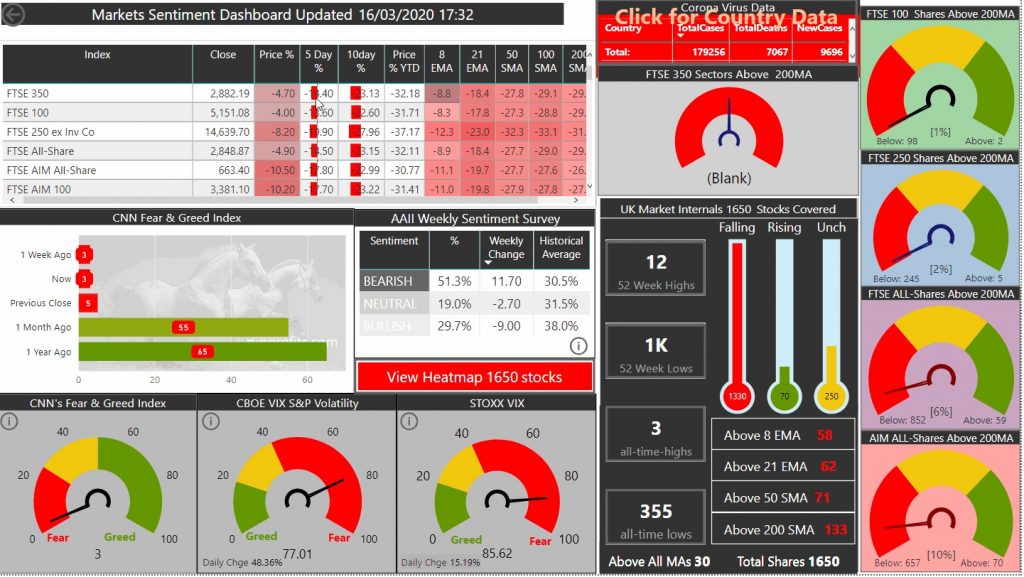

Today's alarming drop in equity prices could only be described using the term crash. In Friday's musings I highlighted some of the disconnects in terms of the VIX to S&P relationship compared to historic and the troubling precipitous drop in the Oil and Gas Sector as a potential prequel to a market crash. Today saw this play out as global markets not only failed to take any comfort in the co-ordinated central bank actions announced last night but actually took fright and entered full-on panic. At one stage today the FTSE 100 was down over 8% and the FTSE 250 down over 12%, they did recover somewhat into the close with the FTSE down 4% and the FTSE 250 down 8.2%. AIM ended down almost 11%.

At pixel the US S&P is down 9.6% with the Dow Jones down over 10% - the US markets having been suspended twice earlier today on limit-down circuit breakers With increasing numbers of countries in lock-down and an escalation in restricted movement in most of those economies. the markets are struggling to discount the economic fall-out but the probability of recession is now mounting significantly and it is more a question of estimating depth and duration.

Chinese data overnight caused further alarm as the impact of their lock-down was reflected in their numbers Analysts had been expecting a 3.0% fall in industrial production, a 2.0% drop in fixed asset investment and a 4.0% contraction in retail sales. Instead the readings came in at -13.5%, -24.5% and -20.5% respectively

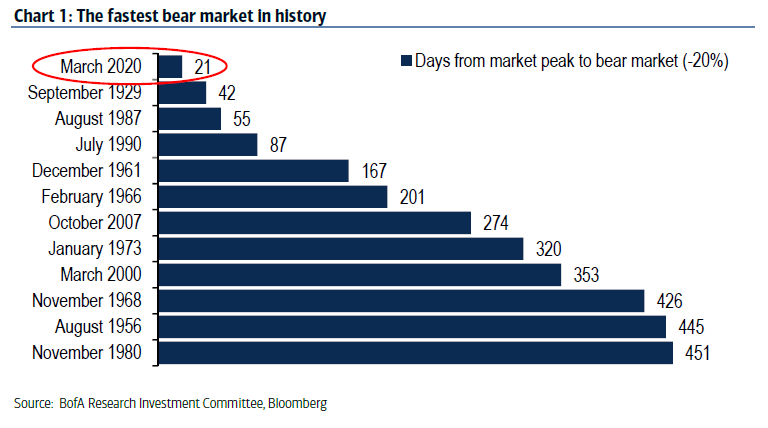

This is the fastest bear market in history , the previous record being held by the 1929 crash at 42 days, we are living in accelerated times with the current bear market taking just 21 days

The FTSE 100 seemed to have found some support around the 4890 area which were last visited both in 2010 and 2011. Indeed some of the price action of late reminded me of trading indices in 2010 when markets were hugely volatile. That period also taught me that day trading indices was not my calling. Anyway, I have set this level as key support , it may well be retested in the coming days and weeks: the results of which will tell us a lot about future directions

Gold finally caught a bit of a bid today having fallen with all other markets as correlations collapsed in the panic selling. Gold may also be victim to enforced selling owing to margin calls where leveraged traders have needed to cover heavy loss making positions. It is stil in the red , down 1.9%m but off its lows.

