Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

Wrap at the Close: Oil at Mutli-Year Lows Weighs on UK Indices

The drop in crude oil shows little sign of abatement as Brent crude lost over 2% making a new low for both 2020 and 2019 with the lows of 2018 in sight around the $50 mark. To put this move in perspective, Brent started 2020 above $72, almost 50% higher than the current value.

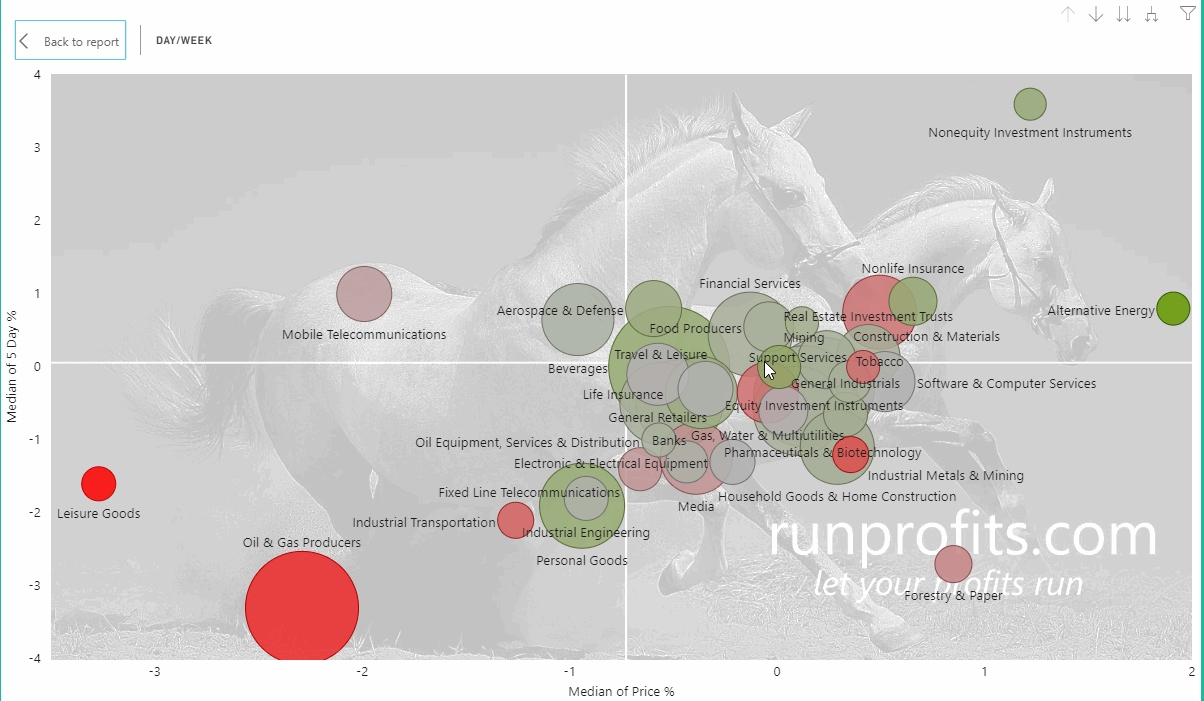

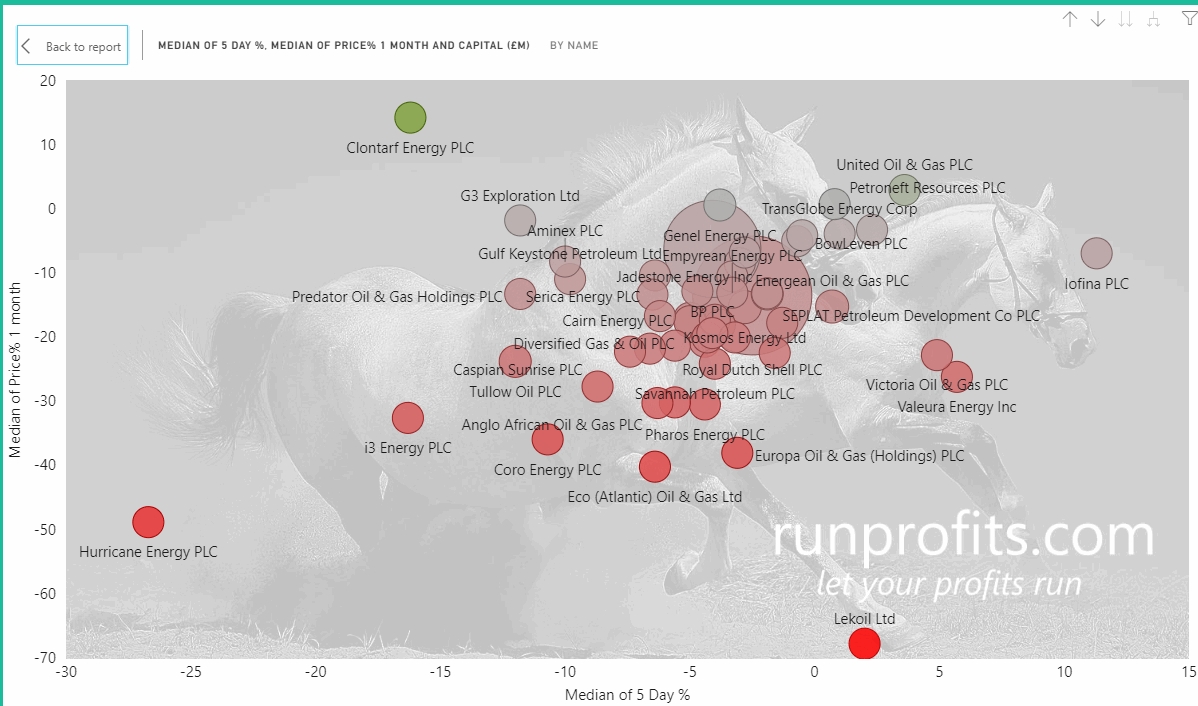

O&G was one again the poorest performing sector in the UK today - See Figure 2: while once again, Alternative Energy was again the outperforming sector. Most of the other sectors were relatively flat on the day and lay in the -1 to +1 % range

