Contents: Click on Link to View

ToggleBelow are the summary pages and links to the 2024 global macro outlook reports from the world's biggest financial insitutions.These give nsights on how some of the biggest money managers are postioning based on market expectations.

Click on the image ot the right of each summary to open the full report

Blackrock 2024 GLOBAL INVESTMENT OUTLOOK

Grabbing the wheel: putting money to work

Barclays Q1 2024 Global Outlook

Q1 2024 Global Outlook: Light turbulence, soft-ish landing

Our Research analysts expect the world economy to slow in 2024, but in a fairly benign fashion, with low peak jobless rates and further declines in inflation in major economies.

This is not an outright soft landing, but it is distinctly soft-ish.

BoA: Outlook 2024: Looking Forward to a New Era of growth

Hear our experts discuss their outlook for 2024 and learn steps

you could take now to prepare.

Topics explored:

- Insights on the economy, markets and emerging investment themes

- Where earnings, interest rates and inflation could go next

- How heightened geopolitical risks might affect the market outlook

- Portfolio ideas and strategies

Deutsche Outlook 2024 : The year of disenchantment?

Outlook 2024: The year of disenchantment?

The external environment as well as monetary and fiscal policy should provide strong headwinds. Sentiment will likely be dragged lower by the increasingly evident structural problems. We anticipate a modest recession during the winter half to be followed by a gradual recovery from spring onwards. We expect the government to survive the internal quarrels with respect to the 2024 budget, following the constitutional court ruling. Debt brake reform is unlikely in the short run. A cross-party consensus for a Transformation Fund 2.0 might emerge before September regional elections

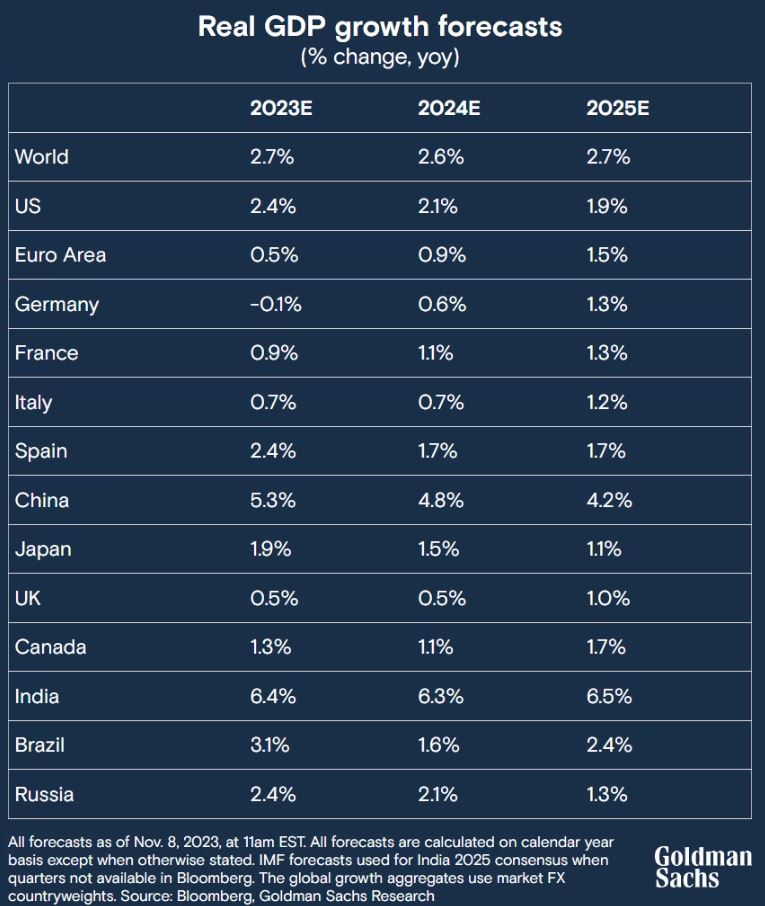

Goldman Sachs: Macro Outlook 2024: Btter Than Many Expect

The global economy will perform better than many expect in 2024

Goldman Sachs Research expects the global economy to outperform expectations in 2024 — just as it did in 2023.

That outlook is based on our economists’ prediction for strong income growth (amid cooling inflation and a robust job market), their expectation that rate hikes have already delivered their biggest hits to GDP growth, and their view that manufacturing will recover. Central banks, meanwhile, will have room to reduce interest rates if they’re concerned about the economy slowing. “This is an important insurance policy against a recession,” Goldman Sachs Research Chief Economist Jan Hatzius writes in the team’s report titled Macro Outlook 2024: The Hard Part Is Over.

Worldwide GDP is forecast to expand 2.6% next year on an annual average basis, compared with the 2.1% consensus forecast of economists surveyed by Bloomberg. In fact, Goldman Sachs Research’s forecasts for GDP growth in 2024 are more optimistic than the consensus for eight of the world’s nine largest economies, as of Nov. 8, 2023. And notably, our economists expect US growth to outpace its developed market peers again.