Oil cratered today losing over 11% and rechecking last week's lows around $31.5: it looks increasingly likely that oil will drop into the twenties and potentially revisit the lows see in 2016 around $27

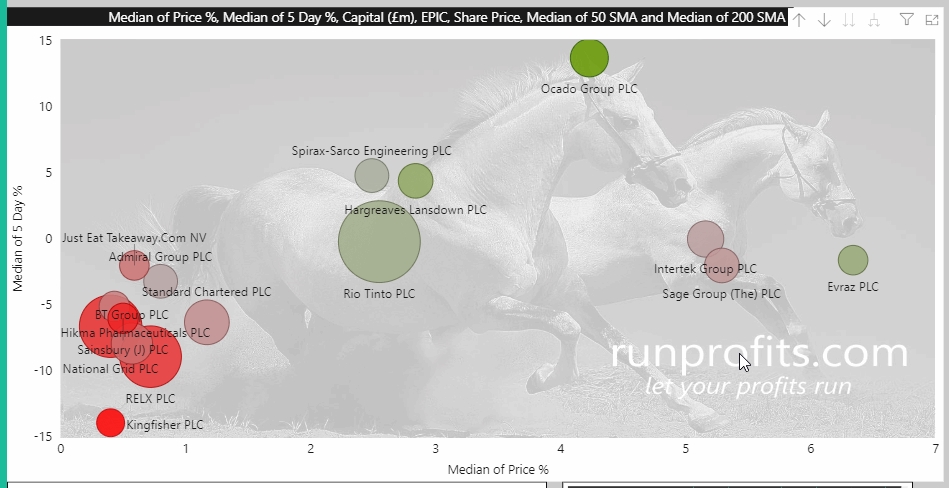

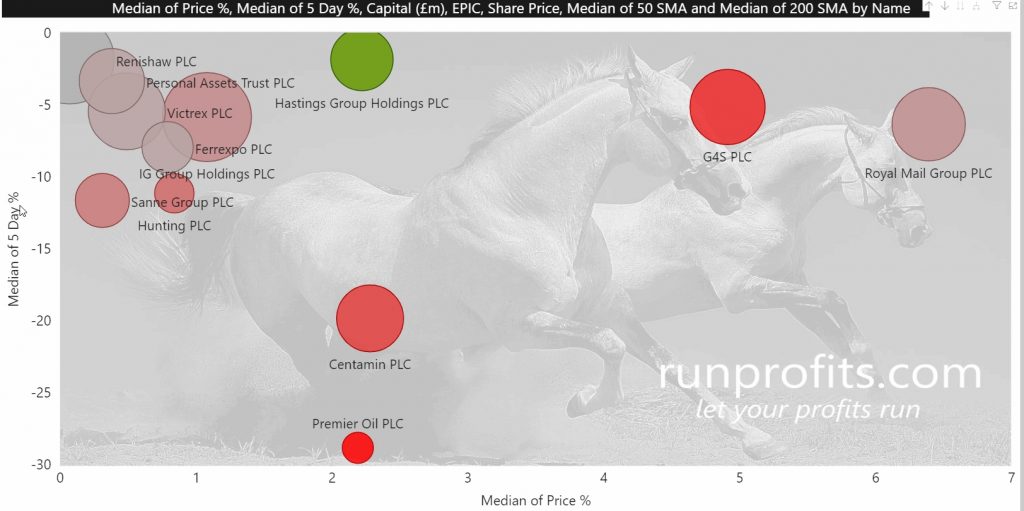

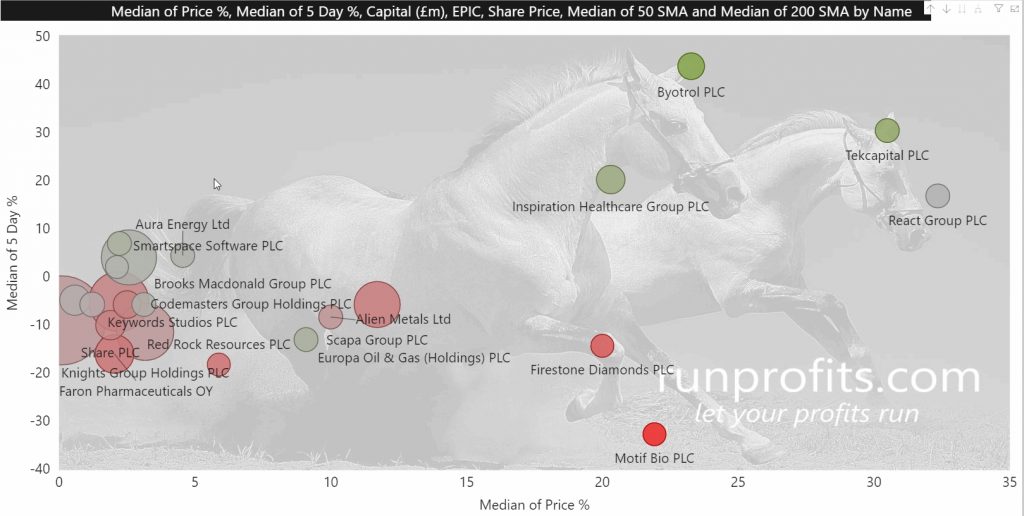

Not everything sold-off today with outperformers with 70 shares rising while 1330 fell

Outperformers per index are show below

US Fed Drops Interest rates to 0-0.25% and Restarts QE

The overnight announcement of co-ordinated central bank activity to ease liquidity and support the financial system globally in the face of the Covid-19 crisis was met with a limit-down suspension of US futures and more selling in Asia. At pixel the UK futures look set to open lower at around 5097, down 4.3% from Friday. In addition to the below announcement available here the US Fed is to restart QE. So starts another turbulent week in the markets

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing US dollar liquidity swap line arrangements.