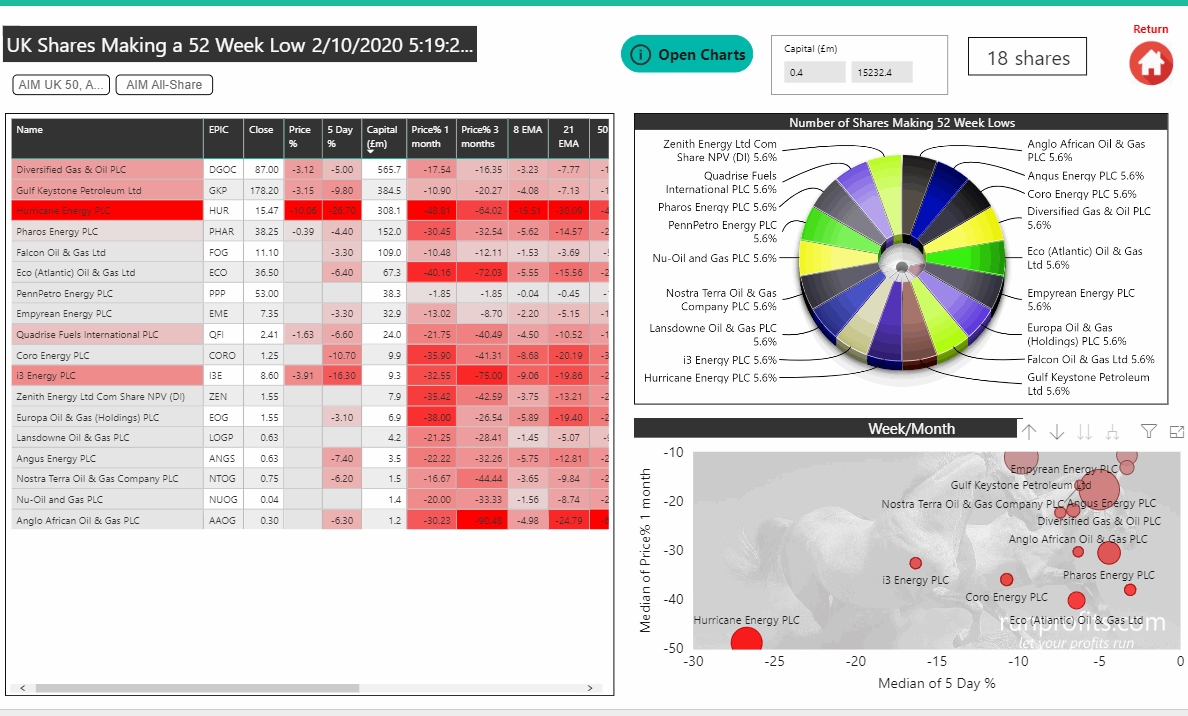

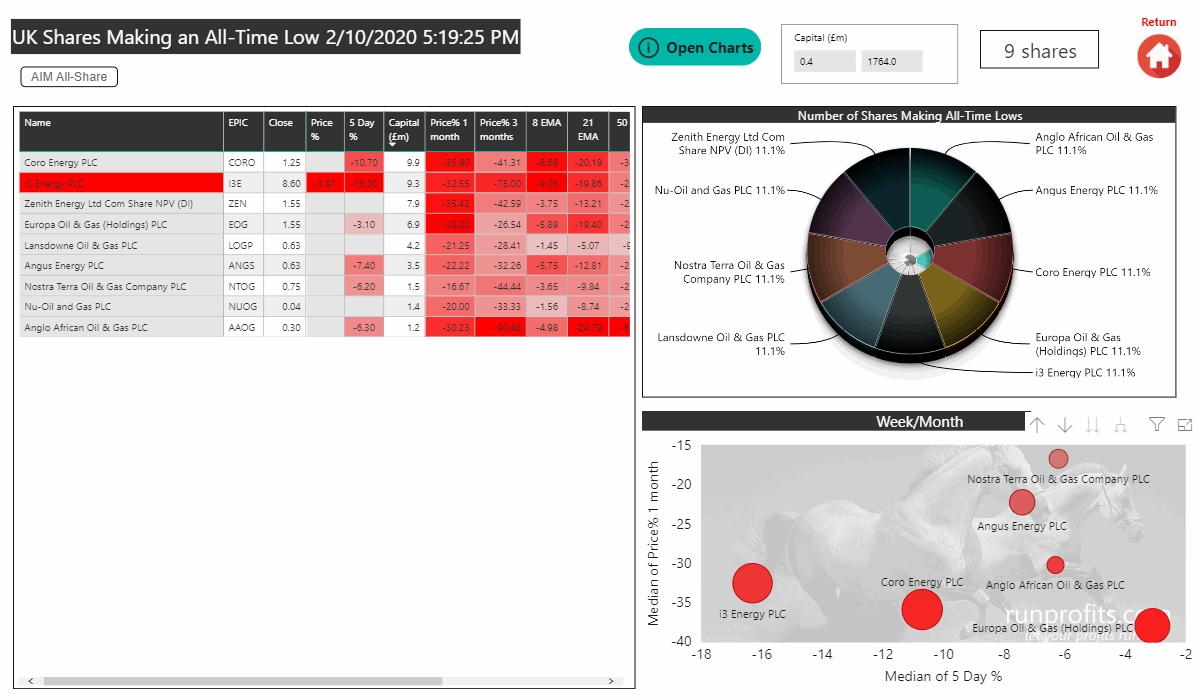

Of the 103 O&G Shares on the UK markets, 70 have lost value in 2020 and 73 are bellow their 200 day moving average. 18 of these made 52 week lows today of which 9 were at all time lows: see Figures 3-5

