Run Profits is now live with access to all the data reports for low cost monthly subs find out more ....

FTSE 100 Futures at 7500

US back from holidays closed red across the board with the NAZ bearing the brunt: the selling following a China narrative though a big run over the past month and profit-taking into month end likely needed a catalyst. The DOW did make a big double top on Friday and seems to be receding with the Transports dropping the 200MA. Meanwhile both the S&P and NASDAQ remain below their 200MAs and so in longer term downtrends. In the short term a pullback on big runs is heathy though if that signals a broader bear market rally sell-off is anyone’s guess.

Here is what we know for now

FTSE 100 strong bounce back on oil recovery to touch the 7500 overnight: this is a big area of resistance . This is likley linked to the fate of oil prices given the size of BP and SHEL in the index as well as broader commodiy prices and dollar strength. All of these combined overnight to support the lift in the futures .

The FTSE250 suffered the brunt of yesterday’s selling and dropped the 200MA closing at the low but off just 1.5% on a month that gained 18%: not a big deal in the broader picture.

Oil dipped to $80 handle but has bounced overnight back to above $85 but is rejecting its 8EMA: I fancy a deeper sell-off to the $72 level before finding support (see chart)

Gold sold-off to the $1740 level but has also bounced to regain the 8EMA at $1754: I would prefer a check and bounce on the 21EMA around $1731 before adding

Copper briefly dropped below he 21EMA yesterday after a gap down on China news but has recaptured both the 8 and 21EMA

Watch levels in oil, copper with a potential short oil and a short FTSE 100 off a 7500 rejection in the cash: conversely, if oil holds and rallies and the FTSE 100 stays north of 7500 into the end November then we may well set-up for a seasonal rally into Christmas

(click on any of the images to expand)

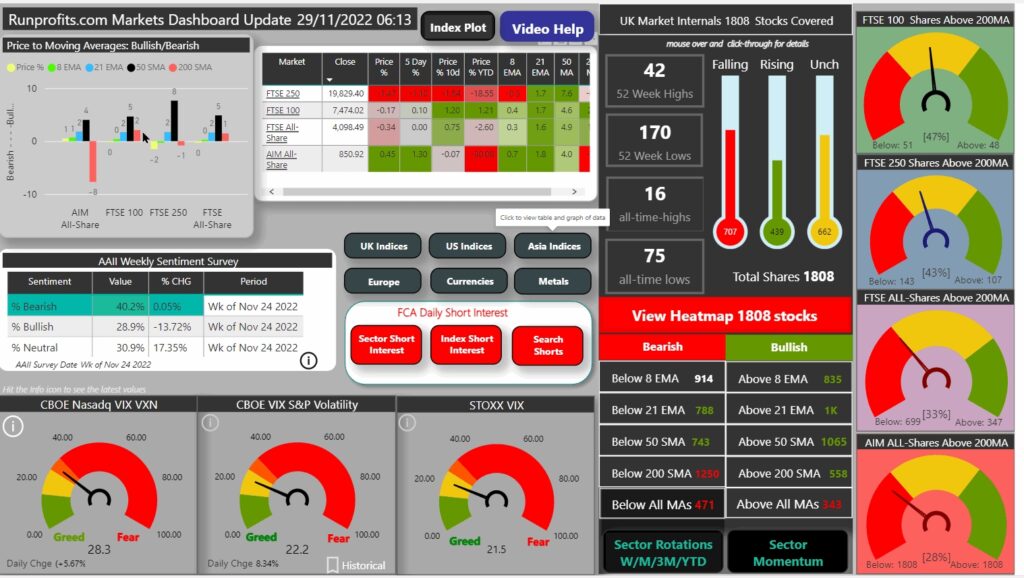

Market Dashboard and Sentiment:

VIX upticked from 20.5 to 22.2 still remains supportive of risk-off

US Heatmap as of Close Mon 28 Nov 22

Econ Calendar

Today's economic calendar