Pre Market 07:15 Oil Above $46 as Gold Sells as PMI Data Adds to Vaccine Boost in Confidence: Yellen as Treasury Secretary

- FTSE 100 futures show an open +28 points at 6375 after dropping 18 points yesterday: US closed in the green with Asai following as vaccine-driven risk-on predominates

- Mid 250 and AIM All Share closed +0.5 and +0.3 yesterday and remain extremely bullish with the 250 approaching 90% bullish

- Oil has cleared $46 and is challenging the level set in August 2020 as PMI data reports add to vaccine good news in economic recovery expectations

- VIX drops to 22.7 and F&G index advances to 75: a higher Greed score. Investor sentiment is 44.4% bullish above the average of 38%. Elevated levels of sentiment suggest more complacency and higher risk tolerance

- Gold, the worry trade, has sold-off further and is now finding some support around $1824 with a good chance of an intraday bounce: if this fails a check at 1800 appears likely which is confluent with the 200MA. Stronger dollar is also weighing on the metal as the greenback is boosted by Biden's pick of Yellen for Treasury in the US.

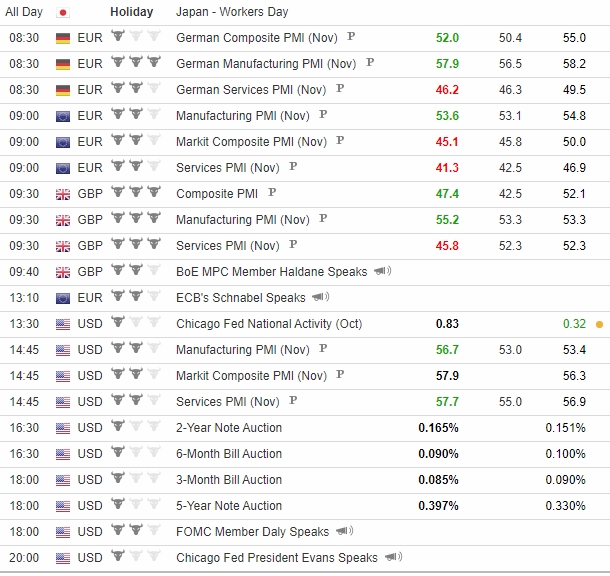

Manufacturing PMI Data Beats in UK, Europe and US

Godl Under Pressure as Dollar Strengthens and Risk Appetite Improves

27 UK Companies Reported by 07:15