HSBC 2024 Opportunities in a Complex World

Top Trends and High Conviction Themes Q1 2024 - Riding the Waves: Trends and Themes Shaping our World

In our complex world, it often helps to tune down the noise of the busy economic data flow and zoom out. Gathering inputs from sociologists, scientists, futurists and political commentators can help us to form a clearer picture of the big trends. That’s important to help ensure that we don’t miss the big turns and opportunities, and it is therefore a great and necessary complement to the usual data analysis. And, frankly speaking, big real-world trends often ‘speak’ more to investors than economic data. So we are glad to present our Top Trends and High Conviction Themes Brochure, for Q1 2024 - “Riding the Waves: Trends and Themes Shaping our World”.

https://www.privatebanking.hsbc.com/wih/investments-Insights/House-views/investment-outlook-q1-2024-opportunities-in-a-complex-world/

Morgan Stanley: 2024 Global Macro Outlook

Morgan Stanley Research expects slowing global growth as central banks walk a fine line between inflation and recession.

As central bankers try to maneuver a “soft landing,” Morgan Stanley economists expect their efforts will come with a tradeoff: lackluster growth in 2024 and 2025, especially in developed markets.

“Inflation has peaked globally, but getting through the last stretch won’t happen until 2025 and will likely require a period of subpar growth,” says Seth Carpenter, Global Chief Economist at Morgan Stanley.

Our economists predict that global economic expansion will tick down to 2.8% in 2024 and 2.9% in 2025, from 3% in 2023.

Getting Back to Target

In 2023, central banks successfully tamped down price gains by ratcheting up interest rates, slowing the pace of inflation to mid-to-low single digits. Heading into 2024, inflation should continue to fall in developed markets, while emerging markets may see a more gradual letup due to the volatility of food and energy prices.

“The decline of inflation in 2024 should be much more gradual than in 2023, as inflation is close to—but not quite at—target in most developed market economies,” Carpenter says.

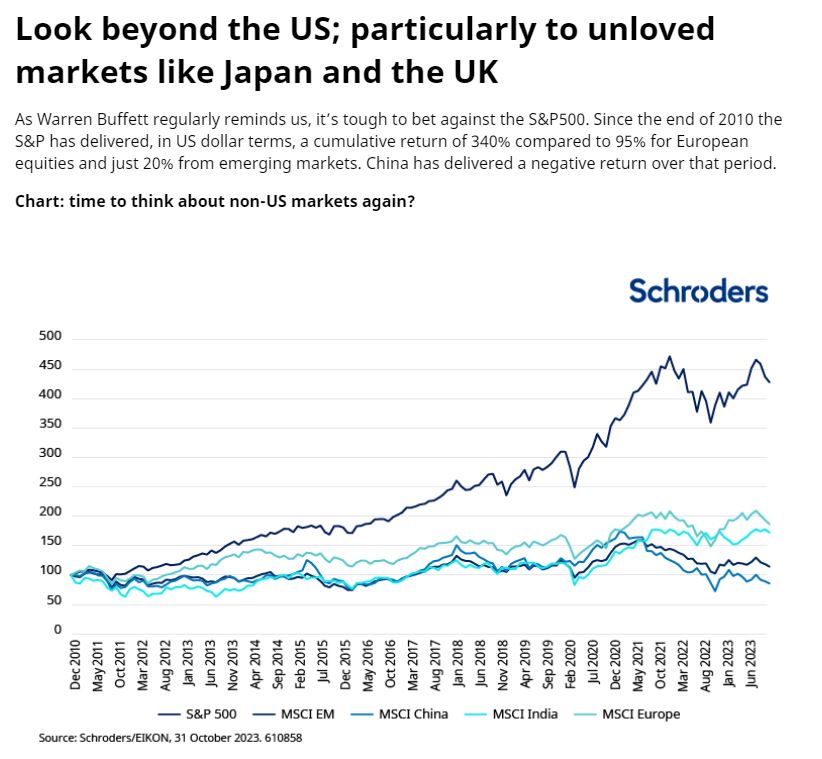

Schroders: Outlook 2024: Equities in the age of the 3D Reset

Outlook 2024: Equities in the age of the 3D Reset

The mega-themes reshaping the world economy provide a wealth of opportunities and risks for investors in equities. Taking a global view, Alex Tedder and Tom Wilson look across developed and emerging markets for the sectors, countries and themes best placed for the period to come

Franklin Templeton - 2024 UK outlook: Signs that the storm is over…

2024 UK outlook: Signs that the storm is over…

We are entering a new post-COVID regime. Elevated interest rates and inflation (as in above recent historic lows) are likely to mute/temper the effect of stock market returns. We expect central banks to focus on containing inflation in the domestic economies rather than rapidly cutting rates to boost growth.

Stock selection is increasingly important to an overall return profile, and we believe the opportunities for skilled, high-conviction managers to add active returns will significantly outweigh the opportunity for market returns.