Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

A day in green Commodities Help Lift Indices: Sentiment Remains Fearful

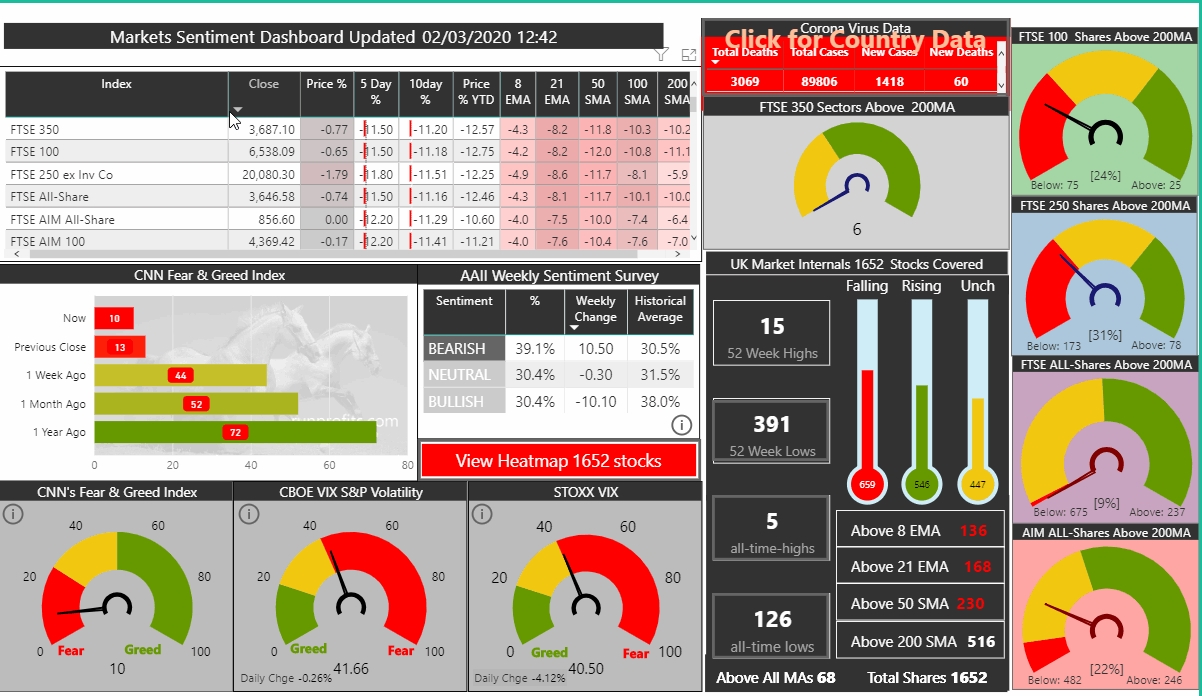

All of the UK indices ended in the green today albeit significantly off their intraday highs. The initial almost 3% flush in the FTSE 100 and 250 were rapidly sold mid-morning as sellers once again entered the markets. The US did open positive and provided a renewed boost to the UK as the NASDAQ added over 3% with the S&P up 2.8% at one stage.

FTSE 100 and 250 closed almost 1% to the good with AIM All-Share up around 0.6%

Much of today's heavy lifting was done by the resource sector where fillips in both crude and copper helped lift the Oilers and Miners many from deep oversold. BP and RDSB spent a rare day in green adding 3.8 and 3% respectively.

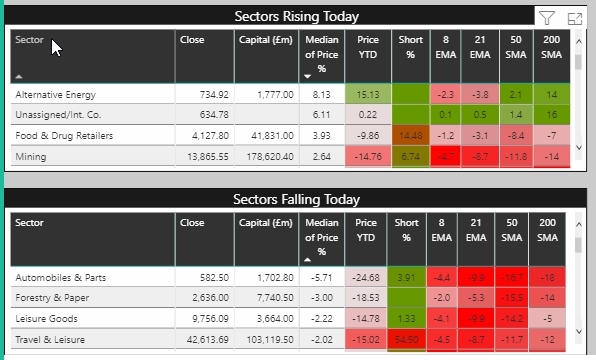

Pharm also performed well as did Food & Drug retail. These combined with out performance in Utilities does add to the recession-like sector rotations in ultra defensive stocks

Travel & Leisure and Leisure Goods were among the underperforming sectors

705 UK stocks rose today while 514 fell

Sentiment remains fearful with the Fear and Greed index at Fear - 10 and the VIX very elevated above 40

Market Volte-Face as Indices Pivot Green to Red: Supply and Demand Shocks

The speed with which an almost 3% rally faded this am in the FTSE 100 and particularly the 250 is not too unexpected given the prevailing uncertainty but is dramatic in its pace. Clearly many participants took the opportunity to sell into the rally on slight improvements to last week's prices. This volte-face to the dip buying mentality is consistent with a strong downtrend and is likely to continue for the foreseeable.

China was unusually frank with its updated manufacturing PMI data for February which cratered to a value to of 35.5 from 51.1 in January owing to coronavirus disruption. A value below 50 is indicative of contraction and analysts had expected something nearer to 45. It is exactly these kind of supply shocks that the market are desperately trying to adapt to. China's inability to manufacture has huge impacts on global supply chains heavily reliant on parts sourced from China. This will lead to unfinished products for western manufacturers massively inflating inventory and working capital while directly hitting turnover and cash flow. It is for these reasons that an increasing number of western companies are announcing they cannot give guidance for 2020 until uncertainty is reduced. With a big question mark on the Earnings component of a P/E, Price is reacting to try and adjust to unknowns in the denominator.

The restrictions on travel, large gatherings and the potential for whole cities to be closed has caused a demand shock for many goods and services especially airlines, hotels and leisure

The result of the above? With many manufacturers operations halted mid cycle without clearing inventory and WIP then there is an expected credit squeeze which in turn has been hurting banks. Airlines, hotels, leisure sectors have also been severely hit as demand shocks remain unknown.

At Last a Day in Green: Is it Buy Dips or Sell Rips?

As highlighted on Friday , when Fear is at a peak on sentiment indicators it is often a contrarian sign: when the Fear and Greed index got to 9 it had little more room left in this iteration. That doesn't mean it won't get lower: it can and will go lower. But for now we get a relief rally, the FTSE 100 Futures suggest almost 3% up day. This will reverse some of Friday's damage but leaves that nagging question: is this rally sold or bought? Given the continuing uncertainty the best bet would appear be to the downside. On the other hand, given the rapid slides last week some one argue the market may have overshot in discounting the damage to earnings expected from the the virus disruption. The best strategy for now is to watch the price action, look for areas of strength and be nimble in one's trading.

A few data points

- Brent has bounced making a potential inside day and is up over 4% though at $51. This should boost oilers and lift the FTSE 100 owing to RDSB and BP

- Asia in the green as the BoJ promises to do what is needed to help companies and markets

- Gold has pulled back significantly since the Friday session