Figure 3: Losing Oil and Gas Shares in 2020

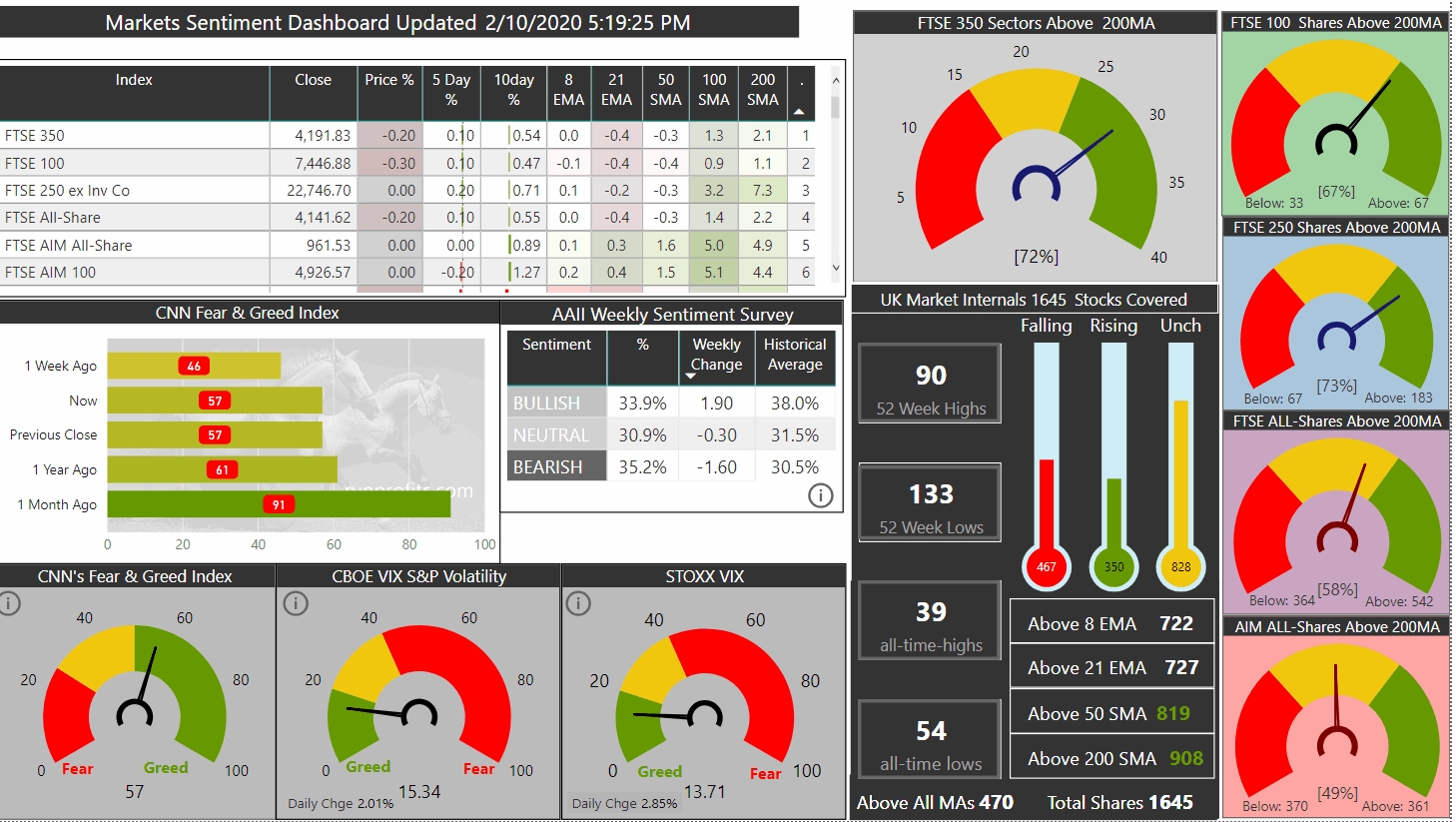

Figure 1: Market Sentiment

View at The Half 14:00 - RP Scanner Will now be Updated Intraday!

From today, RP Scanner will be updated with intraday data after the 12:00 uncrossing

This will give insights on sector and price movements during the trading day allowing the identification of opportunities before the close each day.

All of the runprofits.com data will be updated EOD as usual including RP Scanner

The intraday version will be timestamped at 12:xx

Morning View: Weak Start to the Week

A weak start to the week as UK and European markets opened flat but then sold-off slightly lacking any real direction or catalyst to offset growing macro fears. Brent has dipped below $55 while GBP has steadied against USD around the $1.292 level.

Bitcoin cleared the $10,000 mark over the weekend but encountered resistance around 10,100 and has pulled back to 9800. The 10,100 level is significant as it is the confluence of last summer's support (now resistance) and a trendline linking the recent highs back to the ATH of $19,900. The battle around this level will be key in the future direction of BTC .

The VIX has climbed around 10% since Friday and remains around the 16 level although the European STOXX VIX sits around 14. Neither levels are indicative of much alarm. The US AAII weekly survey remain bearish

Gold remains bullish and is in the green on the day as is silver which is still in a consolidating sideways move that has been ongoing since last September.

Figure 2: Daily UK Sector Performance